XRP Teeters on Edge of Explosive Breakout as Top Ripple ETF Smashes $158M Barrier

XRP bulls are licking their chops as the embattled token flirts with a decisive technical breakout—just as its flagship ETF cracks the $158 million AUM mark.

The sleeping giant awakens?

After years of regulatory purgatory, Ripple's native token shows signs of life. Chart patterns suggest an impending volatility surge, while institutional money quietly piles into the ETF wrapper Wall Street pretended wouldn't exist three years ago.

Funny how nine-figure inflows have a way of changing minds.

Will this be the moment XRP finally shakes off its 'lawsuit coin' stigma? Or just another fakeout for bagholders? Either way—the suits are paying attention now.

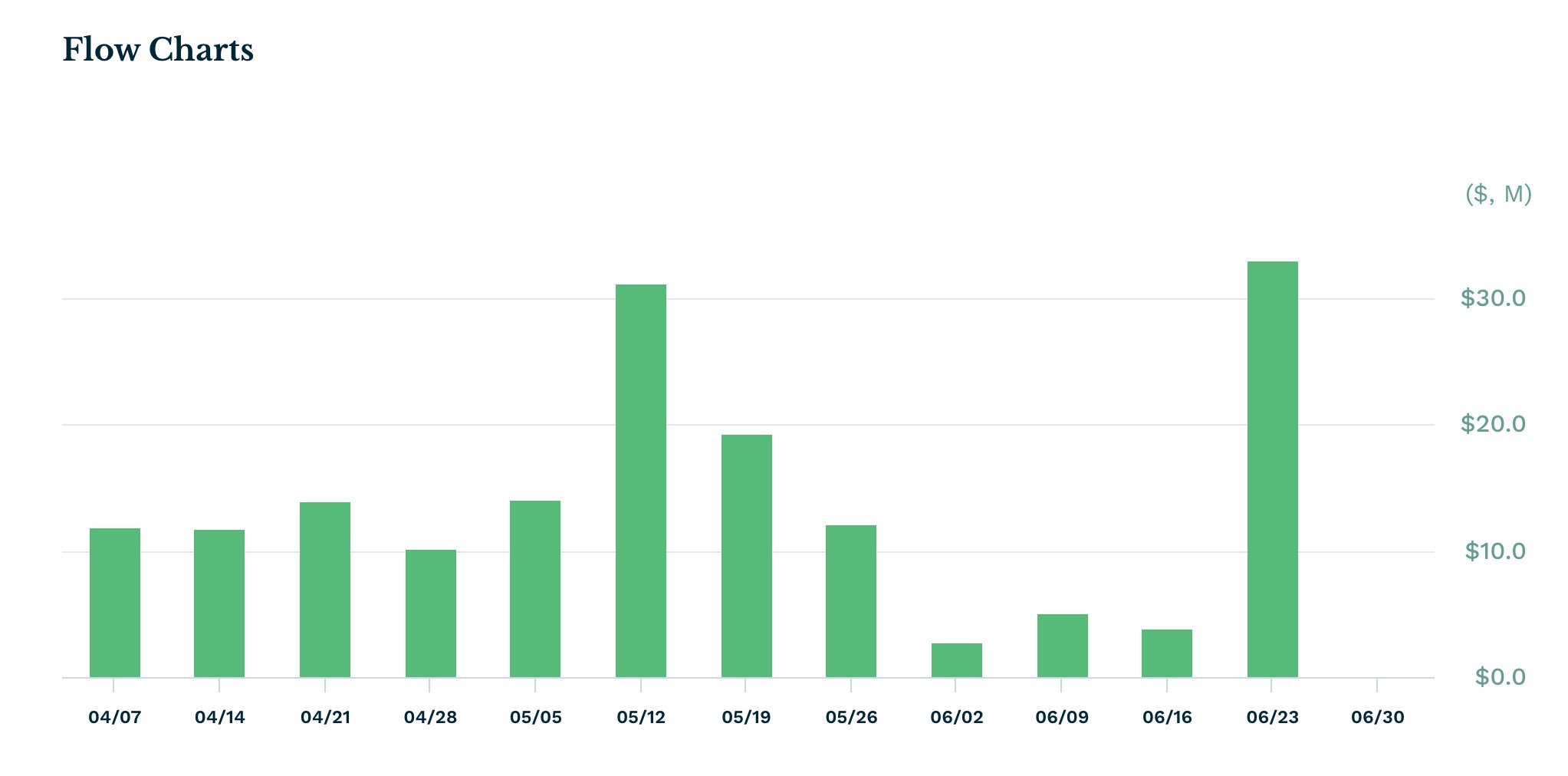

XXRP ETF weekly inflows | Source: ETF

XXRP ETF weekly inflows | Source: ETF

XXRP ETF now has over $158 million in assets, a notable amount because it is one of the most expensive funds in Wall Street. It has an expense ratio of 1.89%, much higher than other leveraged funds. For example, the popular Daily Semiconductor Bull 3X Shares ETF has a ratio of 0.75%.

The rising XXRP ETF inflows are a sign that future spot XRP funds will have demand on Wall Street. The odds that the SEC will approve a spot XRP ETF have increased to 86%.

XRP price has also wavered despite major milestones in the network. For example, the SEC vs Ripple Labs case has ended, which will free the company to reach deals with other US firms.

Further, Ripple will be a major beneficiary of the GENIUS Act, which will regulate stablecoins. The RLUSD stablecoin’s market cap has jumped to $455 million, a figure that will likely continue soaring this year.

XRP price technical analysis

The daily chart shows that the XRP price has remained in a tight range in the past few months. It has held steady above the crucial support level at $2, which coincides with the lower side of the symmetrical triangle pattern.

This triangle pattern formed after the token surged in November last year, making it a bullish pennant. A pennant is a popular bullish continuation pattern.

The other bullish aspect is that the Average True Range has dropped, and the spread between the two lines of the Bollinger Bands has narrowed. This is a sign that its volatility has dried up.

Therefore, the token will likely have a strong bullish breakout, with the next point to watch being at $3.8, up by 60% from the current level.