Ethereum Price Stalls—But Whale Accumulation Hints at an Imminent Explosion

Ethereum's price action has flatlined—but don't let the calm fool you. On-chain data reveals a silent feeding frenzy.

The quiet before the storm?

While retail traders nap, institutional wallets are gobbling up ETH at levels not seen since the last bull run. The pattern mirrors Q1 2024's accumulation phase—right before a 3x surge.

Liquidity sharks circling

Futures open interest just hit a 90-day low. Thin order books plus heavy accumulation? That's the recipe for a violent move. And given Wall Street's newfound love for 'digital oil,' the pump might come faster than expected.

Of course, this could all be another case of 'buy the rumor, sell the news'—Wall Street's favorite crypto parlor trick. But the smart money's betting otherwise.

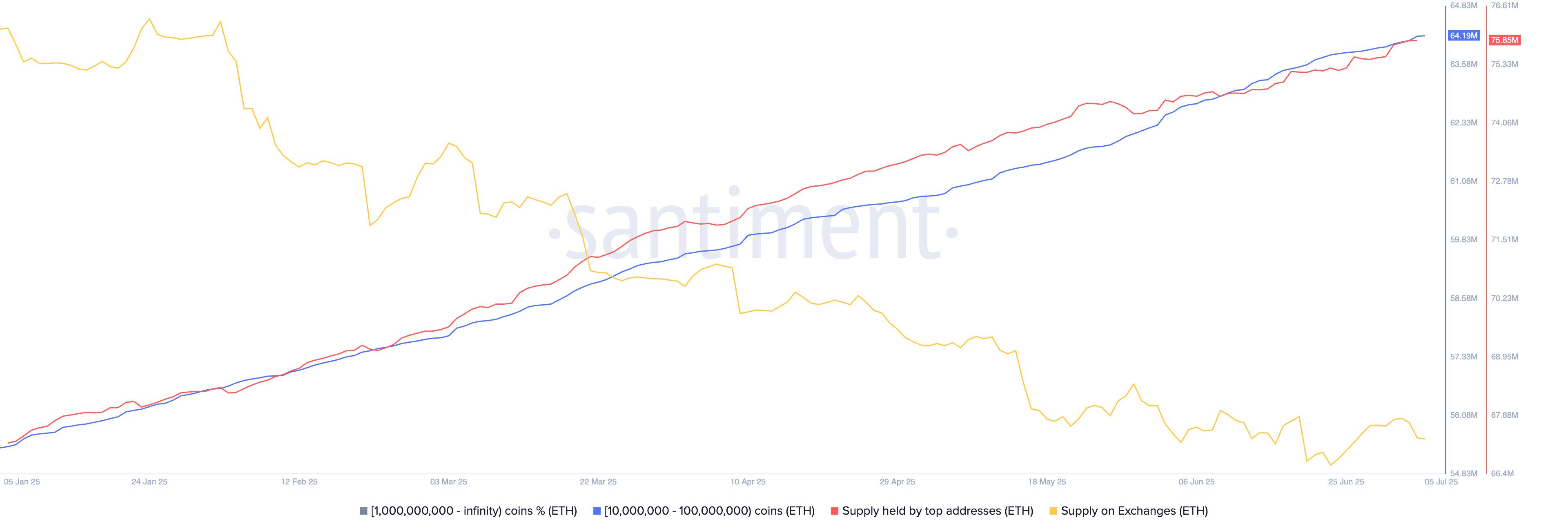

Ethereum balances on exchanges fall, staking levels rise

There are now 7.3 million ETH tokens on exchanges. That’s down from 10.73 million in February. Falling exchange balances is a sign that investors continue moving their coins to self-custody.

More investors are staking their ETH coins. StakingRewards data shows a net increase of 2 million coins, worth over $4 billion, in staking pools. This increase has pushed the staking ratio to 29.45% and the staking market cap to nearly $90 billion.

The ETH outflow from exchanges, coupled with rising staking, signals a shift from short-term trading toward long-term holding and yield generation. It reflects increased trust in Ethereum’s ecosystem, rising decentralization, and a maturing investor base.

Ethereum price technical analysis

The daily chart shows that ethereum price has remained in a tight range since May this year. The accumulation and distribution indicator has continued rising and is hovering near its highest level this year.

Ethereum has formed a bullish flag pattern, comprising a vertical line and a horizontal consolidation. This pattern often leads to a strong bullish breakout, equivalent to the height of the flagpole.

In this case, the flagpole has a height of about 52%, and measuring it from the breakout point gives a target price of $4,287. Gains to that target level will be confirmed if it rises above last year’s high of $4,100.

The bullish Ethereum price forecast will become invalid if it drops below the psychological point at $2,000.