TRON Overtakes Ethereum as Tether’s USDT Settlement Powerhouse – Here’s Why It Matters

TRON just flipped the script—and Ethereum—to become the dominant settlement layer for Tether’s USDT. The blockchain wars just got a liquidity upgrade.

The Layer-1 Shakeup Nobody Saw Coming

Move over, Ethereum. TRON’s cheaper fees and faster finality are now the go-to rails for $72 billion worth of USDT transactions. Traders vote with their gas fees—and the results are brutal for ETH maximalists.

Stablecoins Are the New Oil (and TRON’s the Pipeline)

When 53% of all USDT settlements happen on TRON, it’s not just a trend—it’s an infrastructure coup. The chain’s becoming the Visa of crypto payments while Ethereum’s stuck being the AmEx for DeFi degens.

The Cynical Take: Wall Street still thinks ‘blockchain’ is a Microsoft Excel plugin—meanwhile, actual finance is happening where the friction stops and the liquidity flows. TRON gets the last laugh.

Stablecoin machine

TRON’s grip on the stablecoin market appears stronger than ever as USDT alone accounted for 98% of the top 10 token transfers on TRON during the first half of 2025, totaling 384 million movements.

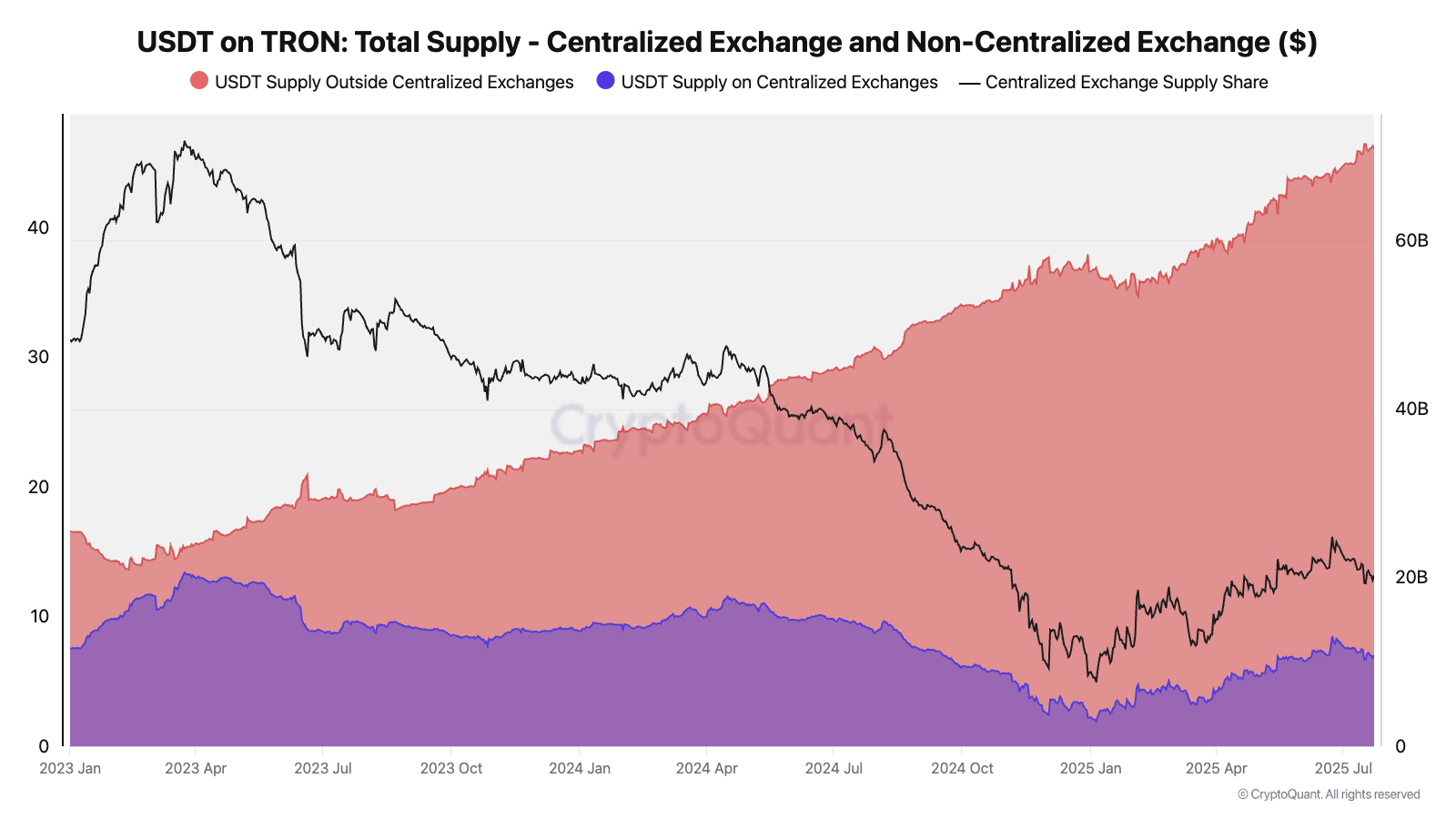

Moreno noted that the vast majority of USDT on TRON is held off centralized exchanges, with the CEX supply share falling from 46% in early 2023 to just 13% today. “Users increasingly leverage TRON for DeFi protocols, lending/borrowing, cross‑border remittances or P2P payments rather than merely parking funds on centralized venues,” he said.

TRON’s dominance in stablecoin usage may also reflect a more practical focus. Unlike Ethereum, which is often used for complex smart contracts and experimentation, TRON has found its niche in fast, low-cost transfers, especially in emerging markets and informal finance.

Still, dominance in transfer volume doesn’t necessarily equate to network health as much of the usage may come from repetitive or automated transactions rather than active, diverse engagement.

DeFi expands, but slowly

Although TRON’s decentralized finance is still far from levels seen on Ethereum, activity is still showing signs of maturity. SunSwap, its decentralized exchange, saw monthly WTRX swap volumes top $3.8 billion in May, with transaction counts significantly higher than 2024 averages. The platform also saw a diversification in trading pairs, as wTRX’s dominance in swaps fell from 98% to 70%, making way for stablecoin- and memecoin-based activity.

JustLend, TRON’s lending protocol, also saw a 23% rise in borrowing transactions, driven largely by stablecoins, while daily deposit volumes on JustLend tripled since January, peaking at $740 million in April, according to the report.

These developments suggest TRON’s ecosystem is expanding beyond simple transfers. Still, as noted above, TRON’s DeFi landscape remains smaller and less complex than Ethereum’s or Solana’s, and critics have pointed to the outsized role of centralized governance in TRON’s architecture.

While the data points to what seems to be real traction, the story of TRON’s USDT dominance isn’t one of pure technological superiority; it’s also about tradeoffs: low fees and gasless transactions have made the network attractive, especially for stablecoin users in regions with limited access to traditional banking.

But whether TRON can sustain that growth without leaning heavily on USDT remains uncertain. Its broader ecosystem — governance, developer activity, novel dApps — still trails behind Ethereum and other platforms.