Fidelity Predicts Bitcoin Illiquidity Crisis: 42% of Supply Locked Up by 2032

Bitcoin's liquidity squeeze is coming—fast. Fidelity Digital Assets just dropped a bombshell forecast: 42% of BTC's supply could go illiquid within the next decade.

HODLers are winning (again)

The report suggests long-term holders and institutional players are vacuuming up coins faster than Satoshi's code mints new ones. Meanwhile, exchanges keep bleeding reserves—down 30% since 2022.

Wall Street's worst nightmare

Imagine explaining to a Goldman Sachs MD why their billion-dollar buy order triggered a 20% price spike. With shrinking liquid supply, Bitcoin's volatility might make GameStop look like a Treasury bill.

Of course, this assumes traditional finance still cares about 'digital gold' after the Nth CBDC pilot fails spectacularly.

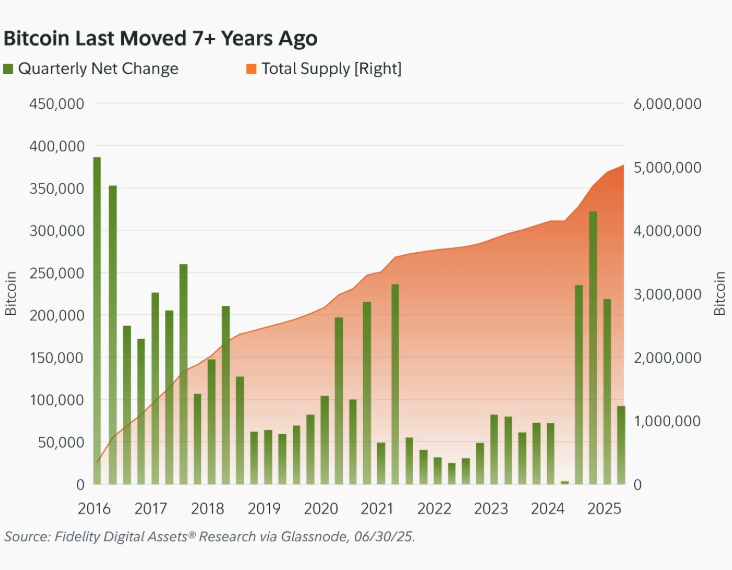

Quarterly net change and total supply of Bitcoin balances that did not decrease in seven years | Source: Fidelity Digital Assets

Quarterly net change and total supply of Bitcoin balances that did not decrease in seven years | Source: Fidelity Digital Assets

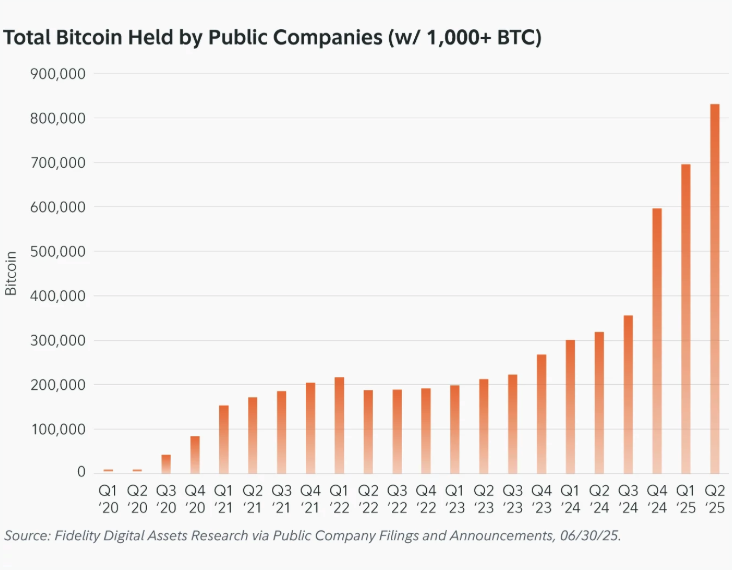

Public companies are increasingly buying up Bitcoin

Public companies are another significant contributor to the illiquid supply. Their holdings have accelerated since the fourth quarter of 2024 and currently stand at more than 830,000 BTC. Moreover, the vast majority of these holdings, according to Fidelity Digital Assets, is concentrated among the top 30 holders.

Both public companies and long-term holders have contributed to positive price pressure on Bitcoin. Moreover, the value of their combined holdings has more than doubled since the same time last year.

Assuming the same rate of accumulation over the past 10 years continues, Fidelity Digital Assets projects that 42% of all Bitcoin could be illiquid by 2032. Still, the report cautions that these trends may change. Specifically, in July 2025, holders sold 80,000 “ancient Bitcoin,” which had been held for more than 10 years.