OKB Token Rockets 200% – Is a Brutal Correction Coming?

OKB just pulled off a moonshot worthy of Wall Street's most reckless meme traders. The exchange token ripped past skeptical analysts with a 200% surge – but now the big question looms: Will gravity finally kick in?

Exchange tokens live dangerous lives. One minute they're riding high on platform growth and fee burns, the next they're getting dumped like last year's NFT portfolio. OKB's parabolic move smells like classic crypto euphoria – the kind that usually ends with someone holding the bag.

History suggests a reckoning comes for all overextended assets. Whether OKB faces a gentle pullback or full-blown crash depends on whether traders believe in the token's utility beyond speculative hot potato. After all, even the shiniest exchange token can't defy market cycles forever – no matter what the 'to the moon' crowd claims between martini lunches.

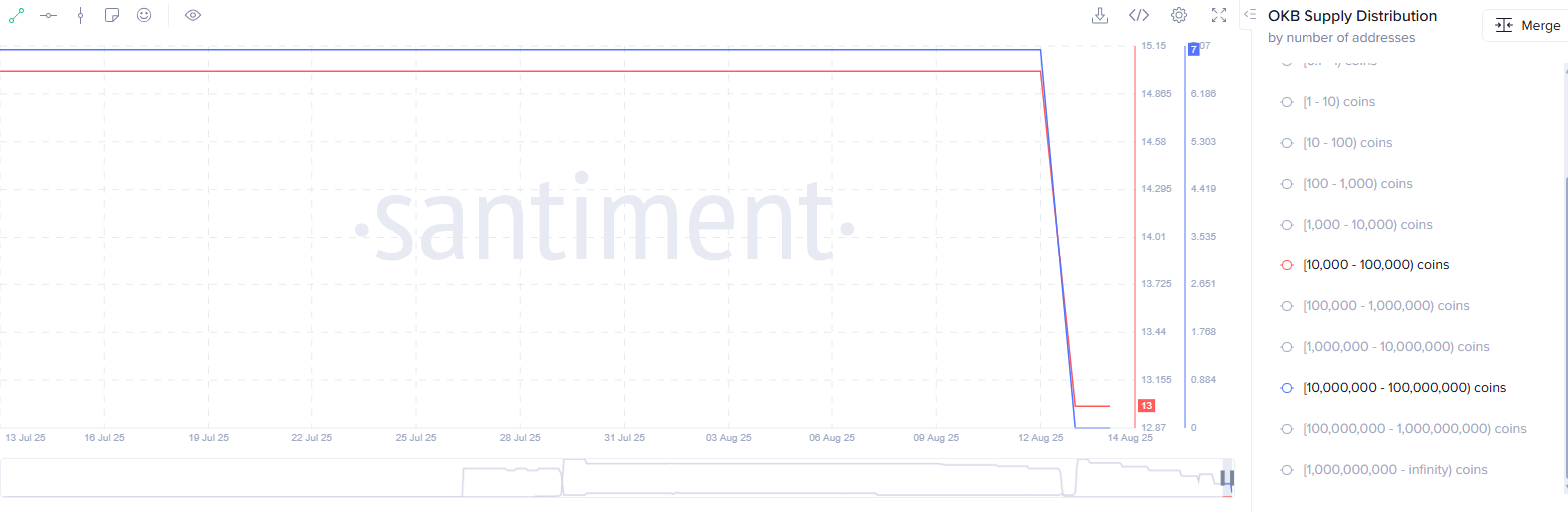

Source: Santiment

Source: Santiment

Such a sell-off from whale investors could lead to further declines if it triggers panic selling among retail traders who often follow these deep-pocketed investors into or out of positions.

It is also common in the crypto market for early investors to sell off their holdings to lock in profits after a cryptocurrency reaches an all-time high. Such moves can accelerate a price decline for OKB if they coincide with a broader market sell-off, especially since the overall crypto market remains close to its new peak and could face heightened volatility.

OKB price analysis

On the daily chart, OKB’s price has not established any distinct pattern, as its recent surge followed months of consolidation within the $34–$65 range since the beginning of the year.

The Relative Strength Index has formed a bearish divergence after entering the overbought zone at 95 and subsequently declining to 91. While this marks a slight pullback, the indicator remains in extremely overbought territory, still signaling elevated risk of a correction.

The Average Directional Index currently stands at 24, suggesting that a potential reversal trend is developing but not yet at full strength. A reading above 25 WOULD confirm that the reversal is gaining momentum.

Fibonacci retracement analysis identifies the next significant support at $81.96, corresponding to the 38.2% level. A decisive break below this level could open the way for a deeper decline toward $44.20, a key long-term support zone.

Conversely, if buying pressure emerges and OKB rebounds from $81.96, it could signal the start of another upward leg for the token.

The next few days will be critical in determining whether OKB can stabilize at higher levels or see its gains unravel once the post-rally momentum fades.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.