PENGU Primed for Takeoff: 3 Bullish Signals Point to a Major Rally Ahead

The memecoin that waddled under the radar is now flapping its wings—PENGU's chart setup screams breakout.

Liquidity pools tightening like an iceberg squeeze

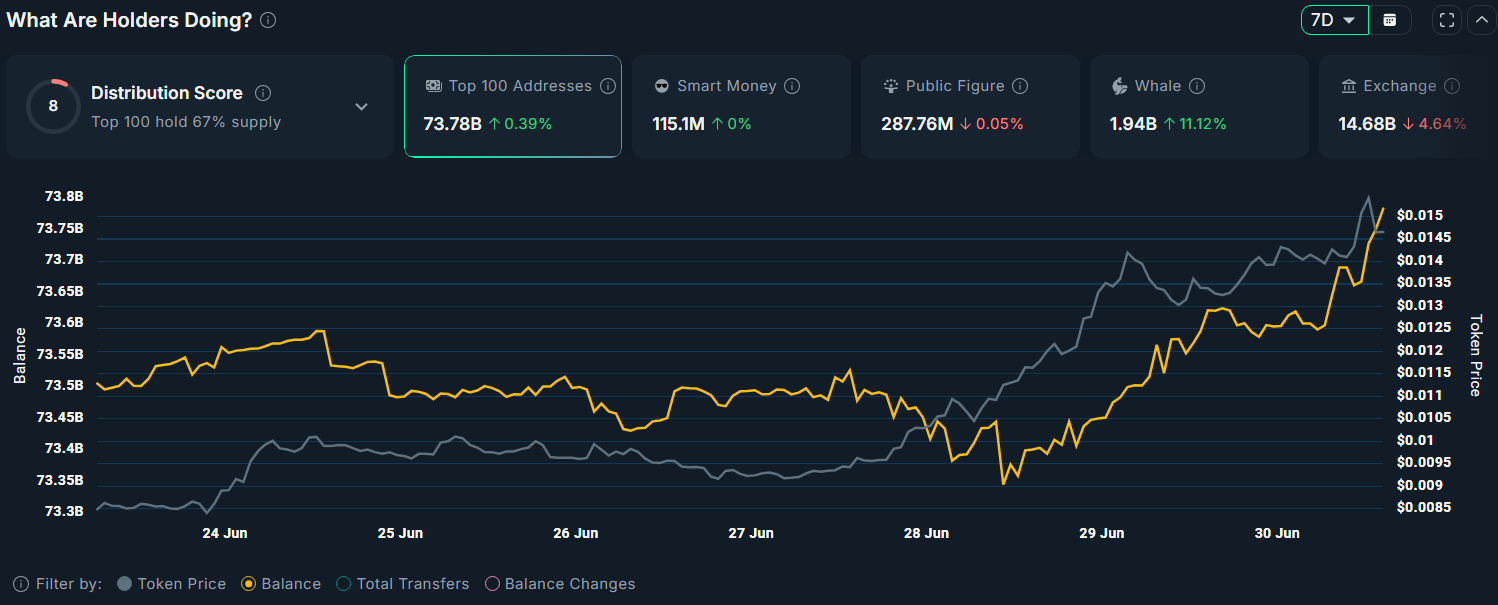

Whale wallets are accumulating faster than krill in an Antarctic current. When the big players move, retail follows—usually late, per crypto tradition.

Technical breakout breaching key resistance

The 50-day MA just got steamrolled like a rookie trader leveraging 100x. Next stop: the .618 Fib level that's been acting as a psychological barrier since Q1.

Exchange reserves hitting 18-month lows

Supply shock incoming? CEX wallets now hold less than 12% of circulating PENGU—down from 34% during last year's 'risk-off' period (when hedge funds pretended to care about fundamentals).

This bird might not fly forever—memecoins rarely do—but the setup suggests one hell of a pump before gravity kicks in. As always in crypto: enjoy the ride, just don't marry the narrative.

Source: Nansen

Source: Nansen

These developments are collectively reinforcing bullish sentiment among PENGU investors and are expected to contribute to continued upward pressure on the token’s price.

PENGU price analysis

From a technical standpoint, PENGU recently broke out above the upper boundary of a multi-week descending channel on the 1-day/USDT chart, signaling the end of its previous corrective phase.

Momentum indicators support further upside with the 20-day Simple Moving Average poised to crossover the 50-day SMA, a formation commonly referred to as a golden cross, typically a bullish trend confirmation. Additionally, the MACD lines have flipped positive, suggesting strong upward momentum.

Therefore, the next key resistance lies at $0.0175, the intraday high from May 14, which represents a 15% upside from current levels. A breakout above this level could open the path toward the $0.023 level, which aligns with a key Fibonacci extension level.

Despite the bullish setup, PENGU may face a short-term pullback, as the Relative Strength Index is approaching overbought territory, indicating a potential pause before the next upward move.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.