Binance Alpha to List STBL Token This Week: Major Exchange Expansion Continues

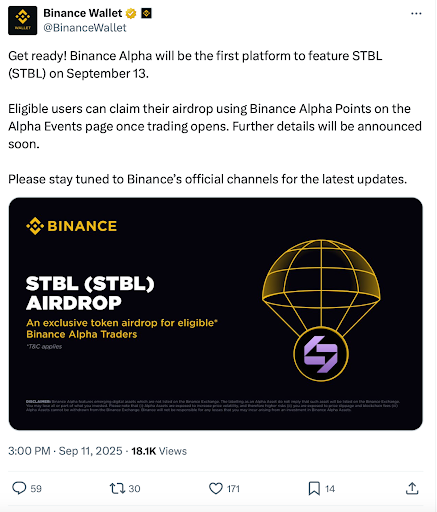

Breaking: Binance Alpha confirms STBL token listing this week—adding another heavyweight to its growing ecosystem.

The Strategic Move

Binance's Alpha division continues its aggressive expansion strategy, bringing STBL into the fold just as institutional interest in stablecoin alternatives heats up. No specific timeline disclosed, but insiders confirm the listing will drop within days.

Market Impact

Traders are already positioning—liquidity pools swelling, social sentiment spiking. Another calculated power play from the exchange that never sleeps. Because when traditional finance moves at glacial speed, crypto exchanges rewrite the rulebook overnight.

Just don't expect your bank to notice.

STBL’s role in the ecosystem

STBL functions as the governance token for a broader stablecoin system centered on USST, a stablecoin designed to be backed by real-world assets such as U.S. Treasuries. The token enables community participation in protocol upgrades, parameter adjustments, and treasury allocation. The model is designed to align user and protocol incentives while introducing accountable mechanisms as new features are rolled out.

Founder’s perspective

Reeve Collins, the STBL’s founder and co-founder of Tether, described the token as the governance LAYER of the project’s ecosystem: “The STBL token represents our vision for giving users an active role in shaping how stablecoins evolve. By connecting stablecoins to real-world collateral and routing benefits back to the community, we believe this model can help push the sector forward.”

Background

Reeve Collins is the co-founder of Tether, the world’s first and largest stablecoin, and is leading the STBL project. STBL is the governance token of the STBL protocol, allowing users to mint the USST stablecoin while earning yield. The stablecoin is RWA-collateralized, meaning holders receive profits from the underlying assets while also integrating DeFi instruments into their investment strategy to increase yields and unlock liquidity.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.