Jasmy Soars as Exchange Reserves Crash – Is This the Next Supply Shock?

JasmyCoin defies gravity while exchange wallets hemorrhage tokens. Traders scramble as liquidity tightens—classic crypto volatility at play.

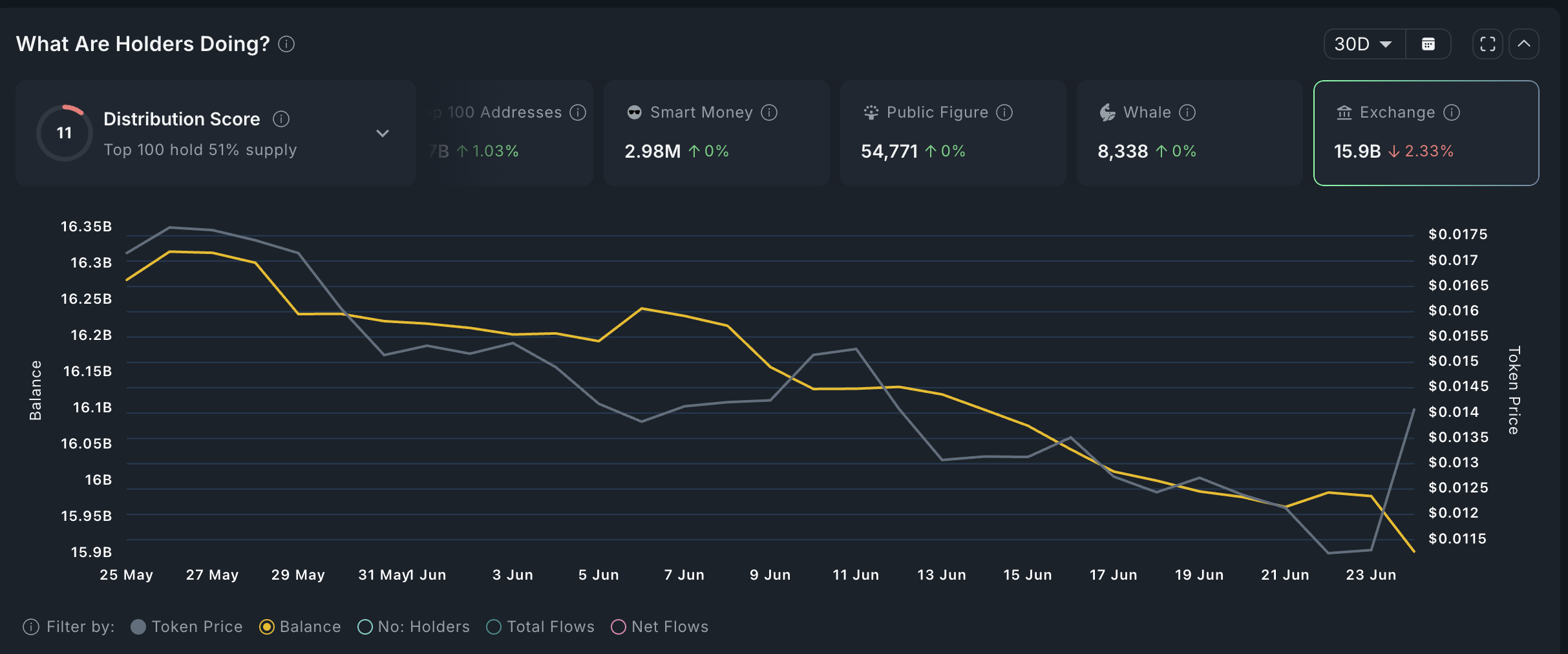

Supply crunch incoming?

Exchange reserves nosedive just as Jasmy's price punches upward. Textbook supply-demand mechanics—or another case of 'whales playing hungry hippos' with retail hopes?

Bullish momentum builds while centralized platforms bleed JASMY. Self-custody wins again as holders yank tokens off exchanges—either diamond-handing for dear life or prepping for something bigger.

Watch those order books. When exchanges run dry, even Wall Street's 'smart money' starts chasing crypto's tail.

JASMY supply on exchanges | Source: Nansen

JASMY supply on exchanges | Source: Nansen

JasmyCoin’s price rose alongside a jump in futures open interest, which climbed to $24 million from $20 million on Monday. Rising open interest typically indicates growing market liquidity and investor demand.

However, JASMY’s weighted funding rate has turned negative for the first time since Saturday—a signal that traders expect the token’s future price to decline from current levels.

Jasmy has jumped because of the ongoing crypto market bull run following truce between Iran and Israel. This truce has pushed most cryptocurrencies higher, with the market capitalization rising by 4.60% to over $3.25 trillion.

Jasmy price technical analysis

The daily chart shows that JasmyCoin has been in a prolonged downtrend over the past few months, falling from last year’s high of $0.0594 to a year-to-date low of $0.0081.

After reaching that low, the token rebounded to $0.02115 on May 14, touching the 23.6% Fibonacci retracement level. Despite the recovery, JASMY remains below both the 50-day and 100-day Exponential Moving Averages.

The price action is slowly forming a potential double-bottom pattern with support around $0.00818 and a neckline at $0.0211.

Therefore, JasmyCoin is likely to retest the $0.00818 support before potentially rebounding toward the neckline at $0.02115. A drop below $0.0081 WOULD invalidate the bullish double-bottom pattern and reinforce a bearish outlook.