PLUME Primed for 40% Surge as Smart Money Goes All-In on Accumulation

Whales are circling—and this altcoin's chart is flashing buy signals.

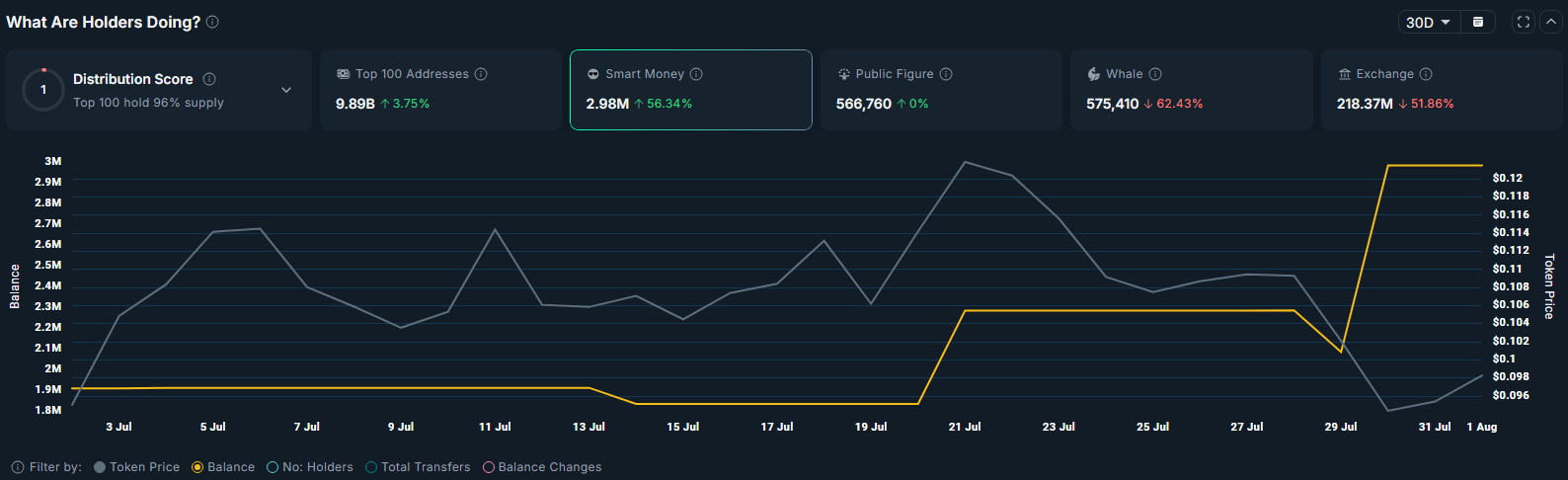

The smart money playbook: On-chain data reveals institutional-grade wallets loading up on PLUME tokens, with accumulation patterns mirroring previous pre-pump setups. When these players move, retail usually follows (and pays the markup).

Technical breakout brewing: The 40% rally projection isn't just hopium—it aligns with historical resistance flips and liquidity pools at key levels. Of course, in crypto, 'historical' means 'last Tuesday.'

Watch the leverage farms: Any price surge will likely get amplified by degenerate yield strategies—because why make 40% when you can liquidate your neighbor's collateral for 400%?

Pro tip: If the 'smart money' was really that smart, they'd have bought Bitcoin in 2010 and retired. But here we are.

Source: Nansen

Source: Nansen

Why does smart money accumulation matter?

Historically, a rise in smart money holdings often precedes major price movements. These investors typically conduct deeper due diligence and allocate capital based on forward-looking fundamentals. As a result, their moves often signal where the market might be headed. Retail investors, in particular, tend to track these wallets closely and may adjust their positioning in response to perceived insider conviction.

In the case of Plume, the recent surge in smart money activity aligns with the protocol’s rapid expansion in the real-world asset (RWA) sector.

Data from RWA.xyz shows that Plume’s RWA holder count has increased sixteenfold since June, rising to 166,892 wallets at the time of writing. This growth has pushed PLUME ahead of Ethereum, making it the blockchain with the largest number of RWA holders.

At present, Plume accounts for nearly 50% of all RWA holders across the entire market.

RWA holders refer to unique wallet addresses that hold tokenized real-world assets on a blockchain network. A rising RWA count typically reflects increased user adoption and growing demand for tokenized financial products.

In Plume’s case, the expanding user base helps validate its infrastructure as a leading RWA-native chain and could enhance its appeal among institutional investors seeking compliant, yield-generating exposure.

Evidence of this growing institutional attention became more evident when Grayscale, one of the largest digital currency asset managers in the world, added PLUME to its list of digital assets “under consideration.” The list includes 28 tokens spanning sectors from DeFi infrastructure to tokenized assets and LAYER 1 protocols.

While it doesn’t guarantee a new product launch, Grayscale’s inclusion of PLUME shows it may be considering the token for a future trust or ETF-like offering. It’s a sign that institutions are starting to take Plume’s role in the RWA space more seriously, which could help boost both investor interest and credibility.

Is PLUME preparing for a technical breakout?

The daily chart suggests that PLUME may be nearing a bullish reversal. After reaching a year-to-date high of $0.209 in May, the token declined by 63% to hit a low of $0.076 on June 22.

At that level, price action formed a double bottom pattern, a classic reversal signal. This structure prompted a rebound to $0.12 before PLUME entered a consolidation phase that lasted through most of July.

In recent sessions, price action has taken the FORM of a falling wedge—typically a bullish continuation pattern—defined by a narrowing range of lower highs and lower lows.

The upper trendline of this wedge currently converges around the $0.100 level, which also aligns with the 50-day simple moving average. A decisive MOVE above this level could trigger a breakout.

Momentum indicators are beginning to support this potential breakout. The 20-day SMA has crossed above the 50-day SMA, forming a golden cross, a pattern often interpreted as a bullish signal.

Additionally, RSI has started to climb after bouncing from a low of 37, suggesting that bearish momentum is fading and buying pressure is gradually returning.

If PLUME breaks above the wedge and clears the $0.100 resistance, the short-term technical target stands at $0.13, representing an approximate 40% upside from current price levels. A successful move above $0.13 could open the path to $0.18, a price level that has served as firm resistance on multiple occasions this year.

However, this setup remains sensitive to broader market conditions. At the time of writing, overall sentiment appears subdued, with the global crypto market cap falling 7% over the past 24 hours amid renewed uncertainty surrounding macroeconomic policy and political developments.

At press time, Plume was trading at $0.096, with no gains in the past 24 hours.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.