Algorand Primed for 40% Rally as Bullish Pattern Meets Blockbuster Q2 Performance

Algorand's charts scream breakout—and its fundamentals just backed it up.

The Technical Setup

A textbook bullish pattern flashes green on ALGO's weekly chart. The 40% upside target isn't hopeful speculation—it's measured move math.

The Fundamentals Fueling It

Q2 numbers dropped like a mic: developer activity up, institutional inflows steady, and that carbon-negative blockchain narrative hitting harder than ESG funds chasing PR wins.

The Bottom Line

When techs and fundamentals align like this, even crypto skeptics pay attention. Though let's be real—if this were TradFi, we'd call it 'efficient markets' rather than 'a totally predictable pump.'

Source: TradingView

Source: TradingView

What’s driving ALGO price?

Beyond technicals, ALGO’s recent price action is also underpinned by fundamental developments highlighted in the Algorand Foundation’s Q2 2025 Transparency Report, released yesterday.

The report shows that Algorand network achieved record transaction volumes, surpassing 3 billion lifetime transactions in May, alongside a 7.5% QoQ increase in quarterly transaction volume. Consensus staking also surged by 28.7%, reaching 1.95 billion ALGO staked, while community-held staking rose 51%, reinforcing decentralization progress.

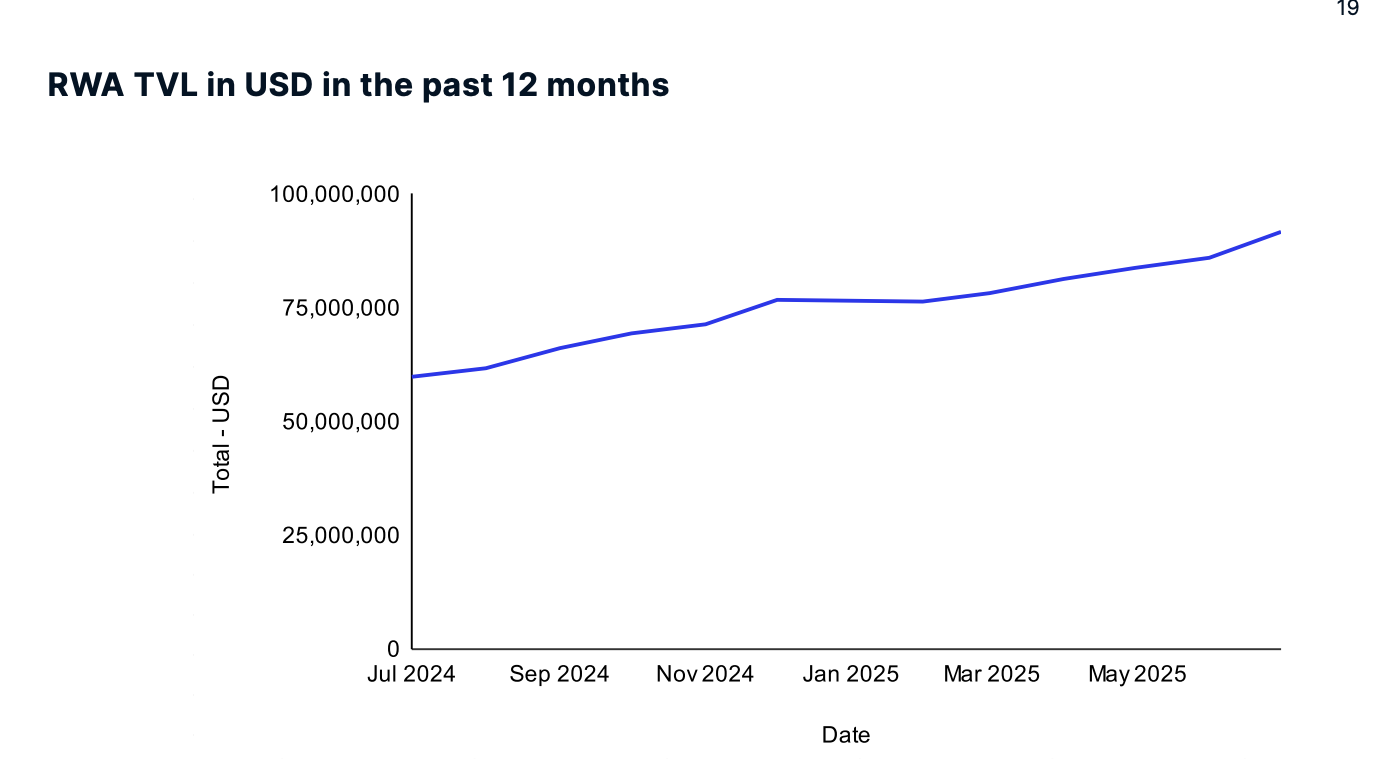

Additionally, RWA TVL on Algorand increased 12.7% in Q2, fueled by tokenization initiatives like the launch of Midas’ mTBILL, a tokenized short-term U.S. Treasury ETF certificate.