Sigil Fund Rakes in 400% Gains on Circle IPO—Wall Street Still Doesn’t Get Crypto

While traditional finance scrambles to decode blockchain’s disruption, early backers like Sigil Fund just pocketed a 4x return on Circle’s public debut. Not bad for a sector supposedly ‘too volatile’ for institutional money.

Behind the win? A simple bet on infrastructure—while hedge funds were busy shorting stablecoins, crypto-native players doubled down on the pipes. Now the suits are left playing catch-up.

Funny how the ‘risky’ asset class keeps printing generational wealth—maybe Jamie Dimon’s next memo will finally admit he missed the boat.

Why Sigil invested in Circle

Sigil Fund explained its investment in Circle was driven by its belief in the strategic importance of stablecoins. According to the fund, stablecoins are “the silent backbone of crypto,” bridging traditional finance (tradFi) and decentralized finance. Additionally, Sigil noted that even big tech firms are exploring the possibility of issuing their own stablecoins.

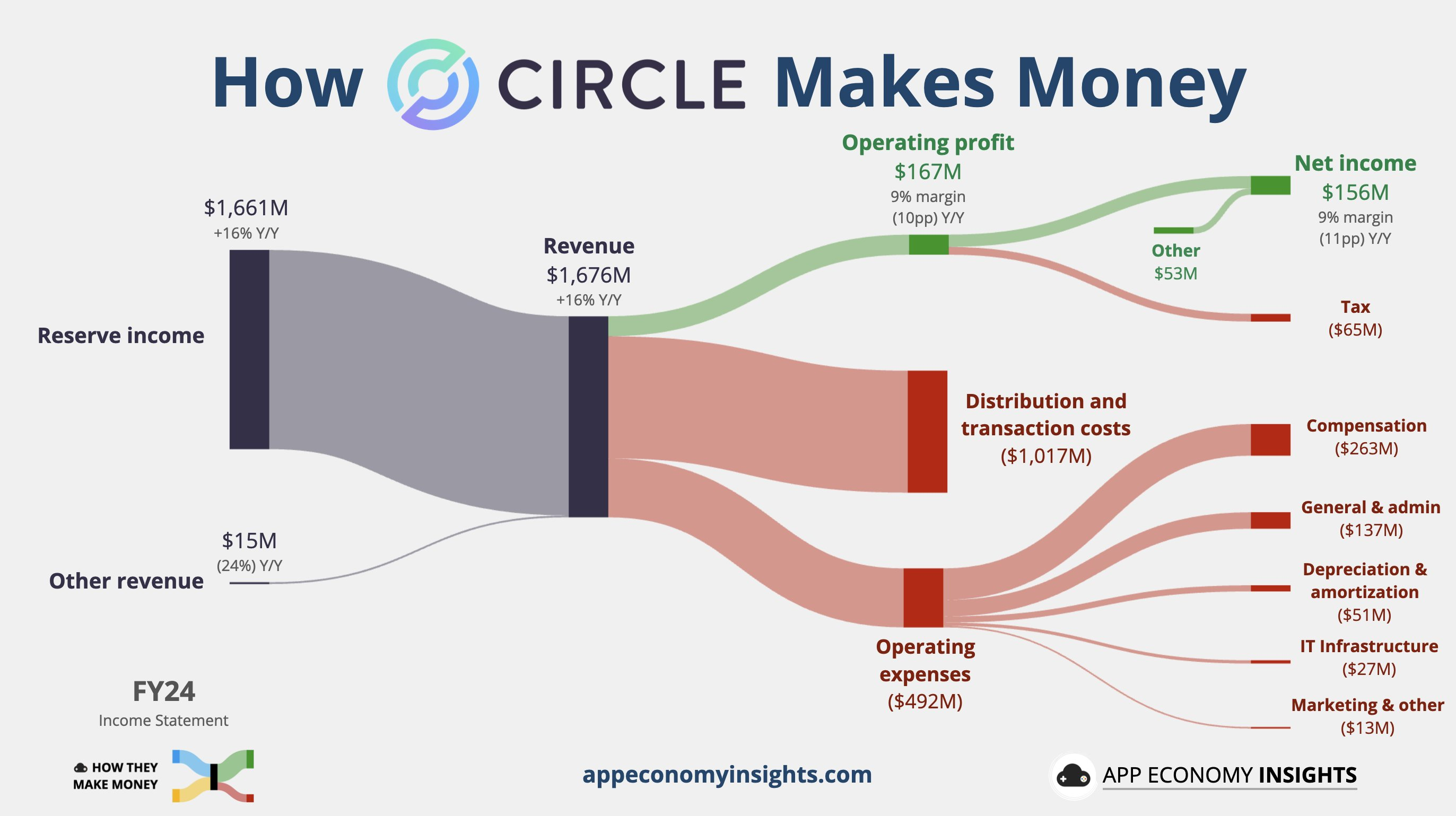

Circle earns revenue primarily from the reserves backing its stablecoins on a one-to-one basis. These reserves are mostly held in short-term Treasuries and repo agreements, both of which generate yield. As a result, the more stablecoins Circle issues, the greater the potential total return.

Currently, Circle holds $33 billion in reserves, including $11 billion in short-term Treasuries and $16 billion in repo agreements. This structure generates $1.46 billion in net revenue for the firm. As the USDC market cap increases, so too will Circle’s revenues and profits.

According to Sigil Fund, Circle remains the only “clean investable” option on the stock market for exposure to stablecoins. For example, Tether, the largest stablecoin issuer, is a private company, meaning there are no Tether shares available for public investment.