Trump’s Tax Overhaul Shakes Up US Economy — Here’s How It Hits Your Wallet in 2025

Brace for impact—Donald Trump’s tax reforms are rewriting America’s financial playbook. Whether you’re a crypto whale or a paycheck player, the rules just changed.

### The Good, The Bad, and The Taxable

Corporate rates slashed, loopholes tightened (or cleverly expanded, depending on who you ask). The IRS won’t like your creative accounting—but your portfolio might.

### Crypto’s Quiet Win

Buried in Section 42B: A gift to hodlers. Long-term digital asset holdings get kinder treatment—because nothing says ‘fiscal responsibility’ like betting on meme coins.

### The Bottom Line

Washington’s math says this pays for itself. Wall Street’s already pricing in the sugar rush. Your move—before the next administration ‘fixes’ it all over again.

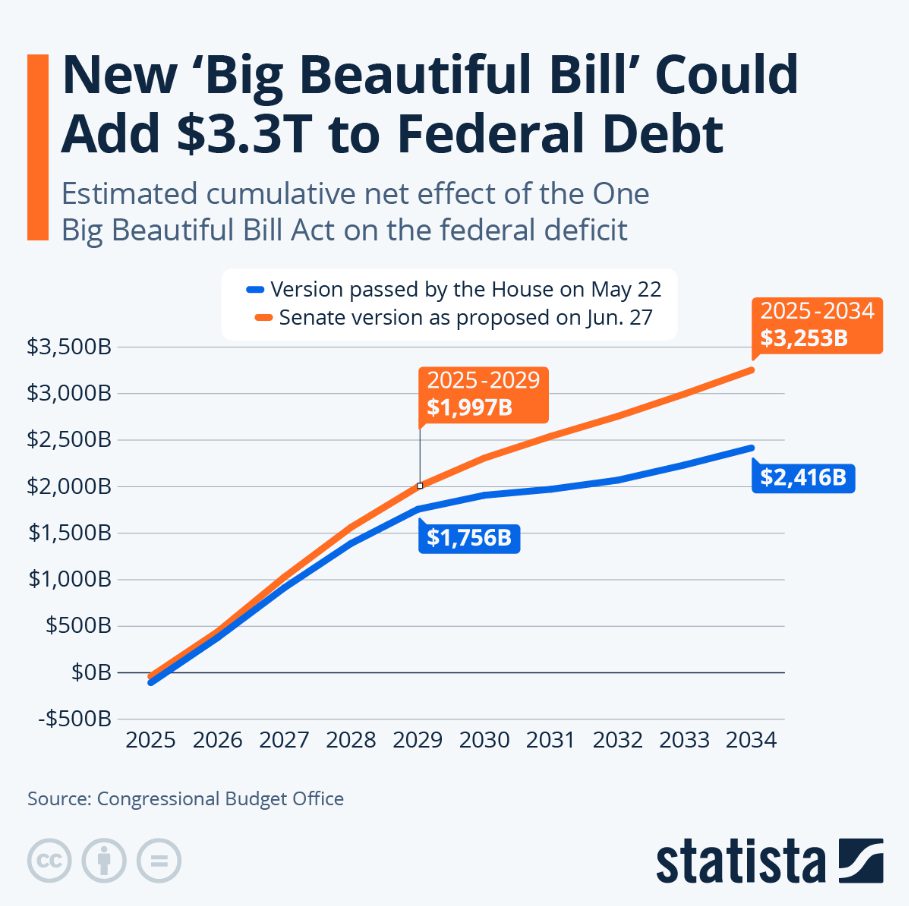

Congressional Budget Office H.R. 1 analysis document – Source: cbo.gov

Congressional Budget Office H.R. 1 analysis document – Source: cbo.gov

Explore Donald Trump Tax Bill Reform Impact on US Tax Reform, Medicaid, and GOP Legislation

