Parataxis Leaps Public with SPAC Deal—Building a $640M Bitcoin War Chest

Wall Street's latest crypto play just dropped—and it's packing serious digital firepower.

Parataxis slingshots onto public markets via blank-check merger, converting corporate coffers into a Bitcoin fortress. That $640 million treasury? Call it a bullish bet wrapped in financial engineering.

SPACs meet HODLing

The backdoor listing bypasses traditional IPO headaches while doubling down on crypto's institutional adoption wave. Because why raise dollars when you can stack sats?

Finance traditionalists are already clutching their pearls—nothing disrupts like a nine-figure corporate treasury mooning with BTC's volatility. Bonus points for the SPAC structure, Wall Street's favorite loophole for companies that prefer PowerPoints over profits.

One thing's certain: the suits are finally speaking our language. Just don't ask them to explain UTXOs.

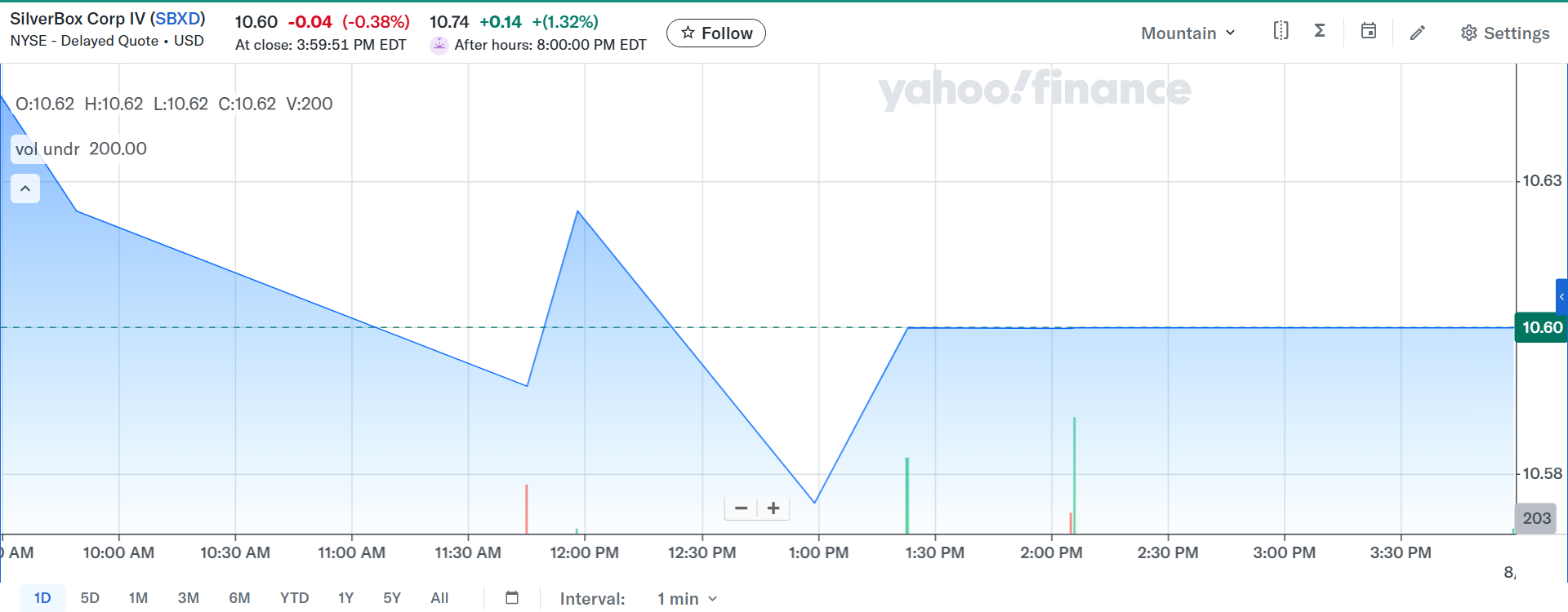

Stock price of SilverBox Corp IV rises after news of the merger, August 7, 2025 | Source: Yahoo Finance

Stock price of SilverBox Corp IV rises after news of the merger, August 7, 2025 | Source: Yahoo Finance

The acquisition of SilverBox Corp IV through a SPAC agreement will enable Parataxis to list publicly on the NYSE under the ticker symbol PRTX, gaining access to the U.S. market.

In turn, it also allows SilverBox to access the South Korean market as the digital investment firm has just recently started operating under a new name and focusing their operations on establishing a BTC reserve in Korea.

Parataxis plans to build a Bitcoin treasury in South Korea

According to the press release, the merger of the two companies will ultimately result in a BTC treasury company that will specifically target the U.S. and South Korean markets. Back in June 2025, Parataxis purchased South Korean biotechnology company Bridge Biotherapeutics Inc., renaming it into Parataxis Korea with the purpose of creating the country’s first Bitcoin treasury platform.

So far, not many South Korean companies have been interested in following the Metaplanet and Strategy blueprint. However, digital assets have been gaining traction in the region due to recent support from the current president, Lee Jae-myung. After Lee won the presidential election, he vowed to allow legalize spot Bitcoin ETFs this year.

Is there debt carried over in the deal?

According to a FORM 10-K filing made to the Securities Exchange Commission dated December 2024, SilverBox Corp IV does not have any outstanding debts carried over to the SPAC.

However, as of June 2024, the company did report $109,000 in current debt and capital lease obligations, all attributable to the unpaid sponsor promissory note. It was later confirmed that this debt was repaid by the first quarter of 2025, as no current debts or capital lease obligations were listed on the company’s balance sheet.

As for Parataxis, there is no indication that the company holds any long-term debt, bank loans, or public bond obligations listed in press releases or summaries. The only indication of debt is the Equity Line of Credit mentioned in the press release worth $400 million.

Though, it is worth noting that an ELOC is not a traditional debt. It functions as a credit facility, giving Parataxis the flexibility to issue equity as needed to fund operations and expand BTC holdings.