Bitcoin’s Wild Ride: Government Shutdown Sparks Volatility Surge as Deficit Warnings Echo

Bitcoin volatility explodes as government gridlock rattles markets

Analysts sound alarm on deficit risks while digital gold dances to its own tune

Traditional finance trembles as crypto proves its crisis resilience—again

Meanwhile in Washington: another day, another debt ceiling drama

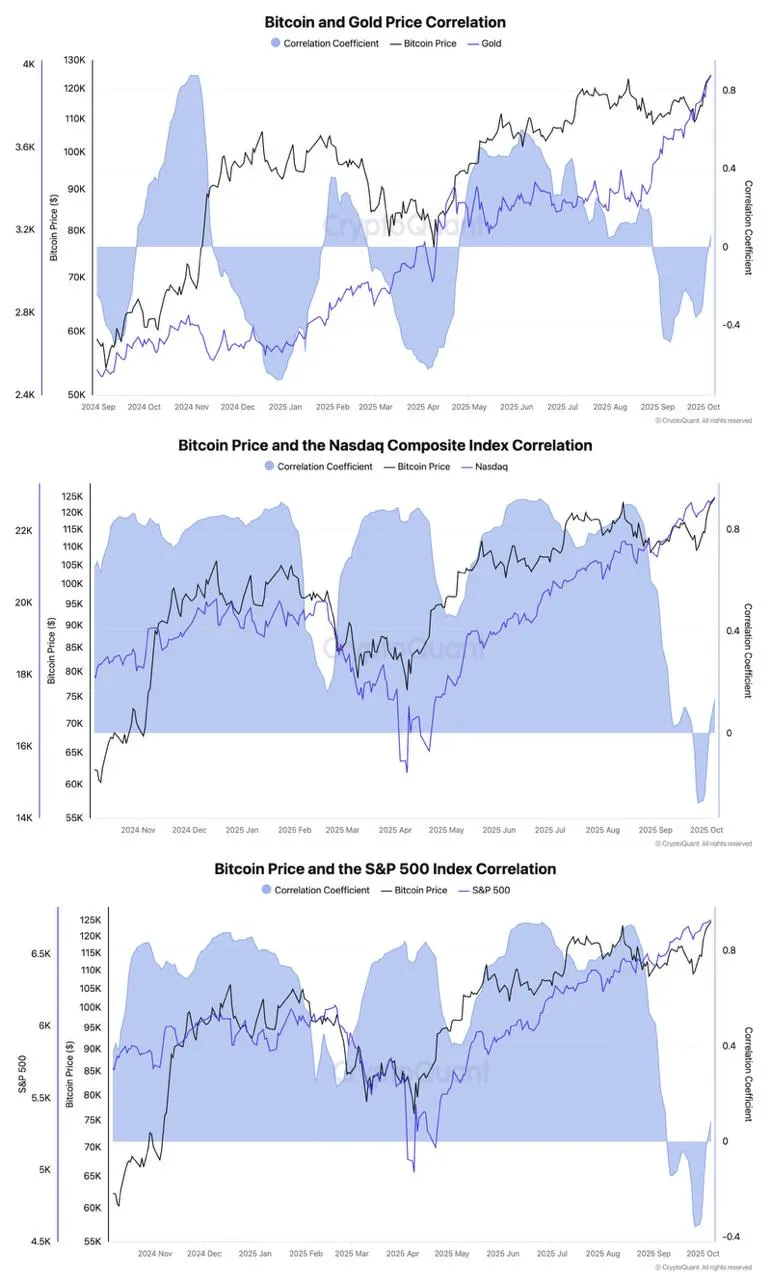

Source: CryptoQuant

Source: CryptoQuant

But there’s still been a spike in the Bitcoin volatility index, which tracks volatility in the price of Bitcoin in U.S. dollars by measuring the standard deviation of daily returns in 30-day windows.

The index fell to 0.88% on Sept. 28—just a few days before the U.S. government shut down on October 1. Since then, BTC volatility has steadily risen to 1.17%, according to Bitbo. That’s about the same level as one month ago and still much lower than in late March, when Bitcoin volatility spiked to 2.87% amid tariff turmoil.

“Crypto markets are likely to stay choppy, but broadly supported next week, led by Bitcoin, as long as ETF flows remain positive and no new macro shock emerges amid the ongoing U.S. government shutdown,” Bitunix analyst Dean Chen told Decrypt.

Even as Friday’s trading session is just beginning, Bitcoin ETF inflows have already pulled even with last week, according to data from London investment manager Farside Investors. As of Thursday’s close, Bitcoin ETFs had pulled in $2.7 billion worth of new funds so far this week.

Even if markets will be broadly supported next week, according to an analyst, users on Myriad—a prediction market owned by Decrypt parent company DASTAN—are expecting to see more red than green over the weekend.

Not long after the opening bell in New York Friday morning, Myriad predictors estimate that there’s a 51.2% chance that BTC sees more red than green candles between now and Monday, Oct. 12.

Analysts at crypto exchange Bitfinex were of two minds about stocks and crypto setting new high-water marks in the middle of a U.S. government shutdown.

“Equity markets trading NEAR record highs while the shutdown persists creates a hopeful environment, suggesting that the macro backdrop remains supportive of speculative asset price appreciation,” they told Decrypt. “This could, however, be seen as a disconnect that masks growing fiscal stress, since official data on national metrics has not been released.”