Monero Nears Critical $269 Support – Is a Massive Bull Run Imminent?

Monero teeters on the edge of a make-or-break moment as it hovers near the $269 support level. Traders are eyeing the charts like hawks—will this privacy coin stage a dramatic rebound or buckle under pressure?

Why $269 matters

This isn’t just another number. It’s a historical floor where XMR has repeatedly found buyers lurking in the shadows. A bounce here could ignite fireworks, while a breakdown might send holders scrambling for the exits.

The rally case

If bulls defend this line, we could see a classic ‘support becomes springboard’ scenario. Monero’s loyal following—let’s call them the ‘privacy maximalists’—won’t go down without a fight. The tighter the squeeze near support, the bigger the potential pop.

The bear trap

Of course, Wall Street’s algo-trading bots would love nothing more than to ‘liquidity hunt’ below $269 before reversing. After all, what’s modern finance without a little predatory behavior dressed up as ‘market efficiency’?

One thing’s certain: in crypto, nobody rings a bell at the bottom. By the time CNBC runs its ‘Monero resurgence’ segment, the smart money will already be counting profits.

Key technical points

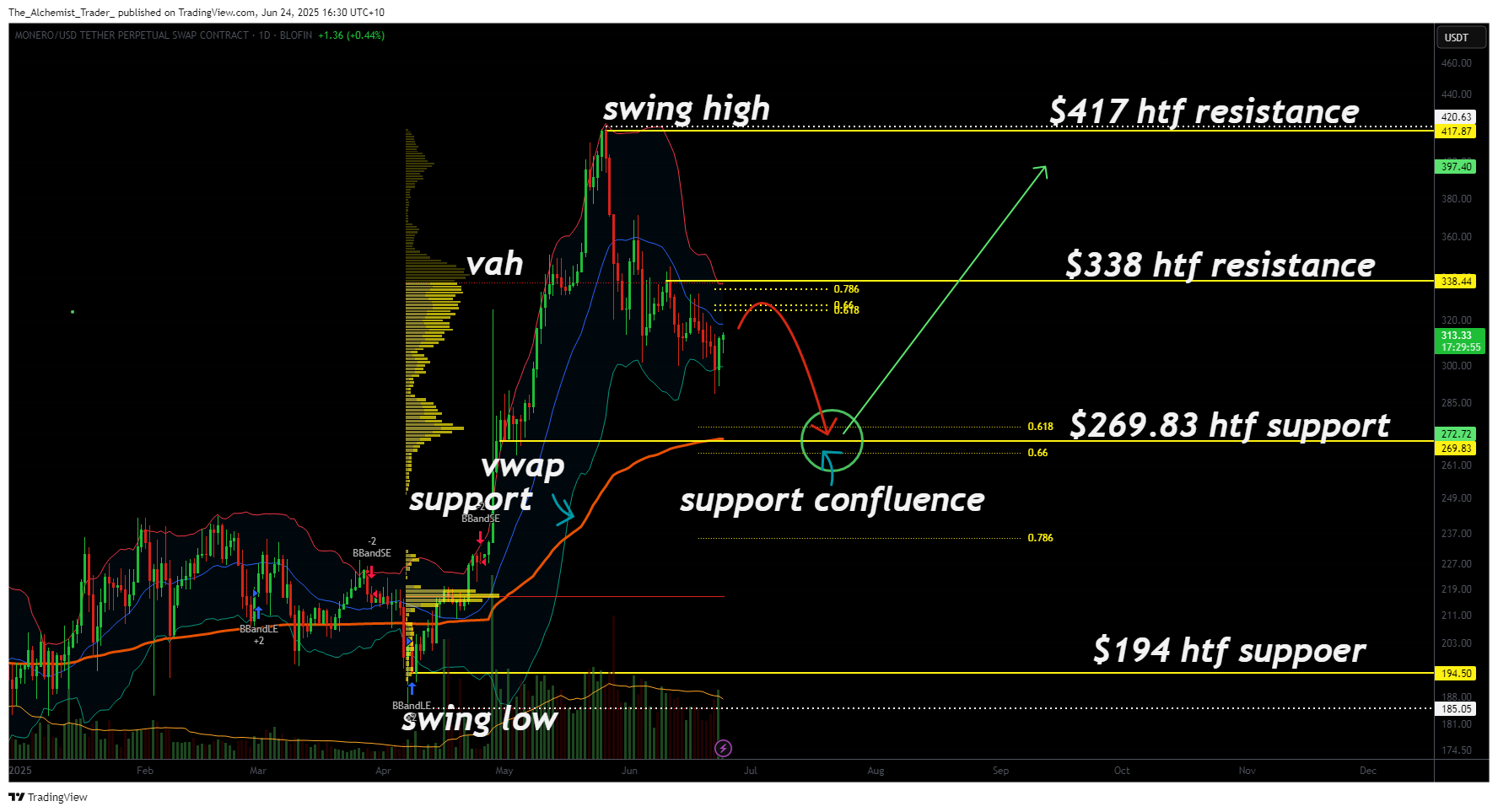

- Major Support: $269; confluence of VWAP, 0.618 Fibonacci, and historical high timeframe support.

- Uptrend Still Intact: Current move is a correction, not a trend reversal.

- Target to Watch: $417; macro resistance if higher low is established.

- Volume Profile: Currently above average; must remain strong near support to confirm demand.

The $269 support zone carries significant technical weight. It has served as a volume-supported region in past rallies and is now reinforced by the VWAP and key Fibonacci levels. Historically, price action has reacted positively to this area, and the likelihood of a bounce is high, provided volume confirms it.

From a structural standpoint, Monero has not invalidated its uptrend. The correction, while notable, still fits within the context of forming a higher low. For this to be confirmed, traders will need to see consolidation or signs of accumulation on the lower timeframes once $269 is tested. This would indicate a shift in sentiment and a potential setup for a reversal back toward the $417 resistance zone.

Volume remains a major factor. The current profile is above average, which is a positive sign in any uptrend. However, if the test of $269 occurs without volume support and price fails to hold, it could break the bullish structure and lead to a deeper corrective move, likely invalidating the current higher low thesis.

It’s worth noting that the recent bullish candlesticks have not been enough to confirm a full reversal. Monero is still searching for a clear bottom in this correction. As long as the $269 support holds and demand returns visibly through volume, the bullish outlook remains valid.

What to expect in the coming price action

Watch how Monero behaves around the $269 support level. A bounce supported by strong volume and accumulation could kick off a fresh rally toward $417. But if volume fades and support breaks, a deeper correction may follow before bulls can regain control.