Monero Nears Critical Support Level: Oversold Signals Flash Buy Opportunity

Monero's price action is painting a compelling technical picture as it tests key support levels. The privacy coin's RSI has plunged into oversold territory—historically a reliable reversal zone for XMR bulls.

Will the 'digital cash' narrative overcome macro headwinds?

Traders are watching for confirmation of a relief rally, though cynics note most altcoins still move at the whim of Bitcoin's mood swings. As one fund manager quipped: 'In crypto, oversold just means it's only 50% overvalued instead of 200%.'

Key Technical Points

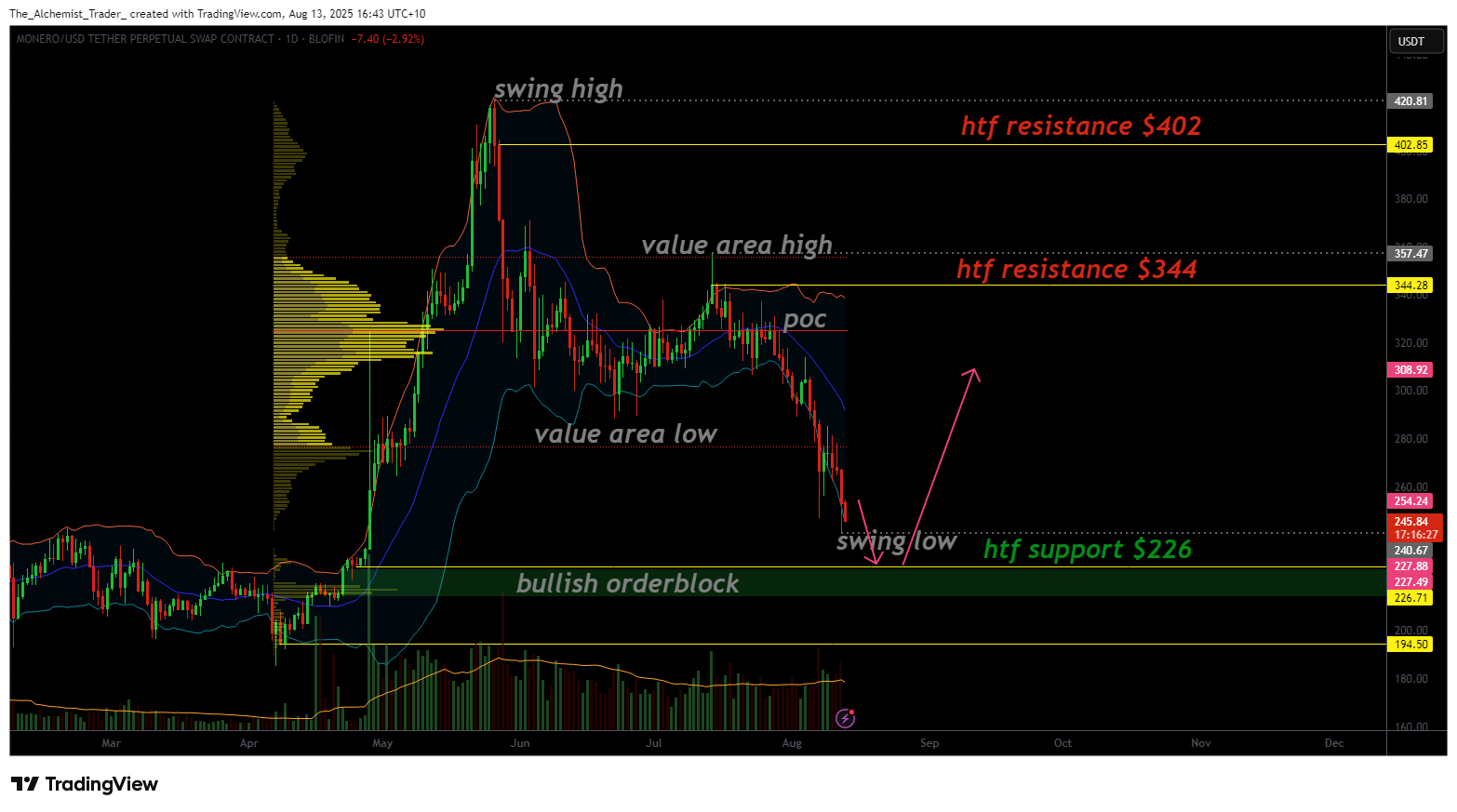

- Oversold Conditions: XMR has been in a sustained downtrend with no relief rally since losing the point of control.

- Major Support at $226: Confluence of a bullish order block and high-time-frame support.

- Volume Profile Signal: No climatic volume spike yet, indicating a bottoming pattern has not been confirmed.

The $226 region is a technical pivot point for XMR. A failure to hold this level WOULD likely result in a deeper correction, breaking below the current structural base and extending the downtrend. Price action needs to establish a bottoming structure here, preferably over several daily or weekly candles to shift momentum toward the upside.

From a volume profile perspective, selling pressure has been strong but has not yet produced a climatic spike, a classic sign of capitulation and a potential bottom. The absence of this signal suggests the MOVE could extend lower unless buying volume increases significantly at support.

If buyers defend $226 and trigger a reversal, the probability of a short-term rally improves, with potential rotation toward higher resistance zones. In this case, XMR could retrace toward previous breakdown levels, easing oversold conditions and allowing the market to stabilize.

However, without this structural support holding, bearish momentum will likely persist. The coming days and weeks will be critical for XMR’s short-term outlook, as the reaction at $226 will determine whether the market can mount a recovery or remain under sustained selling pressure.

What to expect in the coming price action

If Monero holds the $226 support, a relief rally toward higher resistance zones becomes likely, helping to unwind oversold conditions. Failure to maintain this base would reinforce the bearish trend and open the door to significantly lower prices.