Solana Devours 95% of Tokenized Stock Volume as DeFi Traders Flee Legacy Markets

Solana just ate Wall Street's lunch—digitally. The blockchain now commands a staggering 95% of all tokenized stock trading, leaving traditional finance scrambling to explain why their 'innovative' synthetic assets got steamrolled by DeFi's speed and transparency.

Move over, meme coins—this is institutional-grade disruption. Solana's low fees and blistering throughput have turned it into the go-to rails for traders ditching sluggish settlement times (and their brokers' 2% vig). Even the SEC's favorite 'investor protection' arguments crumble when markets settle in seconds.

Of course, the usual suspects will call this reckless. Meanwhile, hedge funds quietly onboard through offshore entities—hypocrisy tastes better with 24/7 trading hours.

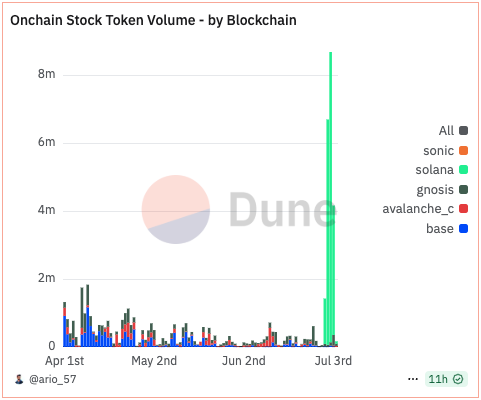

Onchain stock token volume by blockchain | Source: Dune Analytics

Onchain stock token volume by blockchain | Source: Dune Analytics

On the first day of trading, xStocks’ volume surpassed $1.3 million, with Strategy’s stocks capturing 30% of that figure. However, stocks and indices like Tesla and the S&P 500 quickly overtook it in trading activity.

The $SPYx tokenized stock recorded $4.67 million in daily volume on July 2, representing more than 50% of all trading that day. Still, by July 3, trading volumes had dropped by more than half, indicating that initial trading enthusiasm had cooled.

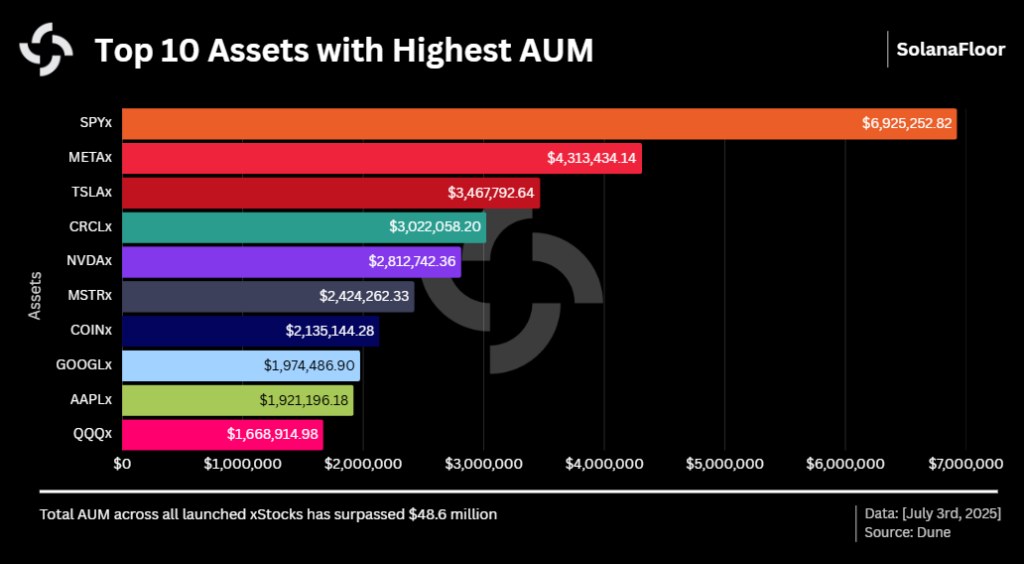

xStocks AUM reaches $48.6 million

Despite the decline in trading volumes, major users on the platform continued to hold their stock tokens. On July 3, xStocks’ assets under management reached $48.6 million. The leading asset was the $SPYx token, with $6.9 million in AUM. $METAx followed with $4.3 million, and $TSLAx came in third at $3.4 million.

The platform also saw significant user adoption, with over 20,000 unique wallets holding tokenized stocks. Among them, the $SPYx token was the most popular, held by more than 10,000 wallets. $TSLAx and $NVDAx followed, with 8,100 and 5,500 holders, respectively.

Still, despite this early engagement, liquidity remains low, SolanaFloor cautioned. The platform noted that liquidity will likely be the key factor in determining whether tokenized stock trading on Solana proves viable.