Metaplanet Shakes Markets with 555B Yen Bitcoin-Backed Share Offering—A Bold Bet on Crypto’s Future

Tokyo's Metaplanet just dropped a financial grenade—filing a shelf registration for 555 billion yen ($3.7B) in shares collateralized by Bitcoin. Move over gold—digital assets are the new institutional safe haven.

The Naked Truth: This isn't your grandpa's equity raise. By backing shares with BTC reserves, Metaplanet's effectively giving traditional finance the middle finger while hedging against fiat debasement. Genius or reckless? The market'll decide.

Numbers Don't Lie: At today's BTC prices, that warchest could buy ~52,000 coins—enough to make even MicroStrategy blush. Meanwhile, legacy banks are still trying to figure out how to custody crypto without getting hacked.

One thing's clear: When companies start using Bitcoin as balance sheet artillery, we're either witnessing financial revolution... or the mother of all bubbles. Place your bets.

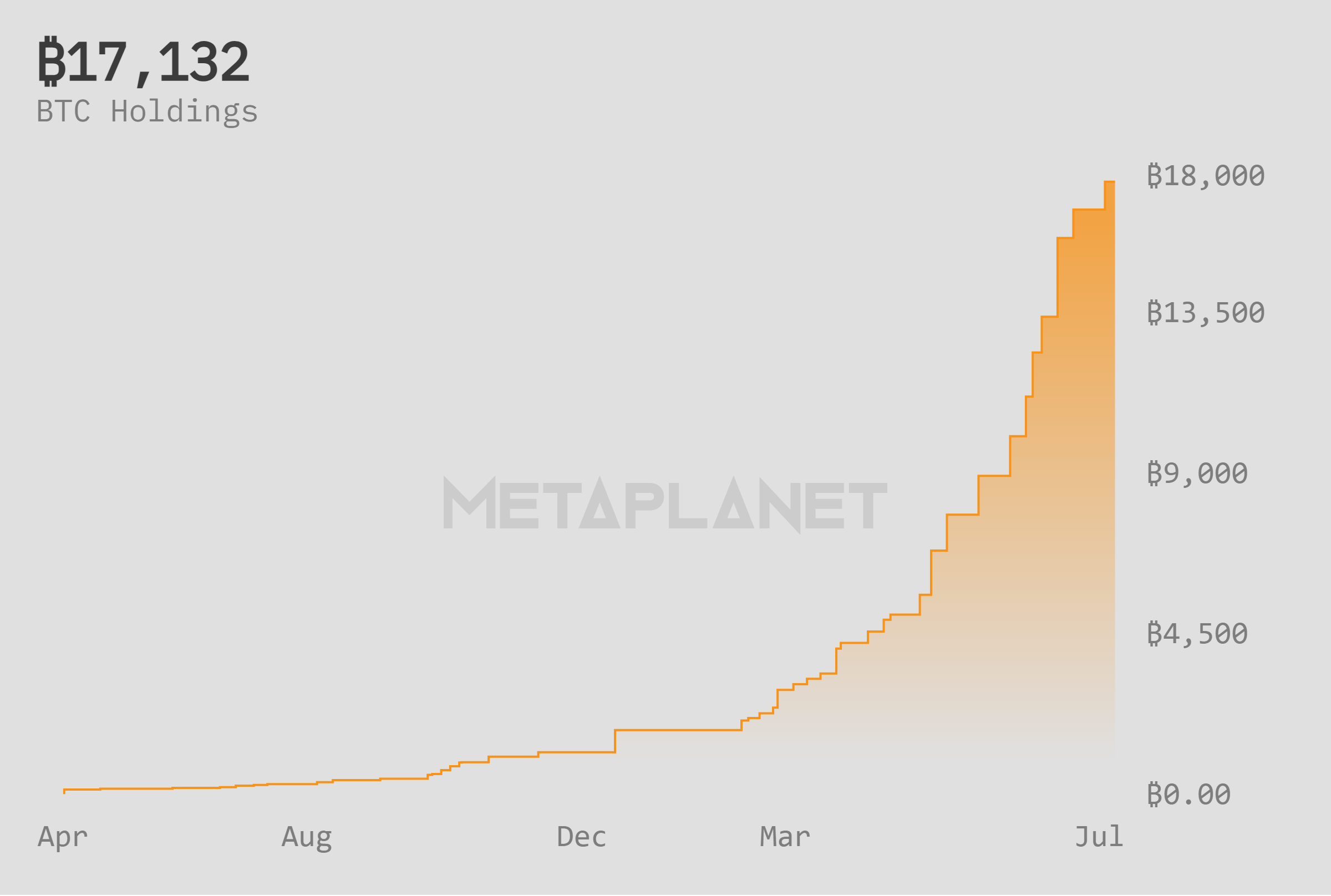

Chart of Metaplanet’s bitcoin holdings growth over the past few months | Source: Metaplanet

Chart of Metaplanet’s bitcoin holdings growth over the past few months | Source: Metaplanet

Metaplanet’s BTC milestone goal for 2027

So far, the firm has been primarily raising funds through common shares issuance to support their Bitcoin acquisition strategy.

Recently, it stated in a recent QnA file that it has been considering other types of shares issuance other than common shares. However, the issuance of preferred shares still depends on shareholders’ approval at the Annual General Meeting for the proposal.

At press time, Metaplanet holds a total of 17,132 BTC in its holdings with each BTC valued at an average price of $114,964, based on data from the firm’s official site. The holdings boast a BTC Yield of 449.7% on a year-to-date basis.

Previously in early June, Metaplanet announced its goal to hold at least 210,000 BTC by the end of 2027. If the firm does manage to own 210,000 BTC by 2027, then it WOULD own 1% out of the total existing Bitcoin supply in the world.

To achieve this goal, the firm has raised its annual target for 2026 from just 21,000 BTC to 100,000 BTC. The leap signifies a nearly five-fold leap from its previous BTC acquisition goal.