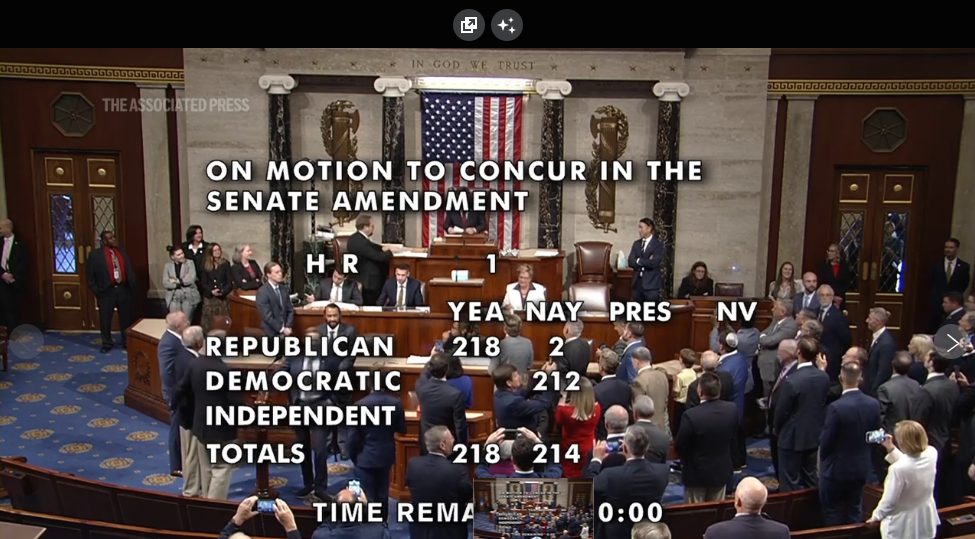

What Is the Big Beautiful Bill That Passed

The Donald Trump tax bill reform prevents a massive $4 trillion tax increase that WOULD have hit American families when the 2017 cuts expired. This US tax reform impact permanently extends lower individual tax brackets, enhanced standard deductions, and also the 20% small business deduction. Your wallet benefits immediately through reduced tax liability and increased take-home pay.

The Trump tax cuts 2025 package creates,The GOP tax legislation also, which parents can use for

Representative Thomas Massie stated:

Although there were some conservative wins in the budget reconciliation bill (OBBBA), I voted No on final passage because it will significantly increase U.S. budget deficits in the NEAR term, negatively impacting all Americans through sustained inflation and high interest rates. pic.twitter.com/rjcRc8t0ay

— Thomas Massie (@RepThomasMassie) July 3, 2025Will There Be No Tax on Overtime in 2025

, and it’s putting more money directly in workers’ pockets right now. This US tax reform impactCombined with, the Trump tax cuts 2025 represent substantial savings for millions of Americans.

Representative Brian Fitzpatrick had this to say:

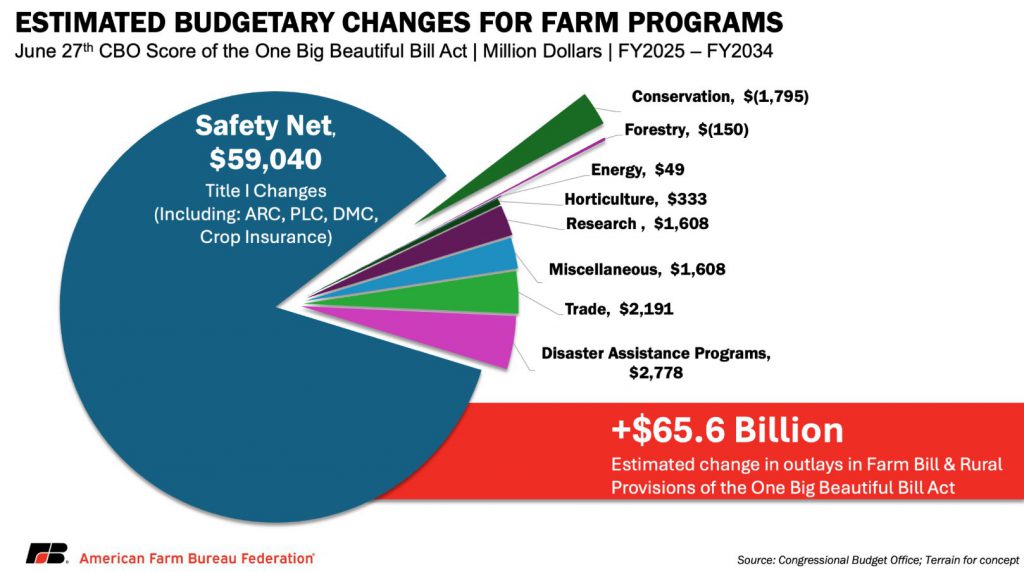

Thewhile also eliminating billions in green energy subsidies. Medicaid spending changes include new work requirements by 2026, and they’re potentially affecting healthcare costs for millions of Americans at the time of writing.