Inflation Shock Hammers Bitcoin - Trump’s Massive Rate Cuts Now in Doubt

Hot inflation numbers just body-slammed Bitcoin, throwing cold water on Trump's promised rate cuts.

Markets Recoil

The latest CPI data smashed expectations, sending Treasury yields soaring and crushing risk assets across the board. Bitcoin took the hit hardest—down double digits as traders priced in a hawkish Fed stance through 2025.

Trump's Grand Plans Derailed

Those massive rate cuts Trump's been touting? Looking increasingly unlikely as inflation proves stubborn. The market's betting the Fed keeps rates higher for longer, because apparently even politicians can't print away economic reality.

Bitcoin's brutal reaction shows it's still tied to traditional monetary policy—no matter how much crypto bros pretend otherwise. Another reminder that when macro sneezes, crypto catches pneumonia.

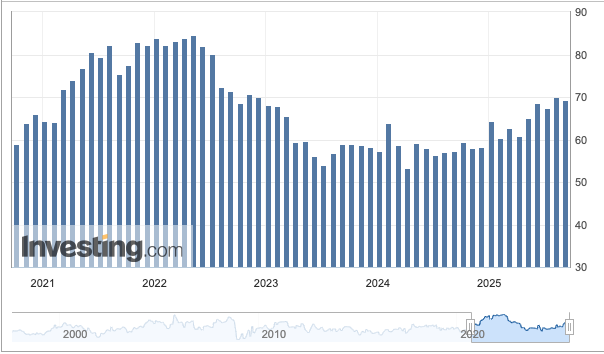

U.S. ISM Non-Manufacturing Prices | Source: Investing.com

U.S. ISM Non-Manufacturing Prices | Source: Investing.com

Elevated inflation figures will likely make the Federal Reserve more cautious when deciding on interest rates in the upcoming September 17 meeting. Still, a rate cut of 25 basis points remains the most likely outcome, on which Polymarket traders put an 86% probability.

Trump’s massive rate cuts less likely

New inflation data will likely undercut Donald Trump’s push for a major rate cut. The president has been pushing for lower interest rates almost since he was elected. However, since July, TRUMP has set a new target of 1%, a massive change from the current 4.25% to 4.50% range.

Still, Trump has more avenues to bypass the Fed. For one, the Treasury Department, under Trump’s direct control, continues to buy its own Treasuries, most recently $2 billion on September 3. This operation, which Investing.com analyst called “QE without the Fed,” aims to reduce the borrowing cost for the government.