Bitcoin Smashes Record Monthly Close—But Guess Who’s Hogging the Spotlight? (Hint: It’s Not Crypto)

Bitcoin just flexed its strongest monthly close in history—yet somehow, the euro stole the narrative. Traders blinked. Charts twisted. And finance Twitter? Already spinning conspiracy theories.

Why the euro’s surprise dominance?

While BTC painted a bullish technical masterpiece, macro forces played puppet master. The euro’s rally cut through risk assets like a hot knife through regulatory paperwork. (Yes, even crypto’s 'decoupled' market still bows to fiat whims.)

What’s next for BTC?

Price action suggests institutional accumulation—quiet, relentless buying that ignores both hype and FUD. Meanwhile, retail traders remain distracted by shiny euro drama. Classic.

Bottom line: Crypto’s king set records while traditional finance played its greatest hit—'Look At Me Instead.' Some things never change.

What to Watch

- Crypto

- July 2: Shares of the REX-Osprey Solana Staking ETF (tSSK) are expected to begin trading on the Cboe BZX Exchange, making this the first U.S.-listed ETF to combine SOL price exposure with on-chain staking rewards.

- Macro

- Day 2 of 3: ECB Forum on Central Banking (Sintra, Portugal)

- July 1, 9 a.m.: S&P Global releases June Brazil data on manufacturing and services activity.

- Manufacturing PMI Prev. 49.4

- July 1, 9:30 a.m.: “High Level Policy Panel” discussion chaired by Fed Chair Jerome H. Powell at the ECB Forum on Central Banking in Sintra, Portugal. Livestream link.

- July 1, 9:45 a.m.: S&P Global releases (final) June U.S. data on manufacturing and services activity.

- Manufacturing PMI Est. 52 vs. Prev. 52

- July 1, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services sector data.

- Manufacturing PMI Est. Est. 48.8 vs. Prev. 48.5

- July 1, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labor market data (i.e. the JOLTS report).

- Job Openings Est. 7.3M vs. Prev. 7.391M

- Job Quits Prev. 3.194M

- July 2, 9:30 a.m.: S&P Global releases June Canada data on manufacturing and services activity.

- Manufacturing PMI Prev. 46.1

- July 3, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 139K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -1K

- Manufacturing Payrolls Est. -6K vs. Prev. -8K

- July 3, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended June 28.

- Initial Jobless Claims Est. 240K vs. Prev. 236K

- Continuing Jobless Claims Est. 1960K vs. Prev. 1974K

- July 3, 9 a.m.: S&P Global releases June Brazil data on manufacturing and services activity.

- Composite PMI Prev. 49.1

- Services PMI Prev. 49.6

- July 3, 9:45 a.m.: S&P Global releases (final) June U.S. data on manufacturing and services activity.

- Composite PMI Est. 52.8 vs. Prev. 53

- Services PMI Est. 53.1 vs. Prev. 53.7

- July 3, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services sector data.

- Services PMI Est. 50.5 vs. Prev. 49.9

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- GnosisDAO is voting on renewing its partnership with Nethermind for Gnosis Chain maintenance and development, proposing 750,000 DAI funding for the first year from June, with 4% annual increases. Voting ends July 2.

- Radiant DAO is voting on potentially compensating users whose wallets were drained via unlimited token approvals in the October 2024 hack. If passed, a follow-up plan would outline stablecoin conversions, claim contracts on Arbitrum, and phased repayments. Voting ends July 2.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Unlocks

- July 1: Sui (SUI) to unlock 1.3% of its circulating supply worth $122.75 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating supply worth $10.59 million.

- July 11: Immutable (IMX) to unlock 1.31% of its circulating supply worth $10.65 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $52.7 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $14.42 million.

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $15.73 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $30.33 million.

- Token Launches

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER), and LTO Network (LTO) to be delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 2 of 4: Ethereum Community Conference (Cannes, France)

- Day 2 of 6: World Venture Forum 2025 (Kitzbühel, Austria)

- Day 1 of 6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Francisco Rodrigues

- While all eyes were on the introduction of Robinhood’s tokenized stocks and on Kraken and Bybit’s xStocks debut, a layer-2 network built to streamline DeFi quietly launched its mainnet yesterday.

