Bitcoin Bull Michael Saylor Shatters Expectations with Debut on Bloomberg Billionaires Index

Michael Saylor just joined finance's most exclusive club—and he did it with digital gold.

The MicroStrategy chairman blasted onto the Bloomberg Billionaires Index this week, cementing his status as Bitcoin's most vocal institutional advocate. His fortune—built almost entirely on conviction in cryptocurrency—now ranks among the world's wealthiest.

Saylor’s ascent mirrors Bitcoin's own relentless climb. While traditional investors hedged and hesitated, he doubled down—acquiring BTC aggressively through MicroStrategy and personally. That bet’s paying off spectacularly.

Not bad for a guy who basically told Wall Street to ‘have fun staying poor.’

Love him or hate him, Saylor’s blueprint is now case study material: leverage corporate strategy to accumulate Bitcoin, ignore short-term noise, and reap long-term rewards. His inclusion in the Bloomberg index isn’t just personal—it’s symbolic. Crypto wealth is now mainstream wealth.

Still, something tells us the old-guard billionaires—the ones who still think 'blockchain' is a ski resort term—aren't exactly thrilled to see a crypto maximalist crashing their party.

Saylor joins crypto billionaire club

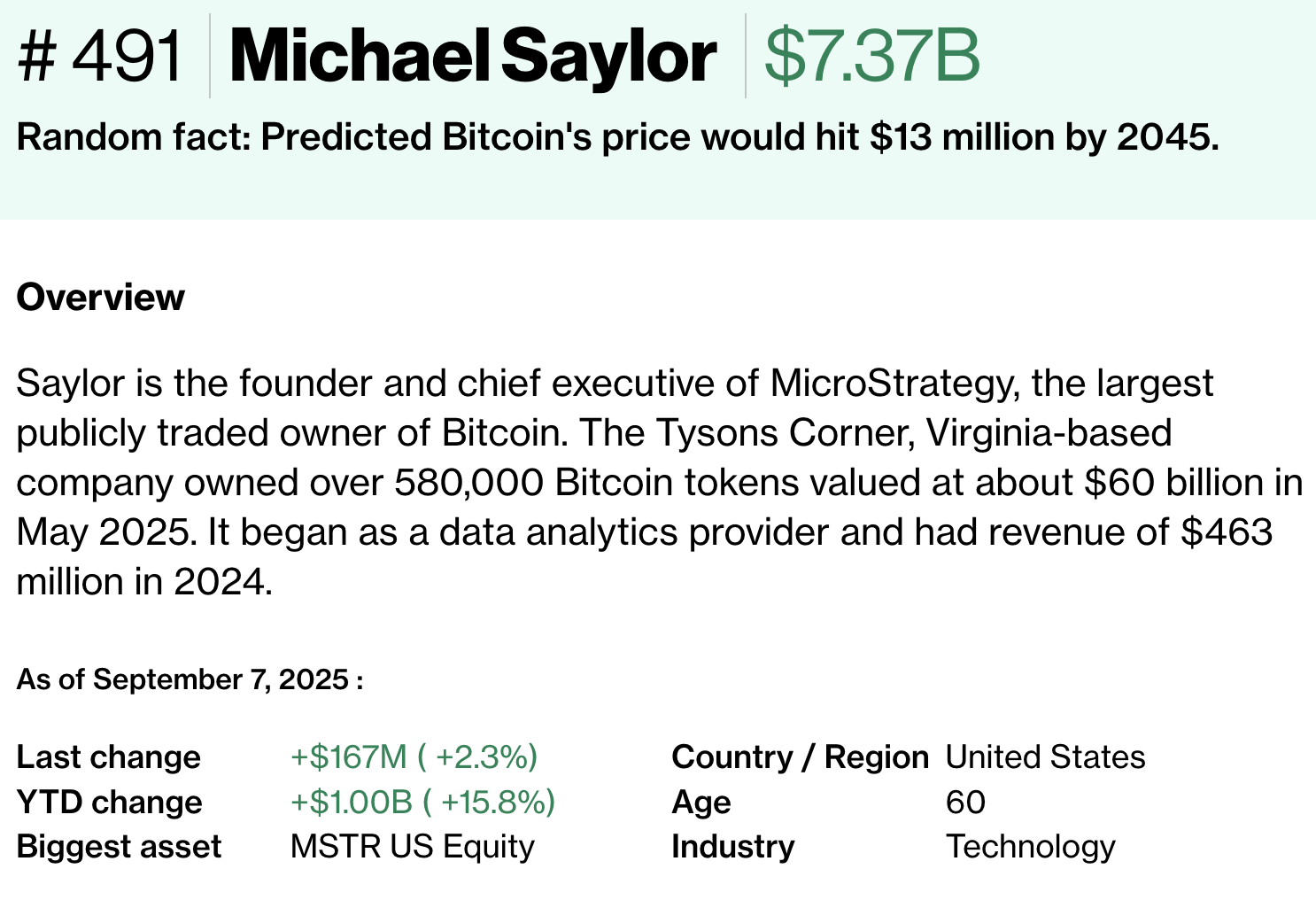

Saylor’s net worth has risen by $1 billion since the start of the year to $7.37 billion, ranking 491st globally.

The wealth surge coincides with Strategy’s continued Bitcoin (BTC) accumulation strategy and the cryptocurrency’s price movements throughout 2025. With 636,505 BTC as of September 2025, the firm has the most extensive corporate crypto treasury on record.

Saylor, who founded Strategy (previously known as MicroStrategy) in 1989, has $650 million in cash and $6.72 billion tied up in company stock, according to Bloomberg’s tracking methodology.

The direct correlation between his wealth and cryptocurrency markets makes him one of the most Bitcoin-exposed billionaires globally. See below.

Saylor’s debut comes as bitcoin trades around $111,000, down about 4.3% over the last 30 days.

Strategy’s first bitcoin purchase was in 2020. As of August 2025, it has accumulated 628,946 BTC — valued at roughly $76 billion — acquired at an average price of $73,288 per coin for a total investment of about $46.1 billion.

The most recent major purchase occurred on Sept. 2, when Strategy acquired 4,048 Bitcoin at an average cost of $110,981 per coin, spending $449.25 million.

Earlier purchases in August included 3,081 BTC on Aug. 25 at $115,829 per coin for $356.87 million and 430 BTC on Aug. 18 at $119,666 each for $51.46 million.

The company also bought 155 BTC on Aug. 11 at $116,401 per coin for $18.04 million.

Strategy’s Bitcoin strategy has helped Saylor

Saylor’s inclusion places him among other prominent cryptocurrency billionaires on Bloomberg’s list.

Coinbase CEO Brian Armstrong ranks 234th with a net worth of $12.8 billion, while Binance founder Changpeng “CZ” Zhao holds the 40th spot with $44.5 billion.

The crypto billionaire club has seen changes over time. Former FTX CEO Sam Bankman-Fried was previously on the list before his exchange collapsed in November 2022, wiping out his fortune and leading to criminal charges.

Strategy’s aggressive accumulation strategy has made it a proxy for Bitcoin exposure among traditional investors. Yet, it was also notably left out of the S&P 500 index inclusion in August.

The company is also involved in lawsuit with investors who allege that the company misled shareholders about the risks and financial impact of its strategy.