🚨 $1B Bitcoin Time Capsule Cracked: Satoshi-Era Wallet Awakens After 14 Years

A dormant Bitcoin wallet—untouched since the early days of crypto—just shook the market by moving $1 billion in BTC. Was it Satoshi? A whale? Or just another trader who finally remembered their password?

The Sleeping Giant Stirs

On-chain sleuths spotted the transaction from a 2011 wallet, sparking instant speculation. The coins moved at today's prices—imagine buying a pizza with 10,000 BTC, then forgetting the leftovers for a decade.

Market Whiplash

Traders scrambled as the news hit. Some saw it as a bullish signal (diamond hands finally cashing out?), while others panicked about sudden sell pressure. Meanwhile, Wall Street analysts still can't decide if Bitcoin's a currency or a 'digital collectible.'

One thing's clear: in crypto, even dust settles at a billion-dollar valuation.

Source: Glassnode

Source: Glassnode

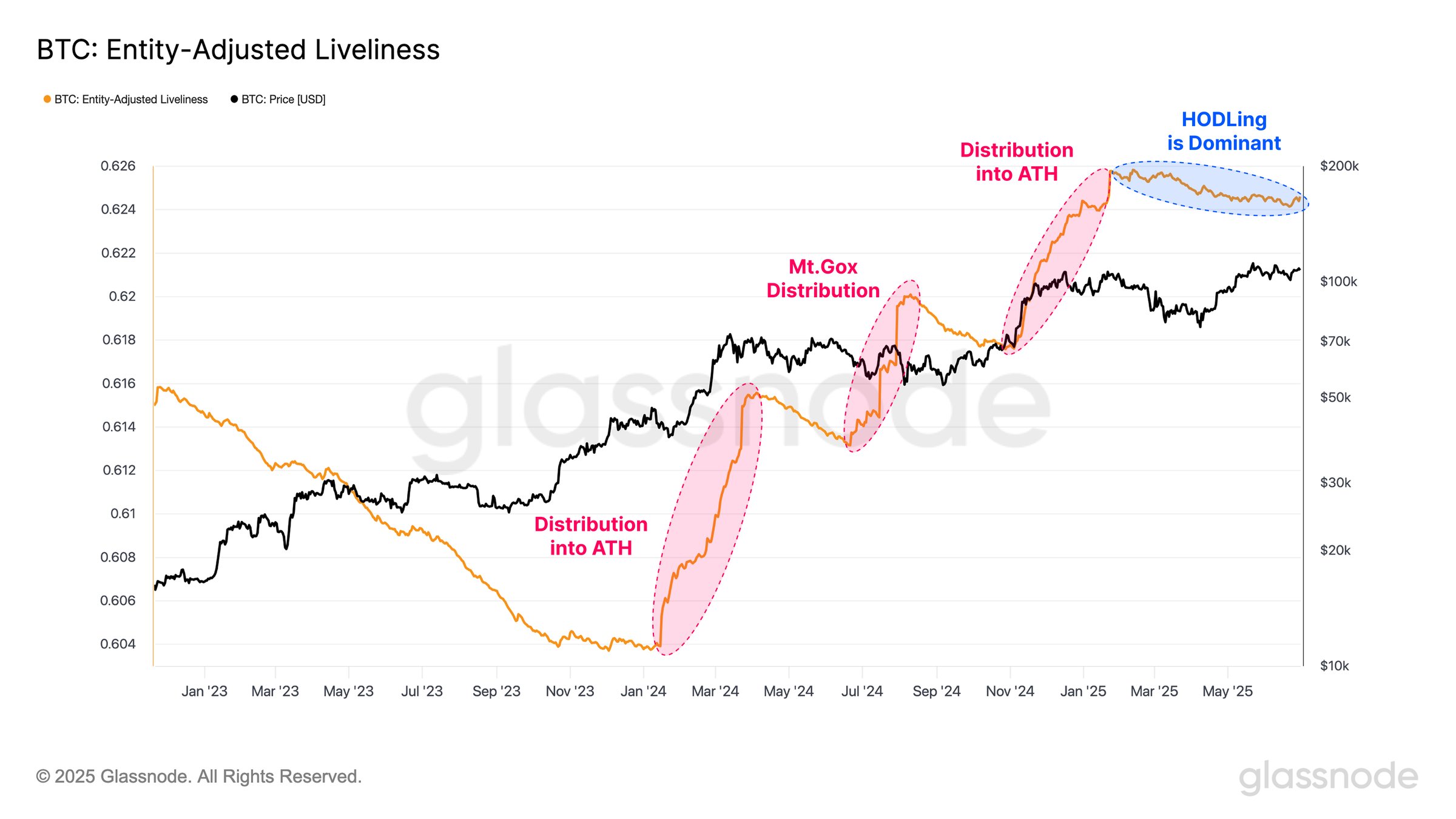

Unlike previous cycles where profit-taking surged as prices reached new highs, current behavior suggests long-term investors are maintaining their positions, even near peak valuations.

Supporting this trend, the total BTC held by long-term holders, defined as those who have held for over 155 days, has reached a record high of 14.7 million coins.

Notably, most BTC that were acquired near the $100,000 breakout threshold remain unmoved, reflecting growing conviction and reduced speculative pressure among investors.

Institutions ramp up their BTC buying

While long-term whale holders could be positioning their holdings for a sell-off, institutional investors have been steadily increasing their exposure to Bitcoin.

Over the past week, multiple companies have announced ambitious plans to establish or expand Bitcoin treasuries. These include Fragbite Group, whose stock surged 64% after revealing its intention to allocate part of its balance sheet to BTC, and Vanadi Coffee, which gained over 240% in a month following shareholder approval to invest up to $1.1 billion in Bitcoin.

Other firms that are jumping in include Belgravia Hartford, which disclosed it had secured $1 million in funding to grow its BTC treasury, while Norway-based Green Minerals announced a plan to raise $1.2 billion for the same purpose.

The uptick in corporate interest shows growing institutional interest in Bitcoin as a strategic reserve asset, especially as it edges closer to price discovery territory. It comes as a growing number of analysts project even higher targets for BTC in the months ahead.

According to crypto trader CryptoFayz, if Bitcoin breaks its current all-time high of $111,960, a continuation to $116,000 is likely, citing technical chart structures.

Meanwhile, long-term projections remain even more bullish. Standard Chartered and Bernstein both forecast Bitcoin to hit $200,000 by the end of 2025, while BitMEX co-founder Arthur Hayes has set an even higher year-end target of $250,000.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.