- Katana’s mainnet went live after it saw pre-deposits near $250 million, according to DeFiLlama data. The blockchain is backed by GSR and Polygon Labs.

- The non-profit Katana Foundation says the chain attacks three chronic pain points: thin liquidity, erratic yields and capital flight. It does so by folding yield generation into the base layer.

- When users bridge USDC, ETH, WBTC, AUSD or USDT, Katana’s VaultBridge pushes those funds into lending pools such as those on Morpho and Sushi, then sends the earnings back to depositors and app builders.

- A separate mechanism called chain-owned liquidity captures transaction fees to bankroll the network over time.

- Katana is distributing its native token, KAT, through liquidity mining. KAT is non-transferable for now, but the team expects an exchange listing by next year. Holders will be able to lock tokens for vKAT and share in staking rewards.

Derivatives Positioning

- Perpetual funding rates for most tokens major tokens, including BTC and ETH, held marginally positive. XRP led with near 10% rates while XLM and ADA showed bias for shorts with sub-zero readings.

- On the CME, BTC and ETH futures basis remained locked in the annualized 7% to 10% range.

- On Deribit, risk reversals out to August-end expiry showed a bias for protective puts, with subsequent tenors showing a mild bias for calls. In ETH's case, bearishness in the short-term tenors was more pronounced.

- Block flows over the OTC desk Paradigm showed demand for the September expiry BTC $180K call option.

Market Movements

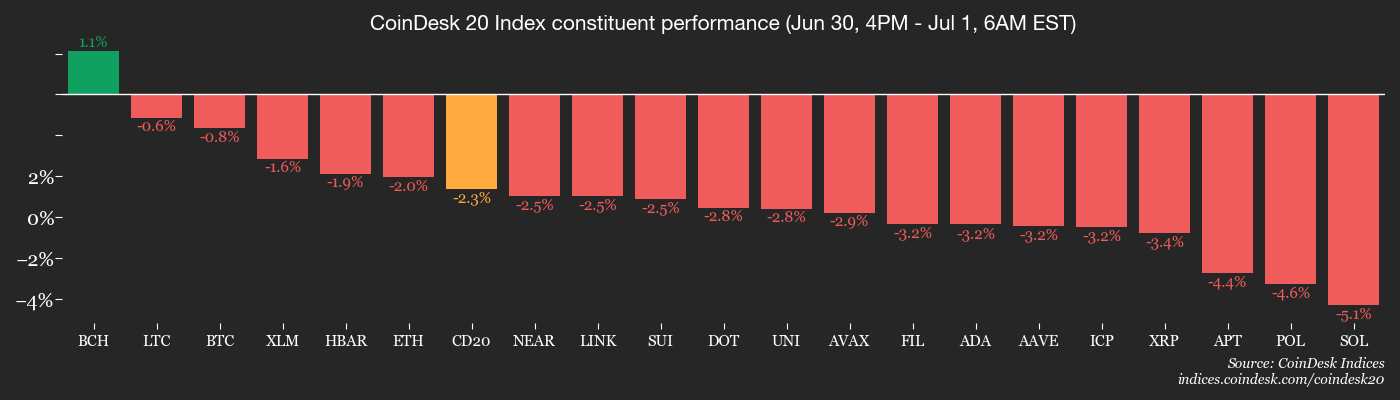

- BTC is down 0.91% from 4 p.m. ET Monday at $106,629.81 (24hrs: -0.96%)

- ETH is down 1.81% at $2,458.53 (24hrs: +0.15%)

- CoinDesk 20 is down 2.37% at 3,010.77 (24hrs: -0.17%)

- Ether CESR Composite Staking Rate is up 7 bps at 2.96%

- BTC funding rate is at 0.0048% (5.3042% annualized) on Binance

- DXY is down 0.47% at 96.42

- Gold futures are up 1.49% at $3,357.10

- Silver futures are up 1.81% at $36.50

- Nikkei 225 closed down 1.24% at 39,986.33

- Hang Seng closed down 0.87% at 24,072.28

- FTSE is down 0.17% at 8,745.89

- Euro Stoxx 50 is down 0.30% at 5,287.47

- DJIA closed on Monday up 0.63% at 44,094.77

- S&P 500 closed up 0.52% at 6,204.95

- Nasdaq Composite closed up 0.47% at 20,369.73

- S&P/TSX Composite closed up 0.62% at 26,857.11

- S&P 40 Latin America closed up 1.41% at 2,694.58

- U.S. 10-Year Treasury rate is down 2.9 bps at 4.197%

- E-mini S&P 500 futures are down 0.26% at 6,237.50

- E-mini Nasdaq-100 futures are down 0.33% at 22,817.75

- E-mini Dow Jones Industrial Average Index are down 0.13% at 44,331.00

Bitcoin Stats

- BTC Dominance: 65.34% (0.19%)

