Metaplanet Doubles Down: $515M Share Offering Fuels Aggressive Bitcoin Accumulation

Tokyo-listed Metaplanet just fired a $515 million bullet into its Bitcoin war chest—because apparently, corporate treasuries weren't volatile enough.

The move signals a full-throttle pivot to crypto, leaving traditional asset allocations in the rearview mirror. Shareholders either get front-row seats to the digital gold rush—or a masterclass in high-risk balance sheet acrobatics.

One thing's certain: while Wall Street hedges with ETFs, Metaplanet's going straight for the blockchain jugular. Because when has doubling down on crypto after a 200% rally ever backfired?

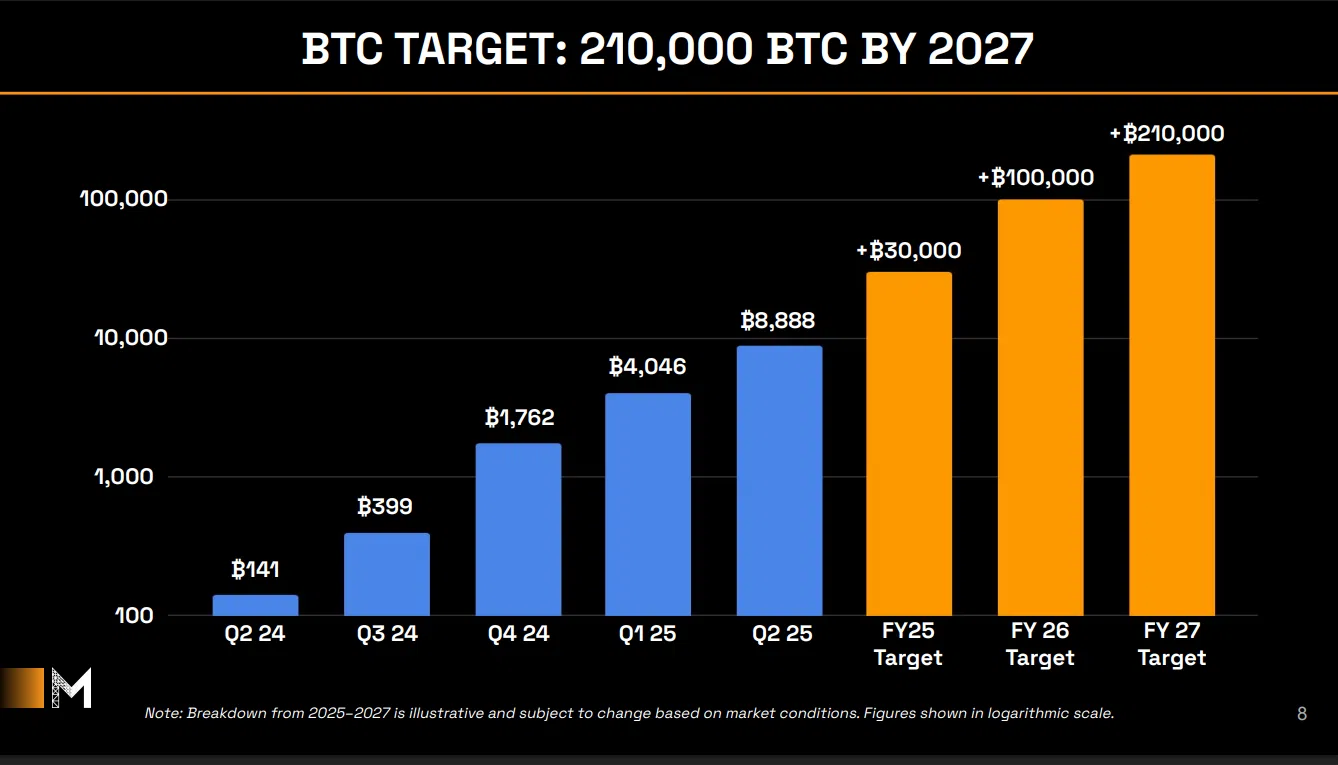

Metaplanet’s projected target for Bitcoin accumulation | Source: Metaplanet

Metaplanet’s projected target for Bitcoin accumulation | Source: Metaplanet

Metaplanet BTC buys raise concerns over dilution

Metaplanet was one of the first firms in Asia to follow in the footsteps of Michael Saylor’s Strategy. Like Strategy, the company seeks to raise funds through stock offerings to buy Bitcoin. Both firms aim to benefit from Bitcoin’s appreciation and investor enthusiasm for the asset.

Still, Metaplanet is using a somewhat more conservative approach. Unlike Strategy, it does not buy Bitcoin with debt. This shields the firm from potential bankruptcy if the price of Bitcoin declines significantly, which remains a risk for MicroStrategy.

Metaplanet’s aggressive share issuance has raised concerns about stock dilution, with total shares set to climb to 760 million. This has prompted some hedge funds to bet against Metaplanet, building significant short positions against the company.