Crypto Wallets Are Eating Traditional Banking in Emerging Markets—Bitget Report Exposes the Shift

Forget brick-and-mortar branches—digital wallets are now the de facto banks for millions in developing economies. A new Bitget study reveals how crypto adoption bypasses legacy financial infrastructure, offering unbanked populations their first taste of economic sovereignty.

No more waiting for Wall Street’s crumbs. From Lagos to Jakarta, self-custody wallets cut out middlemen while delivering instant cross-border payments—something traditional banks still charge 8% fees to bungle. (Take notes, SWIFT.)

The irony? These ’unregulated’ crypto tools provide more financial access than decades of World Bank initiatives. Maybe that’s why Visa’s now scrambling to tokenize everything—too bad their tech moves at the speed of a 1999 ACH transfer.

Emerging markets lead in everyday crypto use

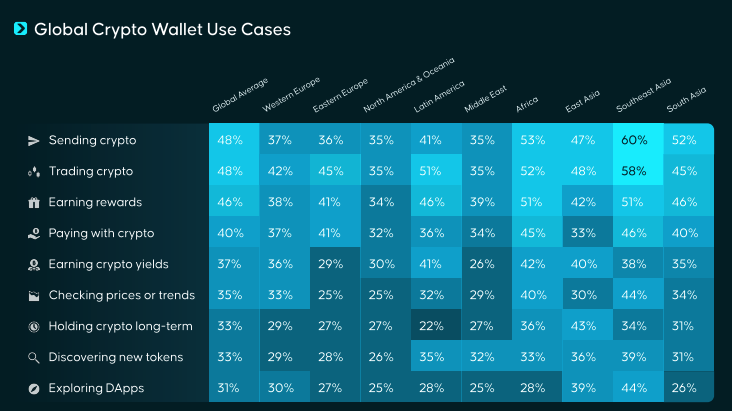

In Europe, most users were primarily engaged in trading crypto with their wallets, with over 40% of respondents citing this use case. The trend was very different in emerging markets. Users from Southeast Asia, South Asia, and Africa were the most likely to use crypto wallets for a variety of use cases, primarily sending crypto to other users.

Users in emerging markets typically struggle with access to reliable banking institutions and payment providers. For this reason, these regions tend to lead with crypto adoption. At the same time, users from these markets are attracted to earning airdrop rewards due to relatively lower income levels.

According to Biget CEO Gracy Chen, this shows a fundamental shift in how users engage with crypto wallets. For this reason, Bitget plans to adapt to this shift by making the wallet more accessible for users who are not crypto natives.

“This report captures a powerful shift: wallets are no longer an extension of the crypto ecosystem — they are emerging to new-age finance ecosystems. At Bitget, we’ve seen firsthand how user behavior is evolving. People aren’t simply trading anymore—they’re earning, exploring, and interacting directly with Web3, often starting with a wallet,” Gracy Chen, CEO of Bitget.

Interestingly, in North America and East Asia, users were split between trading and sending crypto. However, the level of engagement in East Asia was much higher, with 48% and 47% sending crypto and trading, respectively. At the same time, this was the region where the long-term holding rate was the highest, at 43%.