Ethereum’s 2.5M ETH Validator Exit Queue Sparks Network Bottleneck Crisis

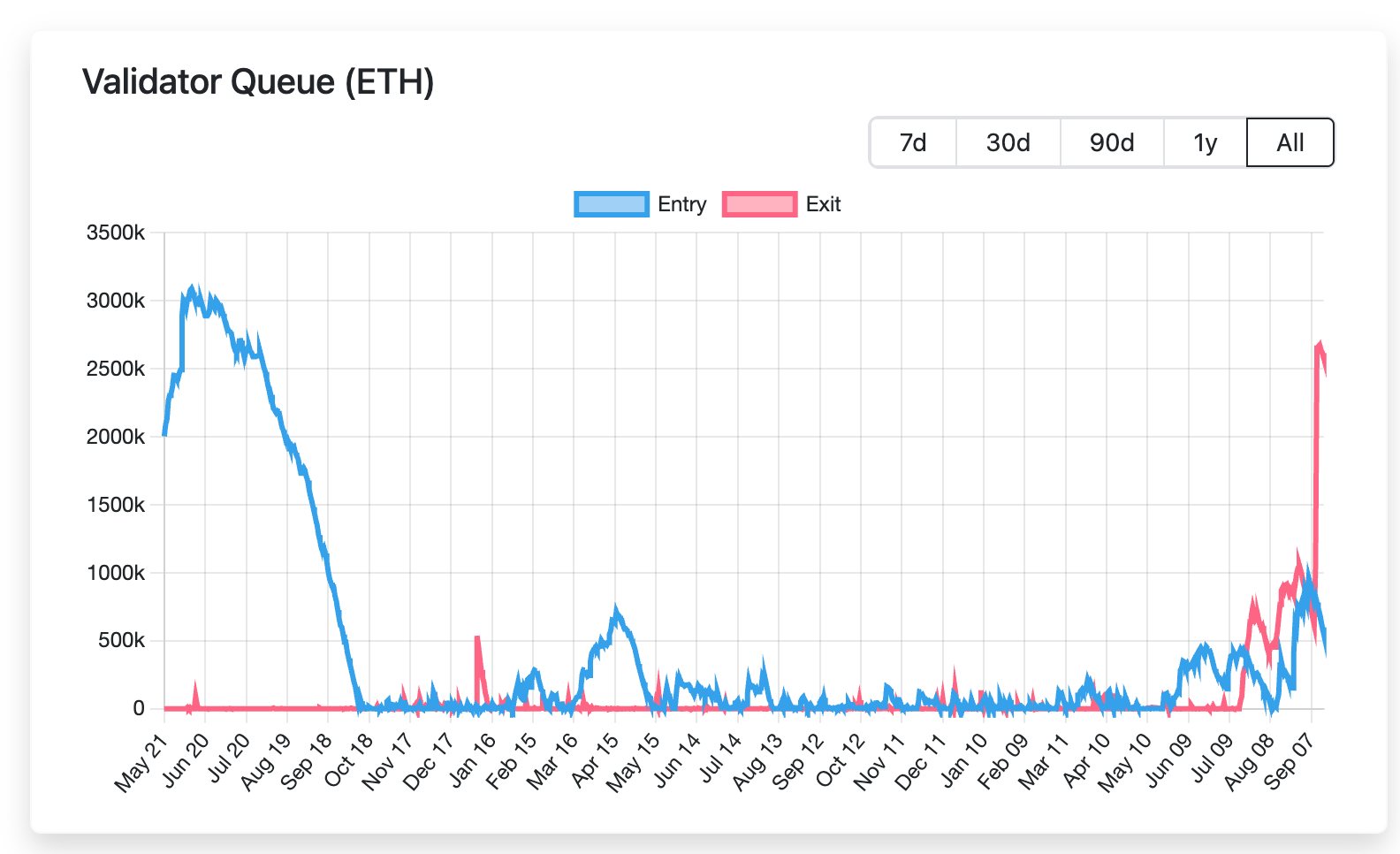

Ethereum's proof-of-stake mechanism hits a critical stress test as 2.5 million ETH—worth billions—gets stuck in validator exit limbo. The network's carefully designed queuing system, meant to prevent mass exodus, now creates an unprecedented liquidity logjam that's testing investor patience and protocol resilience.

Validator Exodus Backlog Grows

Nearly 80,000 validators sit in queue waiting to unstake their ETH positions—a number that keeps climbing daily. The exit process, designed for orderly withdrawals, now resembles a digital traffic jam during peak hours. Each validator must wait their turn, creating a bottleneck that could take months to clear at current rates.

Network Strain Becomes Apparent

Ethereum's elegant solution for preventing mass panic exits now faces its first real-world stress test. The protocol's built-in rate limiting, while brilliant in theory, creates practical headaches for institutions and large stakeholders needing liquidity. Some whales reportedly started their exit process weeks ago—still waiting.

Market Impact and Liquidity Crunch

While the locked ETH represents long-term confidence in the network, it also creates a hidden supply overhang that could impact markets once releases begin. Traditional finance would call this a 'maturity wall'—but in crypto, we just call it Tuesday. The situation highlights the growing pains of a $400 billion network transitioning from experimental tech to global financial infrastructure.

Ethereum's scaling solutions better work—because right now, even exiting the network requires more patience than watching paint dry on a blockchain.

Ethereum’s churn limit, which is a protocol safeguard that caps how many validators can enter or exit over a certain time period, is currently capped at 256 ETH per epoch (about 6.4 minutes), restricting how quickly validators can join or leave the network, and is meant to keep the network stable.

With more than 2.5M ETH lined up, stakers on Wednesday face 44 days before even reaching the cooldown step.

Thalman believes that much of the ETH existing will simply be restaked under new validators, meaning that if even 75% of the current queue is re-deposited, nearly 2 million ETH will flood the activation queue, bringing delays for new ETH staking, and a backlog on both sides of the validator queue.

“The activation queue is currently 13 days, to this add the ~2M ETH from those currently exiting (35 days) and 4.7M from ETFs (81 days), and the total is 129 days. This assumes that there are no other ETH holders that choose to stake and enter the queue, like corporate treasuries,” Thalman wrote in the blog.

The swelling queue underscores a paradox: Ethereum is working "as intended” Thalman notes, and the demand to both exit and re-enter highlights staking’s central role in the ecosystem. The network is thus experiencing the growing pains of a maturing, institutionalized system where infrastructure scares, profit cycles, and regulatory shifts all collide in real time.