Kraken Defies U.S. Tariffs with 18% YoY Revenue Surge—Despite Q2 Dip

Kraken just flexed its resilience—posting an 18% annual revenue jump even as U.S. tariffs bit into quarterly performance. Here’s how the crypto heavyweight turned headwinds into a bullish case study.

The Tariff Tango

Washington’s regulatory squeeze shaved 13% off Q2 revenues—but Kraken still outran 2024’s numbers. Proof that crypto exchanges now treat geopolitical risks like minor speed bumps.

Growth vs. Gravity

While Wall Street banks whine about ‘macro conditions,’ Kraken’s YoY climb shows digital assets aren’t waiting for permission to thrive. (Take notes, Jamie Dimon.)

The Bottom Line

Another quarter proving crypto’s anti-fragility—because nothing fuels innovation like regulators trying to choke it. Bonus cynicism: Imagine paying 30% tariffs while TradFi still uses SWIFT. *Laughs in blockchain.*

Source: 2025 Q2 Kraken Financial Report | blog.kraken.com

Source: 2025 Q2 Kraken Financial Report | blog.kraken.com

Q2 headwinds: EBITDA fell sharply amid market turbulence

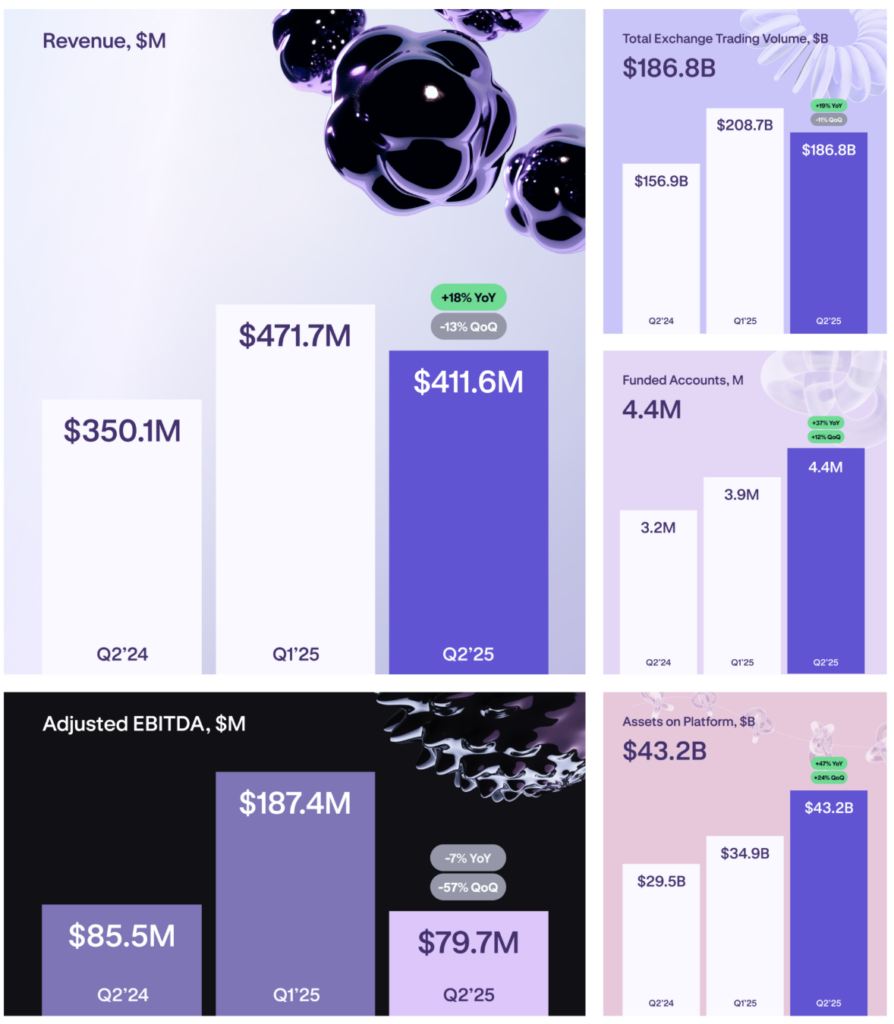

Despite strong top-line and platform growth, Kraken faced pressure on its bottom line. Adjusted EBITDA for Q2 fell to $79.7 million — down 7% YoY and a steep 57% from Q1’s $187.4 million. The drop was largely due to seasonally lower trading activity and macroeconomic headwinds, including volatility triggered by new U.S. tariffs that roiled crypto markets in April.

Trading volume declined 11% quarter-over-quarter from Q1, while revenue slid 13% sequentially. The company acknowledged Q2 tends to be a softer quarter across the industry.

The pullback in earnings from the previous quarter comes as Kraken accelerates its strategic roadmap, expanding into equities, tokenized securities, and cross-border money services. The firm is also ramping up licensing efforts globally, including newly secured regulatory approvals in Ireland and Canada, and is preparing for the launch of Kraken debit cards and international equities trading later in 2025.