- Ethereum to bitcoin ratio: 0.02307 (-0.6%)

- Hashrate (seven-day moving average): 869 EH/s

- Hashprice (spot): $57.97

- Total Fees: 4.22 BTC / $455,433

- CME Futures Open Interest: 147,470 BTC

- BTC priced in gold: 32.2 oz

- BTC vs gold market cap: 9.12%

Technical Analysis

- BTC fell 1% Monday, narrowly missing the bull flag breakout. The decline produced a bearish outside day candle, with a price range wider than the preceding day's candle.

- Bearish outside day candles appearing after notable price gains, as in BTC's case, signal renewed bearish trends.

Crypto Equities

- Strategy (MSTR): closed on Monday at $404.23 (+5.3%), -1.64% at $397.59 in pre-market

- Coinbase Global (COIN): closed at $350.49 (-0.83%), -1.53% at $345.12

- Circle (CRCL): closed at $181.29 (+0.48%), +1.98% at $184.88

- Galaxy Digital (GLXY): closed at $21.90 (+9.66%), +3.47% at $22.66

- MARA Holdings (MARA): closed at $15.68 (+4.32%), -1.85% at $15.39

- Riot Platforms (RIOT): closed at $11.3 (+7.11%), -1.59% at $11.12

- Core Scientific (CORZ): closed at $17.07 (+2.52%), -1.52% at $16.81

- CleanSpark (CLSK): closed at $11.03 (+3.37%), -1.81% at $10.83

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.74 (+4.74%)

