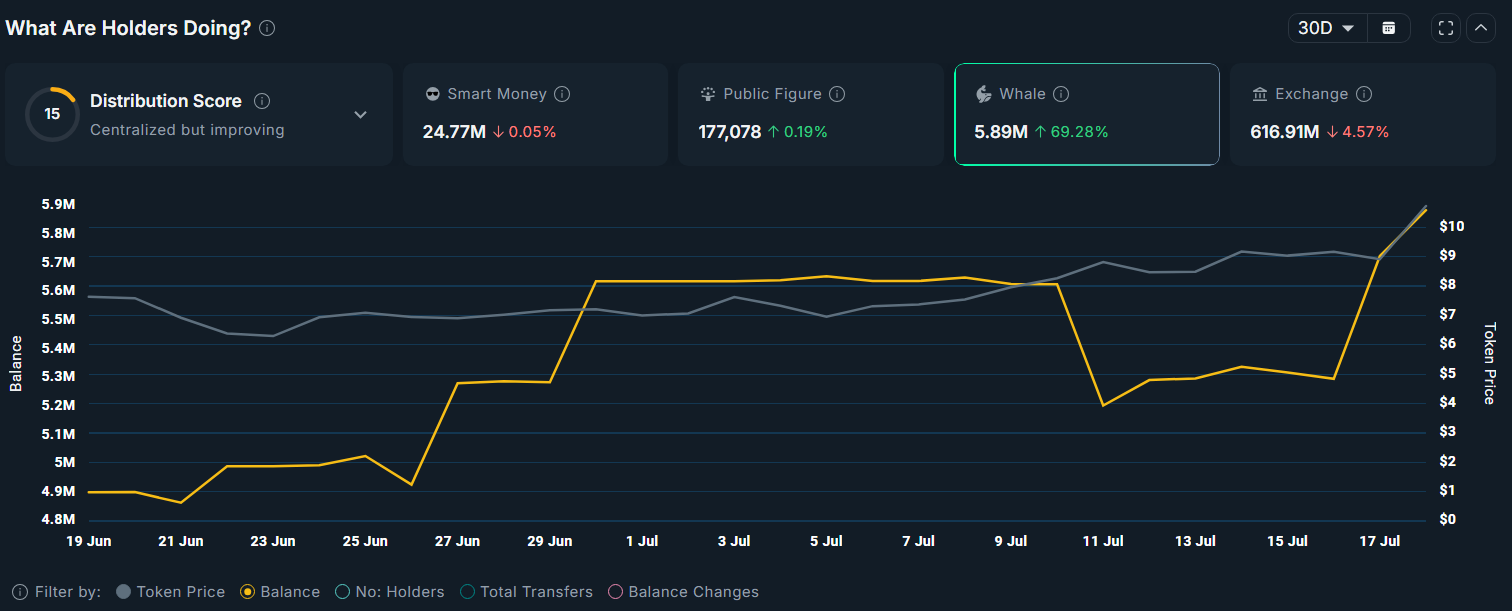

🚀 Uniswap’s UNI Whale Holdings Surge 67% in 30 Days—Bullish Storm Brewing?

Whales are gobbling up UNI like it's a Black Friday sale—and the charts are starting to notice.

### The Whale Feeding Frenzy

When crypto's big players pile into a token, markets tend to move. This time, they're betting hard on Uniswap's governance token—with whale wallets swelling by two-thirds in just one month.

### DEX Dominance Meets Smart Money

Uniswap isn't just another DeFi protocol; it's the liquidity backbone of Ethereum. Now institutional-grade holders are treating UNI like a blue-chip stock—minus the SEC paperwork, of course.

### The Cynic's Corner

Sure, whale accumulation screams confidence. But let's see if they 'hodl' through the next 20% dip—crypto's rich love preaching diamond hands while secretly day-trading.

Source: Nansen

Source: Nansen

The ongoing whale accumulation appears to have sparked a chain reaction, drawing in retail investors as well.

According to CoinGlass, open interest in Uniswap’s futures market jumped 27% in the past day, reaching $763.68 million. That’s a big leap from around $240 million back in May, showing more traders are getting involved and placing bigger bets on the token.

The funding rate also moved higher, rising to 0.0233% from 0.0049% the day before. This suggests more people are going long on UNI, with traders willing to pay extra to keep their bullish positions open. It shows that traders are growing more confident in a potential upward MOVE and are positioning themselves for further gains.

As Ethereum’s largest DEX, Uniswap’s rally has also drawn strength from Ethereum’s sharp rebound over the past week, which lifted market sentiment and revived momentum across the DeFi ecosystem.

Total value locked in Uniswap has climbed back above $5.71 billion for the first time since February, after climbing roughly 21% since late June.

Uniswap price analysis

On the daily chart, Uniswap has been developing a rounded bottom pattern since January this year. The pattern, also known as a saucer bottom in technical analysis, is characterized by a slow and steady price decline followed by a similarly gradual recovery, forming a smooth, curved bottom.

The neckline of the rounded bottom pattern sits at $15.69, with the bottom formed at $4.59 earlier in April.

Meanwhile, the 50-day simple moving average appears poised to cross above the 200-day moving average in the coming days, forming a golden cross, a classic bullish signal that often indicates the start of a sustained uptrend and may further support upward momentum.

Hence, if Uniswap continues to complete the rounded bottom, the next key target lies at $12, a level that also aligns with the 50% Fibonacci retracement zone, making it a key resistance point. A decisive breakout above $12 WOULD increase the likelihood of a full pattern completion at the neckline level of $15.69, up 48% from the current price level.

Should bullish momentum remain intact through that breakout, UNI could potentially enter a parabolic rally, opening the door to much higher price levels in the weeks ahead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.