Bitcoin Soars Past $103k as Geopolitical Tensions Ease—Traders Cheer ’Digital Gold’ Resilience

Bitcoin defies gravity—again—as risk appetite returns following Iran missile interception. The crypto king's rebound proves its uncanny knack for turning global chaos into bullish momentum.

Safe-haven narrative gets a boost

When traditional markets flinch, Bitcoin's volatility works both ways. Today's 5% surge past $103k shows institutional traders still treat crypto like a hedge—just don't ask about last month's 20% crash.

Miners cash in while Wall Street watches

Hashrate spikes suggest big players are accumulating—probably the same hedge funds that called crypto a 'pet rock' at $30k. Nothing like a little FOMO to grease the wheels of adoption.

Another day, another crisis averted—at least for crypto bros. Meanwhile, gold bugs seethe as their shiny metal gets upstaged by digital scarcity. The future's decentralized... until the next Fed meeting.

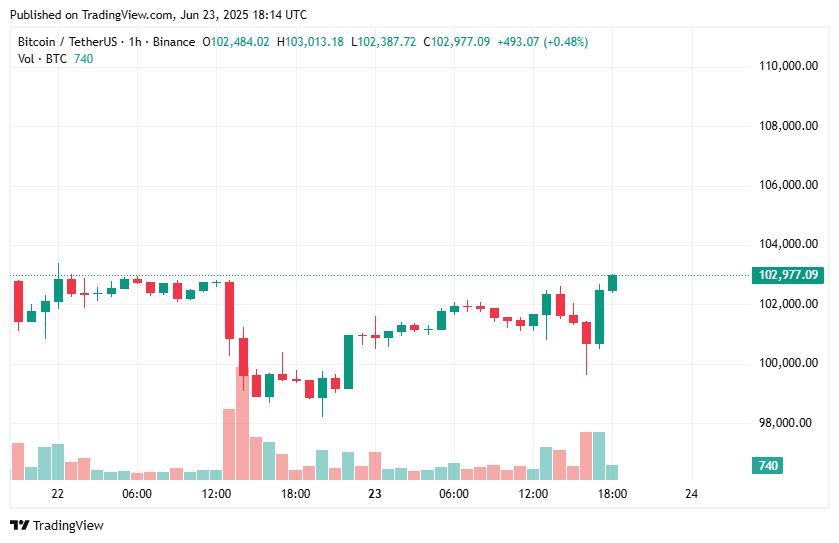

Bitcoin touches $102.5k

At the time of writing, BTC price was hovering around $102,800, up nearly 4% in the past 24 hours. The gains marked a V-shaped recovery following the sharp drop seen during afternoon U.S. trading. Bitcoin touched highs of $103k across major exchanges.

While the crypto market saw a swift rebound, further downside could follow. Reports indicate that Qatar has stated it reserves the right to respond to the attacks. Iraq, Kuwait, Bahrain, and the UAE have also shut down their airspace, and U.S. military bases across the Middle East—including at Ain Al-Asad Airbase in Iraq—are on high alert.