Franklin Templeton’s BENJI Platform Goes Live on VeChain—Unlocking Tokenized Treasury Markets

Wall Street meets blockchain—again. Franklin Templeton just flipped the switch on its BENJI platform via VeChain, giving crypto natives backdoor access to tokenized U.S. treasuries. Because nothing says 'decentralized future' like digitized government debt.

The move signals institutional players are still betting big on blockchain infrastructure—even if they're just using it to repackage the same old financial products. VeChain's enterprise-grade protocol now becomes the plumbing for TradFi's latest crypto experiment.

While the BENJI rollout lacks flashy APY promises, it does offer something rare in DeFi: actual regulatory compliance. The platform delivers 24/7 settlement for treasury exposures—a first for funds traditionally locked in market hours.

Critics whisper this is just finance cosplaying innovation. Supporters counter that onboarding real-world assets is crypto's only path to relevance. Either way, the suits are here to stay—and they brought their own blockchain.

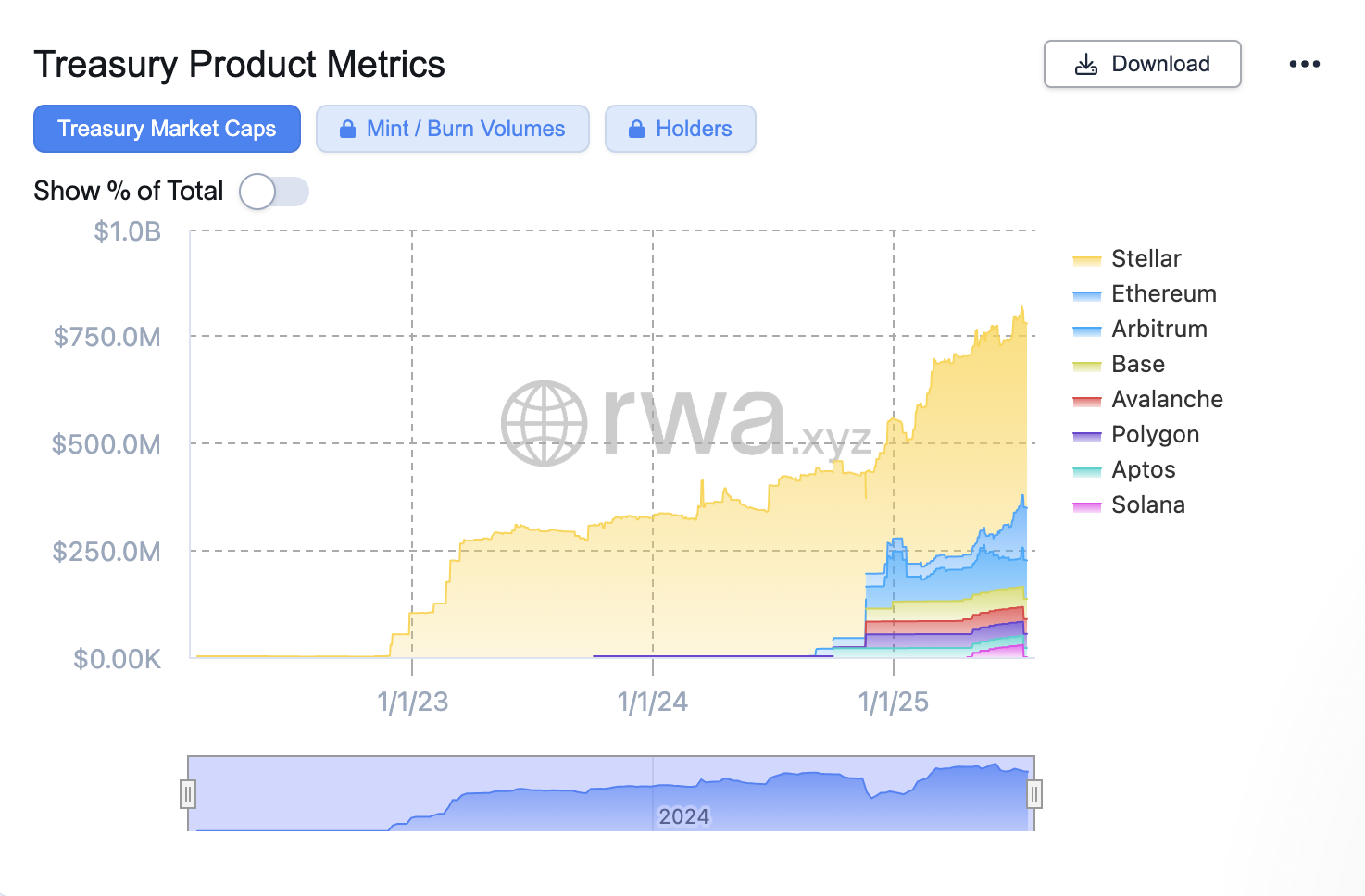

FOBXX fund’s current blockchain presence

The FOBXX fund, which currently holds $780 million, is already available across several other blockchain networks, including Stellar, Ethereum, Solana, Arbitrum, Avalanche, Polygon, Base, and Aptos. Among these, stellar currently holds the largest portion of BENJI’s market cap at over $430 million.

The FOBXX fund directly competes with other tokenized money market products, most notably the BlackRock’s BUIDL fund and ONDO Short-Term U.S. Government Treasuries Fund (OUSG), which recently expanded to XRP Ledger.