Calamos Drops Game-Changer: ‘Protected Bitcoin’ Strategy Targets Institutional FOMO

Wall Street's latest crypto play just went live—and it's wrapped in risk-averse packaging.

Calamos Investments, the $35B asset manager, unveiled its 'Protected Bitcoin Strategy' today, offering institutional investors a hedged gateway into crypto's volatile waters. The move signals growing demand for structured exposure as Bitcoin flirts with all-time highs.

The Fine Print: The strategy combines Bitcoin futures with options overlays—classic institutional alchemy to 'have your crypto and eat it too.' Early documents suggest downside protection up to 15%, though the cost? A juicy 2.5% management fee (because what's Wall Street without its vig?).

Why Now?: With pension funds and endowments still sweating over 2022's crypto winter, Calamos is betting big on fear-of-missing-out meets fiduciary duty. 'This isn't your degenerate cousin's Bitcoin play,' quipped one analyst—though the prospectus notably avoids mentioning Mt. Gox.

The product launches as regulators circle like vultures over spot BTC ETFs. One thing's clear: when traditional finance adopts crypto, it does so with airbags, seatbelts, and a 300-page disclaimer.

Bottom Line: Another brick in crypto's institutionalization—or just another way to repackage volatility for clients who think 'HODL' is a typo? Either way, the suits are coming. And they're bringing lawyers.

Calamos pairs treasuries with Bitcoin

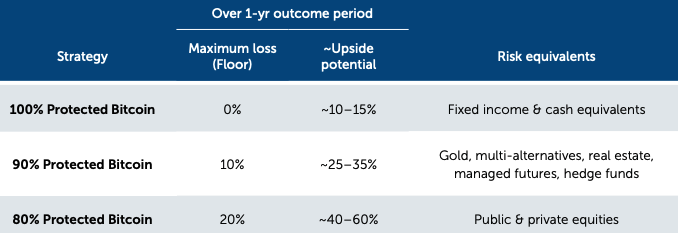

These Treasuries act as a protective floor in predefined worst-case scenarios, limiting losses to 0%, 10%, or 20%, depending on the risk tier. Simultaneously, Calamos buys call options on the Bitcoin Index to capture potential gains. To fund these, the firm also sells out-of-the-money call options, effectively capping the upside between 25% and 60%.

Each risk-return tier is benchmarked to familiar asset classes. The 100% protected Bitcoin tier mirrors the risk profile of Treasuries, offering capital preservation with virtually no downside risk. The second tier is comparable to Gold or alternative assets, while the third tier aligns with equities in terms of expected returns and volatility.

Calamos believes this structured approach could enhance Bitcoin’s appeal relative to traditional assets. However, timing remains critical. Traders must hold positions to maturity to benefit from the downside protection; early exits could result in loss of principal. While rare, another risk includes potential sovereign debt default, which the firm notes is highly unlikely.