OKX Doubles Down on KYC Chaos: ‘Prove Your Dad Is Your Dad’ or Get Locked Out

Crypto exchange OKX just cranked KYC up to DEFCON 1—users now need DNA samples, family trees, and maybe a blood oath to trade.

The Compliance Gauntlet

Forget ‘name and address.’ Try ‘upload your birth certificate, your father’s passport, and a notarized letter from your kindergarten teacher.’ One user reported submitting 12 documents just to withdraw $500 in Bitcoin—because nothing says ‘financial freedom’ like bureaucracy moving at blockchain speed.

Regulatory Theater or Necessary Evil?

OKX claims it’s all about fighting money laundering. Critics call it surveillance overreach wrapped in blockchain buzzwords. Meanwhile, decentralized exchanges are quietly absorbing the user exodus—because nothing kills centralized crypto like treating adults like toddlers with pocket knives.

The Punchline

Bankers still laundering billions through fines-as-a-service? Perfectly legal. Grandma sending ETH to her grandson? Clearly a national security threat. The future of finance is here—and it comes with a 47-step identity verification process.

VPN usage triggers enhanced scrutiny

The exchange flags accounts based on multiple risk factors, with VPN usage from restricted regions being a primary trigger for additional verification requirements.

Users using Tor browsers or having potential ties to sanctioned countries or political figures face heightened document requests, including proof of address, residency history, and employment verification.

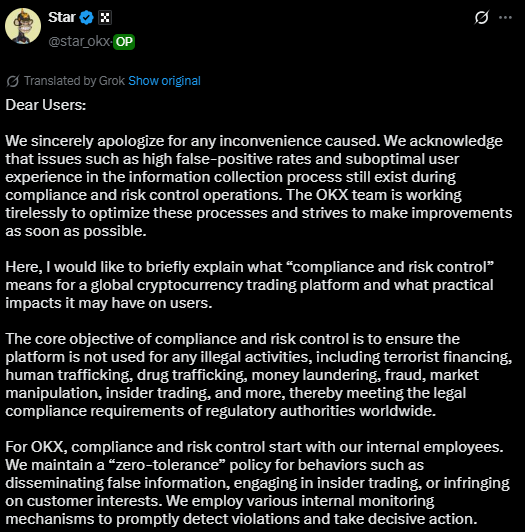

Xu described the challenge of “false positives,” where legitimate users are mistakenly flagged as risky despite normal behavior. The CEO noted that even advanced industry databases and technologies cannot achieve 100% accuracy in compliance determinations.

“Many service providers adopt an ‘aggressive identification’ strategy, and regulatory authorities often encourage platforms to err on the side of caution,” Xu explained. He justified why compliant users sometimes receive requests to “prove your dad is your dad.”

OKX account restrictions may include asset freezing

OKX maintains authority to issue warnings, request additional documentation, suspend account functions, or terminate accounts for policy violations.

In cases involving sanctions or terrorist activities, the exchange is legally required to freeze related assets.

The platform integrates third-party databases with internal behavioral analysis models to identify potential risk accounts.

Xu emphasized that the compliance system starts internally with zero-tolerance policies for employee misconduct including insider trading and customer interest violations.

Customer-facing compliance includes identity verification, transaction monitoring, sanctions screening, and market manipulation detection. The system automatically reviews user activity against global watchlists and regulatory requirements.

Users flagged for additional verification receive requests for fund source documentation, address proof, and employment history. Xu assured users that truthful document submission WOULD not compromise account safety for those not involved in illegal activities.

The CEO highlighted strict data access controls and privacy protections for submitted documents. He also noted that improper disclosure would result in severe legal consequences for the platform.