Crypto Markets Bleed $900M in Liquidations After Fed Chair’s Jackson Hole Bombshell

Powell's words trigger crypto carnage as leveraged positions get vaporized.

The Taper Talk Tsunami

Fed Chair Jerome Powell's Jackson Hole address sent shockwaves through digital asset markets—traders got caught with their leverage showing. Over $900 million worth of positions got liquidated faster than you can say 'quantitative tightening.'

Liquidation Cascade

Longs got slaughtered as Bitcoin and Ethereum led the decline. Altcoins followed suit—nothing like watching your portfolio get rekt while central bankers talk about inflation targets. The usual suspects got hit hardest: over-leveraged degens and those who thought 'this time it's different.'

Market Mechanics Exposed

Exchange liquidation engines went into overdrive—stop losses triggered like dominoes. The whole episode proved yet again that crypto markets remain hypersensitive to traditional finance narratives. Who needs fundamentals when you've got Fed speeches moving markets?

Same old story—traders forget that when the Fed talks, crypto listens. Maybe next time they'll actually hedge something.

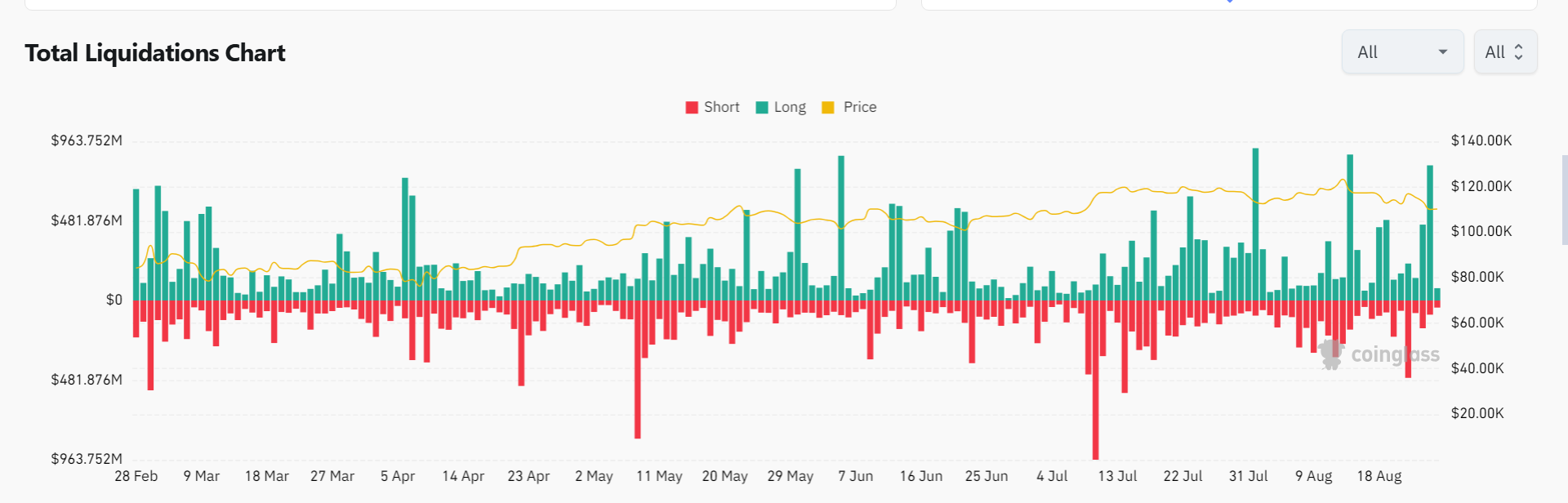

Crypto liquidations in the past 24 hours dominated by long positions | Source: CoinGlass

Crypto liquidations in the past 24 hours dominated by long positions | Source: CoinGlass

On August 22, at the Jackson Hole, Federal Reserve Chair Jerome Powell hinted at possible interest rate cuts ahead as he stated that there was currently a high level of uncertainty that is making it difficult for policymakers.

This move sparked major gains in the crypto market as Bitcoin climbed to a weekly high of $116,960 as it nearly touched the $117,000 level. However, the victory ended too soon as BTC avalanched down to the $109,000 range.

What could high crypto liquidations mean for the market?

Crypto liquidations hitting $941 million could indicate extreme volatility and over-leveraging by traders within the wider crypto market. Considering liquidations are triggered by price swings that close long and short positions, such a large-scale wipeout points to an imbalance between bullish and bearish sentiment, with cascading liquidations accelerating the downward move.

This is evident through the overall crypto market cap losing $200 billion or around 2.2% of its market cap. On August 26, the crypto market cap fell from its $4 trillion high and stands at $3.8 trillion. Meanwhile, Bitcoin has yet to recover from its fall from grace; it hangs precariously at the edge of $110,000 as it currently trades at $110,250.

Ethereum (ETH) is faring slightly better despite a 4.9% dip as it stays within the $4,400 range with a value of $4,429.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.