Gallup Reveals Crypto’s U.S. Adoption: Shallow, Uneven, and Stagnant—But Why?

Crypto’s American Dream? More Like a Side Hustle.

Gallup’s latest data paints a grim picture for digital assets in the U.S.—adoption remains sluggish, unevenly distributed, and barely inching forward. Forget moonshots; mainstream America still treats crypto like a speculative casino chip.

The 'Shallow Footprint' Problem

Despite a decade of hype, crypto’s penetration barely scratches the surface. The numbers don’t lie: adoption is crawling, not sprinting. Wall Street’s pet projects (looking at you, Bitcoin ETFs) haven’t moved the needle where it counts—Main Street.

The Uneven Playing Field

Wealth gaps? Try crypto gaps. Gallup’s data shows adoption skews hard toward the financially privileged, leaving the unbanked—the very people crypto promised to liberate—still waiting at the door.

Stagnation Nation

Growth rates? More like flatlines. While VCs and crypto bros chant 'number go up,' actual user growth resembles a stale stablecoin—pegged to inertia. Maybe it’s the regulations. Or the volatility. Or just the fact that normies still think 'DeFi' is a typo.

Closing Thought: If crypto were a stock, even the most bullish analyst would downgrade it to 'hold' after these numbers. But hey—at least the speculators are having fun.

The demographics of distrust: Who believes in crypto and who doesn’t

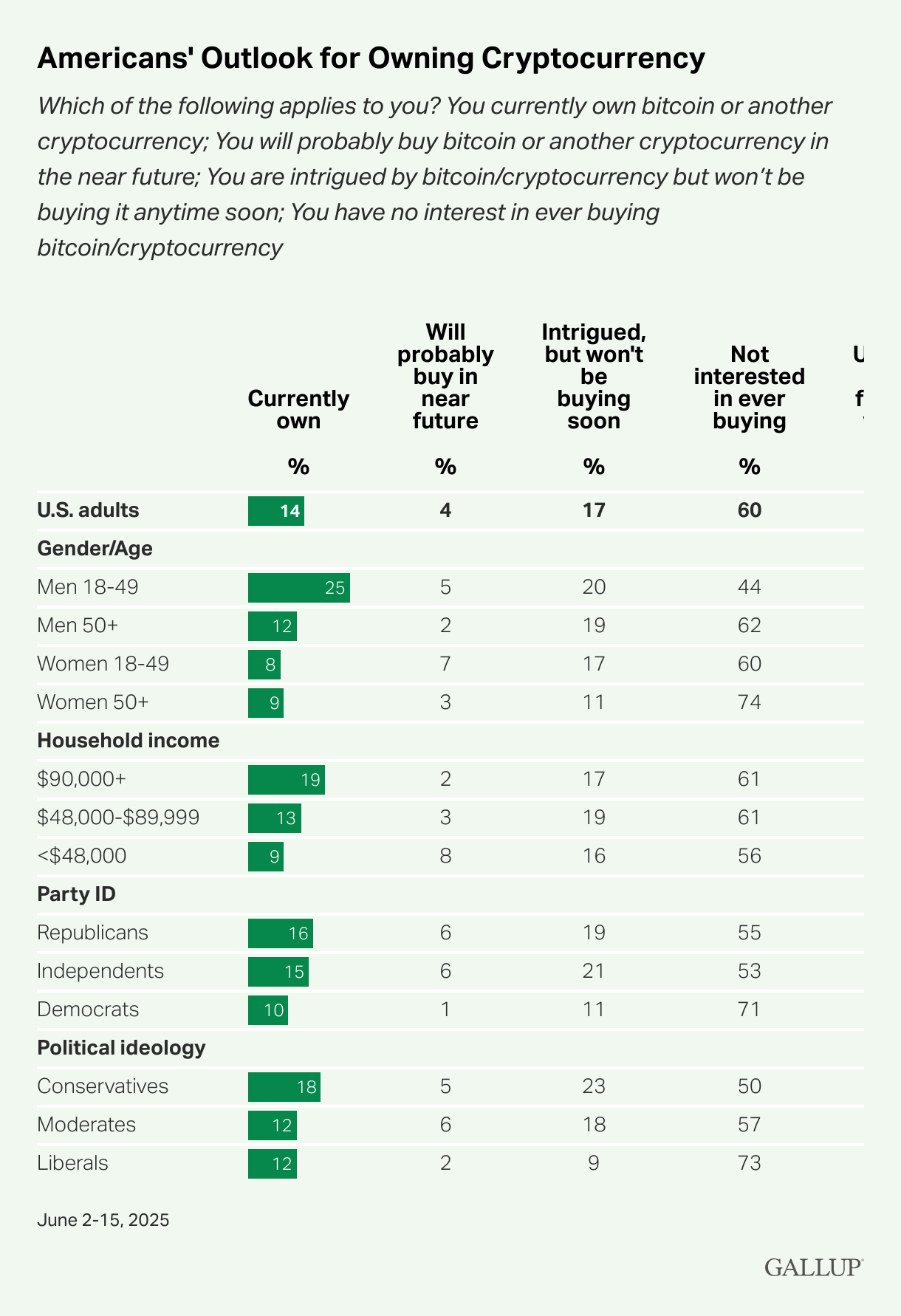

Gallup’s findings show crypto’s adoption split sharply along age and gender lines. A quarter of men under 50 own digital assets compared to just 8% of women the same age, and the gap grows wider with older generations.

Source: Gallup

The numbers suggest more than just ownership differences; they reveal fundamental gaps in access and confidence. Young men, constantly bombarded by crypto ads and steeped in tech circles, are three times more likely than their female peers to hold cryptocurrency. At the other end of the spectrum, only 7% of seniors have taken the plunge.

According to the report crypto’s appeal is still tied to demographics rather than universal utility. 19% of college graduates and high earners are nearly twice as likely to own crypto as 9% of lower-income Americans. Political identity also plays a role: 18% of conservatives hold digital assets, compared to just 11% of liberals. These splits hint at a cultural divide, one where crypto thrives among groups already inclined toward financial risk-taking, while others remain skeptical or disengaged.

The knowledge gap

Gallup researchers said 95% of U.S. adults recognize the term “cryptocurrency,” but only 35% claim any real understanding of it. For 60%, it’s little more than a buzzword; a concept they’ve encountered but can’t explain. This awareness-without-comprehension problem is especially pronounced among women and older adults. While 59% of men under 50 say they grasp crypto basics, just 22% of women over 50 do.

The survey’s most striking finding is that risk aversion transcends knowledge. It doesn’t matter if Americans say they get crypto or not; 87% still see it as risky, with more than half calling it “very risky.” Even seasoned investors, who usually stomach more risk, remain cautious: nearly two-thirds consider crypto highly speculative, showing little shift since 2021.

The numbers paint a divided picture. While younger, affluent men largely see crypto as their high-stakes gamble, everyone else either wants no part of it or remains firmly on the fence about its place in their financial lives..

Regulation, like the GENIUS Act, could legitimize crypto for skeptics. But Gallup’s data suggests rules alone won’t suffice. Until digital assets shed their reputation as a casino for tech bros and prove their staying power, mainstream America will likely keep its distance.