- Semler Scientific (SMLR): closed at $38.74 (+0.62%), +0.15% at $38.80

- Exodus Movement (EXOD): closed at $28.83 (-3.42%), +1.14% at $29.16

ETF Flows

- Daily net flows: $102.1 million

- Cumulative net flows: $48.95 billion

- Total BTC holdings ~1.25 million

- Daily net flows: $31.8 million

- Cumulative net flows: $4.23 billion

- Total ETH holdings ~4.1 million

Source: Farside Investors

Overnight Flows

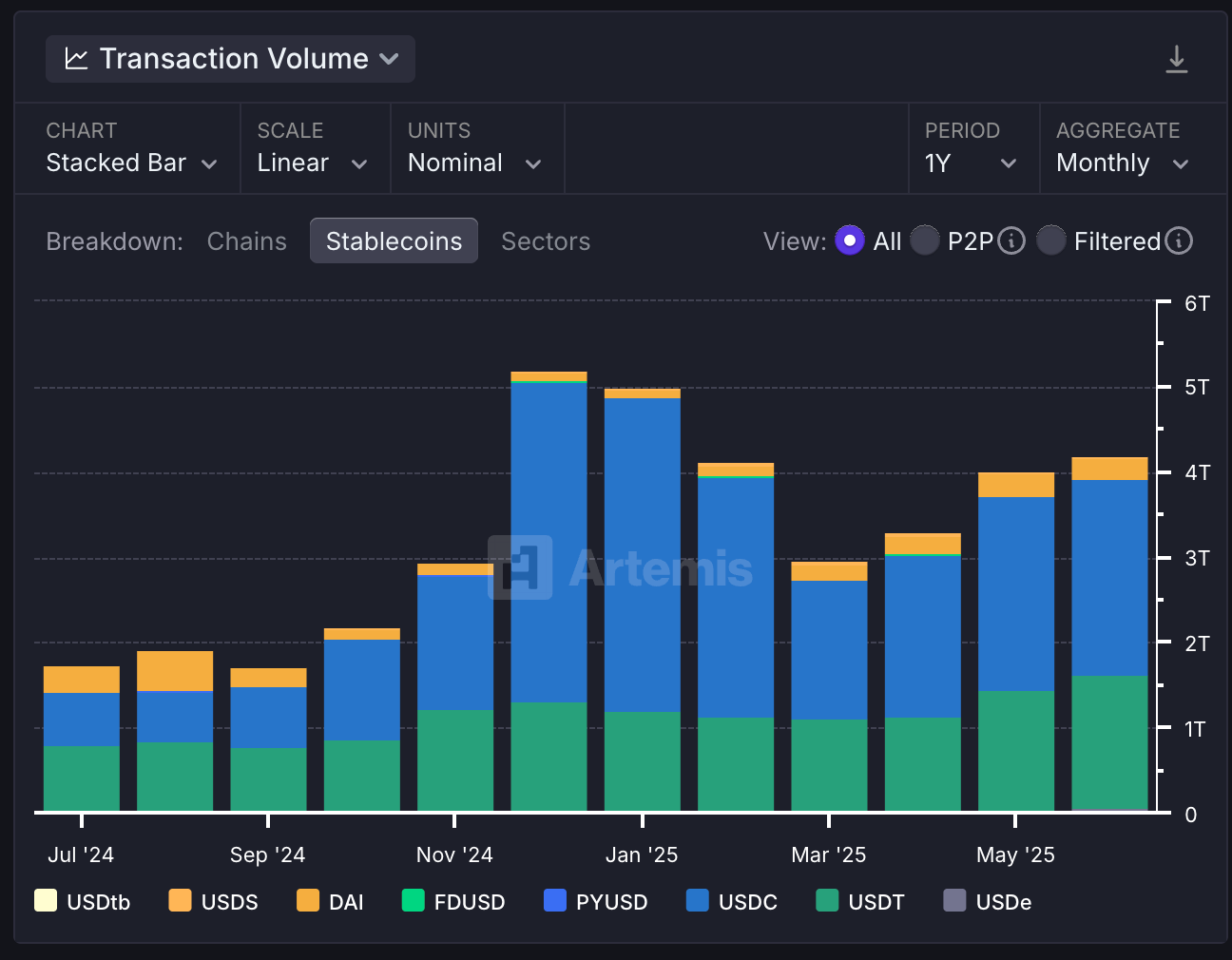

Chart of the Day

- The dollar value of the total stablecoin transactions crossed above the $4 trillion mark in June, the most since January, according to data source Artemis.

- The data shows that while BTC's price didn't do much in the month, adoption of stablecoin continued unabated.

While You Were Sleeping

- Mexico and Brazil Seek Deeper Trade Ties to Expand Beyond US and China (Financial Times): Trump-era tariffs and new leftist governments have created a rare opening for Latin America’s two largest economies to revisit a limited trade pact and explore deeper commercial integration.

- Trump Crypto Venture Raises $220 Million for Bitcoin Mining (Bloomberg): American Bitcoin raised $220 million from private investors including $10 million in bitcoin. Majority owner Hut 8 Corp. plans to take it public through a merger with Gryphon Digital Mining.

- XRP, TRX, DOGE Lead Majors With Positive Funding Rates as Bitcoin's Traditionally Weak Quarter Begins (CoinDesk): Perpetual funding rates indicate a bullish sentiment for top altcoins, with XRP showing the strongest demand, while rates for market leaders bitcoin and ether are marginally positive.

- Robinhood, Kraken-Backed Global Dollar (USDG) Comes to Europe (CoinDesk): USDG is regulated by the EU’s Markets in Crypto-Assets (MiCA) framework, Finland’s Financial Supervisory Authority and Singapore’s Monetary Authority. MiCA requires issuer Paxos to hold reserves with European banking partners.

- The Dollar Has Its Worst Start to a Year Since 1973 (The New York Times): Trump’s tariff policy, rising national debt, and the moves toward de-dollarization have reduced the dollar’s appeal, even amid high interest rates and a booming stock market.

- ARK Invest Sold $95M of Coinbase Shares After COIN's Surge to Record Highs (CoinDesk): Monday’s $43.8 million sale brings ARK’s total to 270,984 COIN shares offloaded over three sessions, as the stock’s surge above $380 triggered sales to keep COIN under 10% in its ETFs.

In the Ether