SYRUP Token Surges as Maple Protocol TVL and Whale Activity Heat Up

DeFi’s sweetener of choice—SYRUP—is bubbling over as institutional liquidity floods Maple Finance and staking metrics hit new highs. Whale wallets can’t seem to get enough, snapping up positions while retail traders scramble for crumbs.

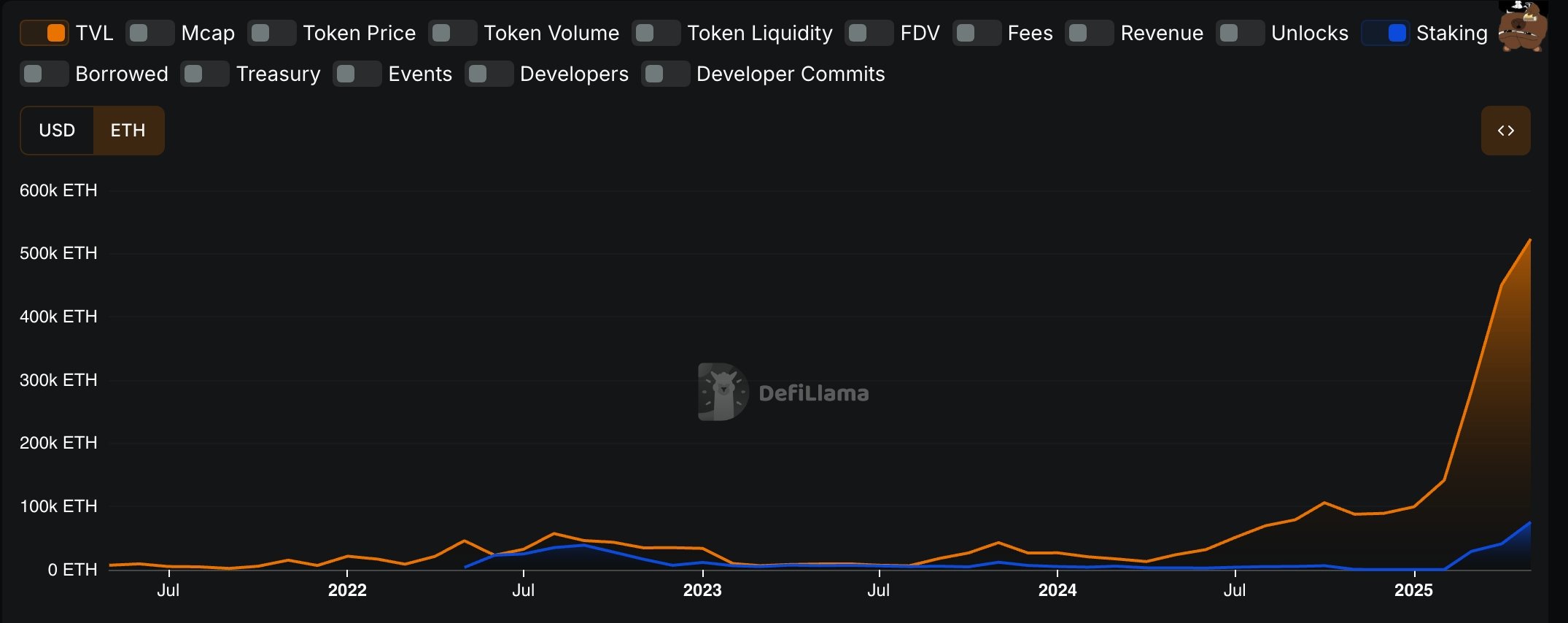

Total value locked in Maple surges alongside staking market cap, proving even crypto’s ’conservative’ yield plays aren’t immune to frenzied speculation. Just don’t ask about risk management—this is DeFi, after all.

The rally defies the usual May doldrums, making SYRUP one of the few bright spots in a quarter where most ’institutional-grade’ crypto products got rekt. Maybe this time really is different... or maybe it’s just leverage in a nicer suit.

SYRUP TVL and Staking market cap | Source: DeFi Llama

SYRUP TVL and Staking market cap | Source: DeFi Llama

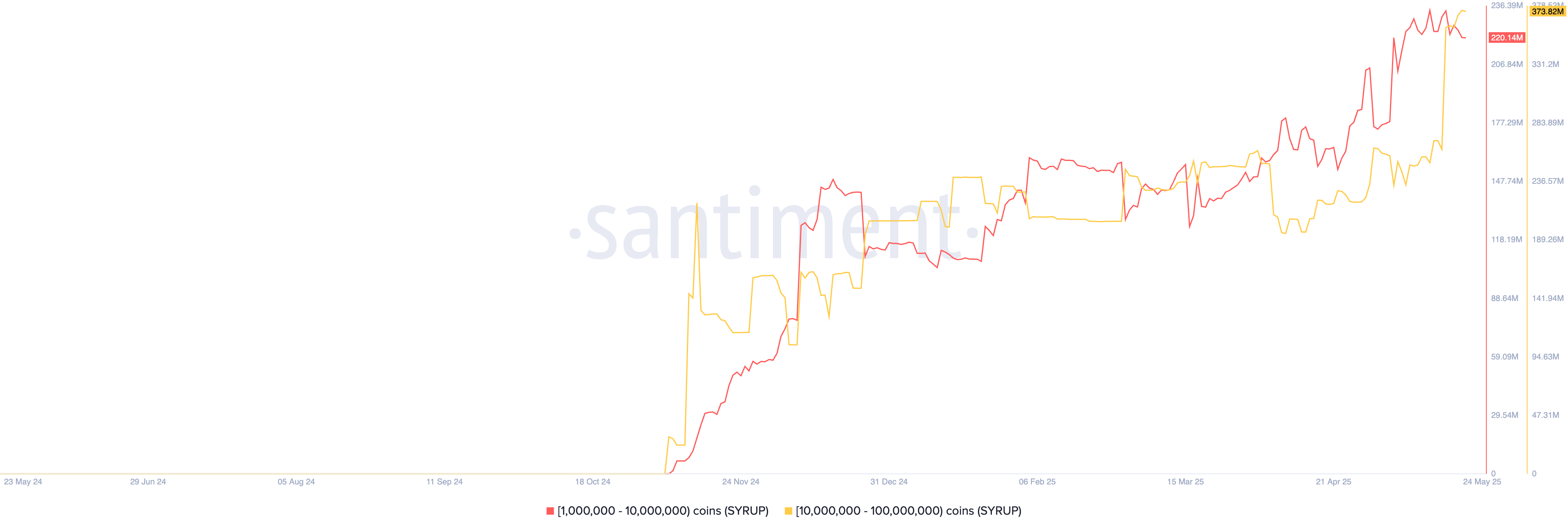

Santiment data shows that whales continue to allocate money into SYRUP. Those holding between 10 million and 100 million SYRUP tokens have boosted their holdings to 373 million from 204 million on January 1.

SYRUP price technical analysis

The daily chart shows that the Maple price has been in a strong bull run in the past few months. This surge accelerated after Binance and Bitget listed it earlier this month.

SYRUP has recently surged above the key resistance level at $0.1920, the highest swing on March 8. It has also moved above all moving averages, while oscillators show it is overbought.

Therefore, while more gains are possible, the price is likely to retreat soon as some investors start taking profits. Such a retreat WOULD bring it to $0.25 before resuming its uptrend.