Solana’s DeFi TVL Soars to $10B – Six-Month High Signals Bullish Revival

Solana’s DeFi ecosystem just smashed through a critical milestone—$10B total value locked (TVL). That’s its highest level in half a year, and traders are scrambling to decode what’s next.

The Comeback Kid

After months of sideways action, Solana’s DeFi stack is flexing again. The $10B TVL mark isn’t just a number—it’s a middle finger to the 'Ethereum killers are dead' crowd.

Why It Matters

Liquidity breeds liquidity. With institutional sharks now circling Solana’s DeFi pools, the network’s fee burn and yield farms could get spicy fast. Just don’t mention the last time TVL peaked—nobody wants that hangover again.

The Punchline

Wall Street still thinks 'DeFi' is a typo, but $10B doesn’t lie. Solana’s back. Now watch the 'experts' suddenly remember its name.

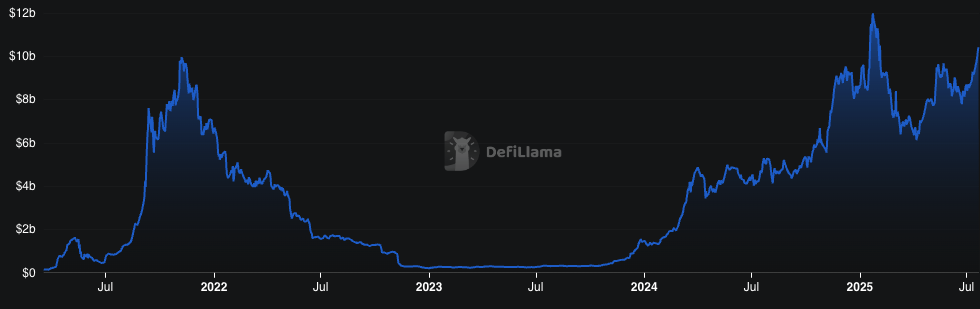

Solana’s DeFi total value locked in USD | Source: DeFiLama

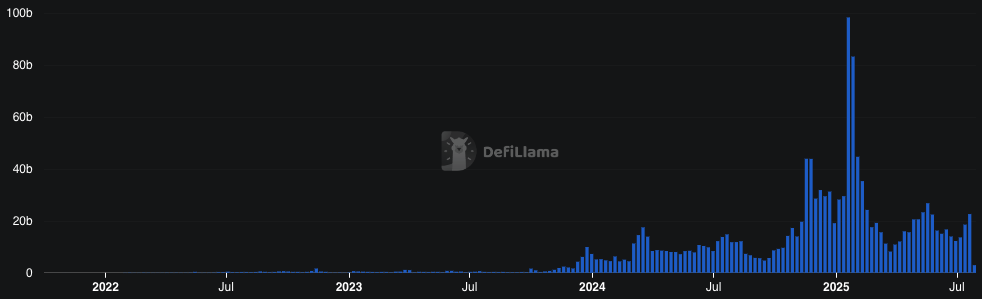

Solana’s DeFi total value locked in USD | Source: DeFiLama

At the same time, the increase in Solana’s price also contributed to the rising value of its total ecosystem. Solana’s DeFi TVL has reached $10.453 billion, the highest this metric has been since January, when SOL hit an all-time high.

The growth was also reflected in the increase in DEX activity, although these figures did not approach the January highs. Between July 14 and July 20, solana DEXs processed $22.58 billion in volume, up from $18.5 billion on the week prior.

Leading among decentralized exchanges are Raydium, Orca, and Meteora, with weekly volumes of $8.4 billion, $5.9 billion, and $5.3 billion, respectively. Still, weekly DEX volume remains far from its peak in mid-January, where it reached $98.28 billion.

Why Solana’s DeFi TVL rose

The most likely reason for Solana’s DeFi TVL reaching a six-month high is the boost from the Solana token price. This is because SOL tokens account for a significant percentage of assets held across the network’s DeFi protocols.

Solana’s DeFi TVL accounts for tokens, stablecoins, and memecoins deposited across various DeFi protocols within the Solana ecosystem. This includes tokens in smart contracts, lending pools, or vaults.

Still, the DeFi TVL does not include Solana tokens that are staked with validators for securing the network. Currently, this figure amounts to 355.4 million SOL, valued at $69.44 billion, or about 66% of all tokens in circulation. DeFi TVL also doesn’t include tokens held on centralized exchanges.