Standard Chartered Doubles Down: Ethereum Now Eyes $7,500 in Bold Crypto Forecast

Banks finally wake up to crypto—just as prices moon.

From skeptic to cheerleader

Standard Chartered’s latest Ethereum price target isn’t just bullish—it’s borderline euphoric. The institutional giant now sees ETH hitting $7,500, a number that would’ve been unthinkable during the 2022 crypto winter.

Why the sudden faith?

While the bank didn’t specify catalysts, the timing speaks volumes. Coming just weeks before Ethereum’s next major protocol upgrade, it reeks of classic FOMO—the same herd mentality that makes traditional finance late to every profitable party.

The fine print no one reads

Price targets are cheap. What matters is whether Wall Street actually puts capital behind these predictions—or just uses them to sell more overpriced research reports to clueless asset managers.

One thing’s certain: if ETH does hit $7,500, the bank will claim clairvoyance. If it crashes? They’ll quietly ‘revise’ their models—again.

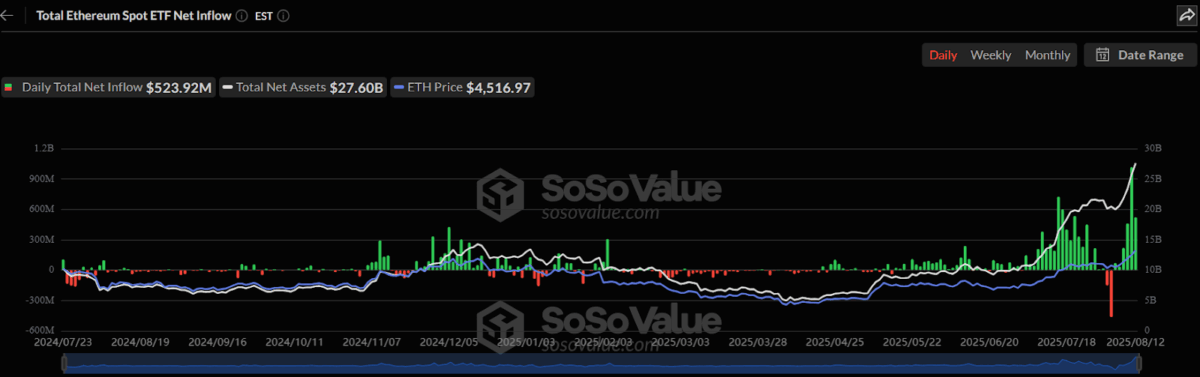

ETH ETFs | Source: Sosovalue

ETH ETFs | Source: Sosovalue

The bull upgrade comes as network activity increases after the July passage of the GENIUS Act, which established a clear U.S. regulatory environment for stablecoins.

Standard Chartered estimates the stablecoin market will grow eightfold to $2 trillion by 2028 with Ethereum, which hosts more than half of all stablecoin issuance, taking most of that growth. Stablecoins currently support 40% of all blockchain fees, giving ETH consistent demand.

Technical improvements are in the works as well. Ethereum co-founder Vitalik Buterin will boost layer-1 throughput by 10x to support more high-value on-chain transactions and push lower-value transfers onto layer-2 solutions such as Arbitrum and Base.

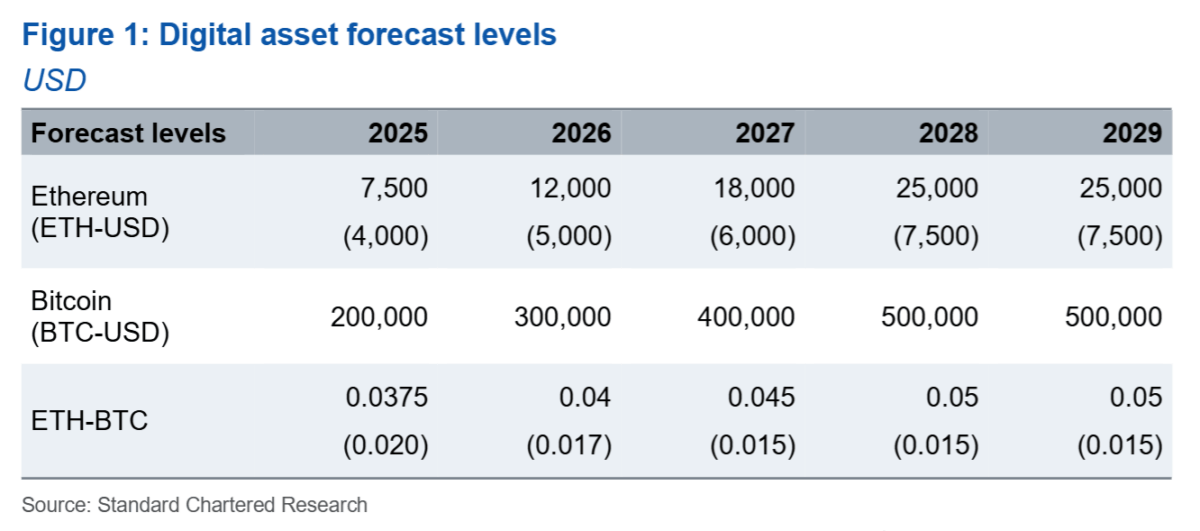

The third-largest cryptocurrency is expected by the bank to outperform Bitcoin in the next twelve months, with the ETH-BTC rate to rise from 0.036 to 0.05 by the end of 2025. The long-term target now are:

- $7,500 by year-end 2025 (up from $4,000)

- $12,000 by year-end 2026 (up from $5,000)

- $18,000 by year-end 2027 (up from $6,000)

- $25,000 by year-end 2028 (up from $7,500)

At the time of writing, ETH was trading at around $4,692, up more than 50% in the past month.

Also Read: ETH Eyes Breaking to New All-Time High Amid Strong Institutional Push

This content is for informational purposes only and does not constitute financial advice. crypto asset investments carry significant regulatory risk and are not suitable for all jurisdictions.