XLM Primed for Explosive Growth as Stellar Stablecoin Adoption Skyrockets

Stellar's XLM is flashing bullish signals as its ecosystem absorbs a tidal wave of stablecoin demand. The blockchain's frictionless cross-border rails—and Wall Street's sudden love affair with tokenized dollars—could catapult the altcoin past resistance levels.

Stablecoin surge fuels network activity

Transaction volumes are spiking as institutions tap Stellar for near-instant settlements. Forget 'slow and expensive'—this is the DeFi pipeline TradFi actually wants to use (ironic, right?).

Technical setup hints at breakout

The charts show XLM consolidating in a tightening range—classic accumulation behavior before volatile moves. With RSI bouncing off support, the stage is set for a potential 2025 rally.

Just don't tell the Bitcoin maxis

While crypto's old guard obsesses over store-of-value narratives, Stellar's quietly building the plumbing for real-world payments. Because nothing terrifies bankers quite like functional infrastructure.

Stellar’s stablecoin growth is continuing

Third-party data shows that Stellar’s stablecoin growth is accelerating, supporting its goal of disrupting the payment industry.

According to Artemis, the circulating supply of stablecoins on stellar jumped 13% in the last 30 days to over $189 million. This suggests the supply could surpass the $200 million milestone in August, especially after the signing of the GENIUS Actin the United States.

The adjusted transaction volume ROSE 10% to $1.9 billion, continuing an upward trend that began a few months ago.

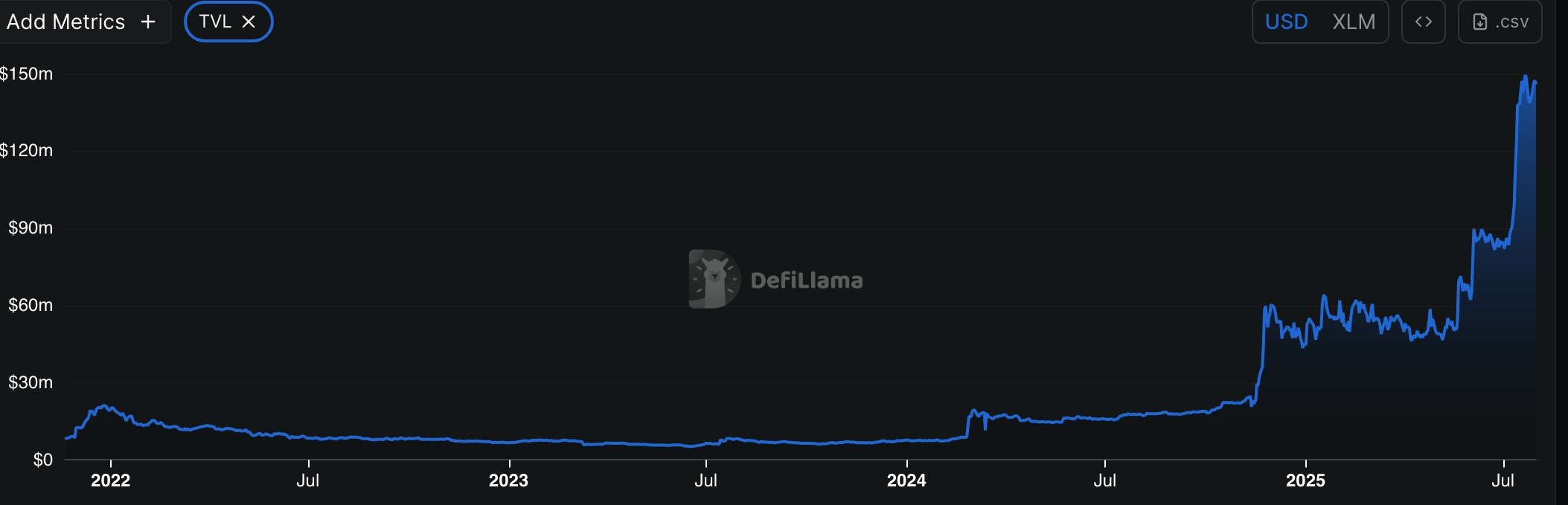

Additional data shows that the total value locked on the Stellar network climbed to a record $145 million, up from a year-to-date low of $52 million. Previously, Stellar’s ecosystem held less than $20 million in assets.

Stellar has also emerged as a notable player in real-world asset tokenization, with its tokenized assets rising to over $441 million.

Nansen data indicates that Stellar’s network activity is growing. Active transactions remained NEAR 20 million in the last 30 days, while the number of active addresses rose 60% to over 30,000.

XLM price technical analysis

The daily chart shows that the XLM token formed a double-bottom pattern at $0.2178 with a neckline at $0.3345, its highest point in May. It then surged to a high of $0.5200 in July during the crypto bull run.

XLM price has since pulled back and formed a falling wedge pattern, a popular continuation signal. This pattern consists of two falling, converging trendlines, with a breakout typically occurring near their intersection.

Stellar price has also formed a rare bullish pennant pattern, featuring a vertical flagpole and a triangle. Additionally, it has formed a golden cross pattern as the 50-day moving average crossed above the 200-day moving average.

Therefore, the token will likely climb higher in August, with an initial target of $0.5200, up 26% from its current level. A break above that level could point to further gains, potentially reaching $0.6385, which is 55% above current prices.