Trump Blasts Powell’s Rate Policy as Bitcoin Stagnates—Is the Fed Killing Crypto Momentum?

Former President Trump takes aim at Jerome Powell's interest rate strategy while Bitcoin flatlines—again. Here's why traders aren't surprised.

Monetary Policy vs. Digital Gold

Trump's latest broadside against the Fed chair coincides with BTC's third week of sideways action. Coincidence? Hardly. Powell's 'higher for longer' mantra keeps sucking liquidity from risk assets—including crypto's poster child.

The Institutional Standoff

Wall Street's Bitcoin ETFs saw zero inflows yesterday. Zero. Meanwhile, the SEC keeps dragging its feet on ETH approvals. Classic regulatory theater—delay innovation until the bankers catch up.

Cynical Take

Maybe Powell's just bitter he didn't buy BTC at $20K. Now he's making sure nobody else gets rich either. Central bankers—the original crypto whales without the bags.

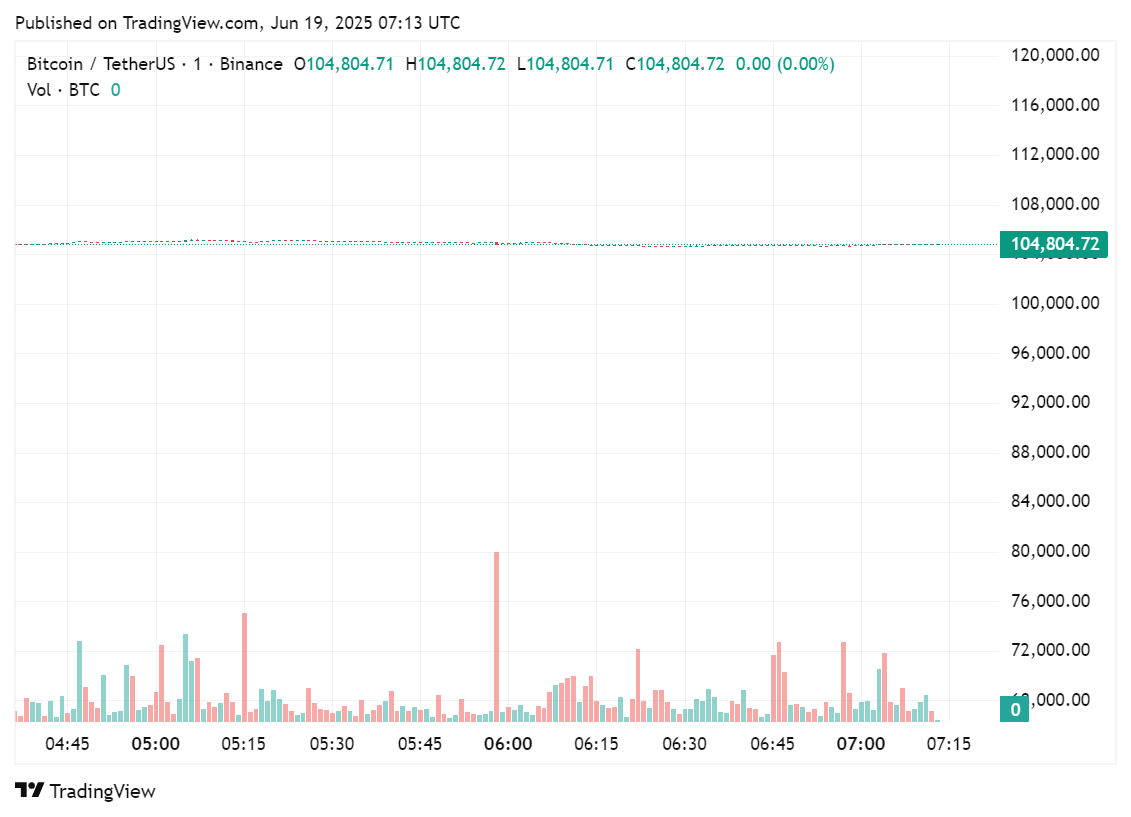

Price chart for Bitcoin after Jerome Powell’s interest rate speech, June 19, 2025 | Source: crypto.news

Price chart for Bitcoin after Jerome Powell’s interest rate speech, June 19, 2025 | Source: crypto.news

Why has Jerome Powell refused to cut interest rates?

On June 18, the Federal Reserve came to a unanimous decision to maintain a “wait-and-see” approach to the current monetary stance in June.

According to a CNBC report, Federal Reserve Chair Jerome Powell said in a press conference that policymakers are “well positioned to wait” before moving further on rates. He also said that the market is beginning to see the effects of Trump’s tariffs on inflation.

“We have to learn more about tariffs. I don’t know what the right way for us to react will be,” said Jerome Powell, as quoted by CNN Business from the press conference.

“I think it’s hard to know with any confidence how we should react until we see the size of the effects,” he continued.

Maintaining interest rates in the 4.25% to 4.5% is considered restrictive by many, considering that it led to a fall in investor confidence. Moreover, Bloomberg reported that the Fed has also revised its economic growth forecast, showing a decline for 2025. Lower GDP projections could suggest less consumer spending, weaker investment, or global headwinds.

The inflation forecast for 2025 has been raised to 3%, which is above the Fed’s 2% target. This signals that inflationary pressures may be more persistent than previously expected.

After the Fed refused to cut interest rates and foreshadowed a bleaker economic outlook, the U.S. stocks took a dive.

According to a report by Reuters, the Dow Jones Industrial Average fell by 0.10% compared to the previous day. Meanwhile the S&P saw a decline of 0.03%. In contrast to the two exchanges, the Nasdaq Composite actually ROSE by 0.13%.

However, overall stock prices were generally higher before the Fed’s announcement.

On the crypto side of the market, the overall crypto market cap fell by 2.3% in the past 24 hours. The current crypto market cap stands at $3.3 trillion, after major tokens like Bitcoin, Ethereum (ETH) and Solana (SOL) saw declines ranging from 1.6% to 0.2%.

Even the overall crypto trading volume suffered a 15% fall following the Fed announcement, from an initial $120 billion to $101 billion on June 19.

Additionally, the CBS reported that the central bank expects inflation to worsen in the coming months. It also foresaw two interest rate cuts by the end of this year. This prediction is the same as its previous projection back in March.

“For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance,” said Jerome Powell.

The Fed’s decision goes against increasing pressures from the WHITE House to lower interest rated by two points. Just hours before the announcement, Trump said that “stupid” Fed Chair Jerome Powell will likely keep the rates at their current levels. The remarks were part of his ongoing attacks on the Fed.