Cetus Protocol Bleeds $11M in SUI—Exploit or Glitch? Liquidity Providers Left Reeling

Another day, another DeFi wound. Cetus—a key liquidity provider on Sui—just got raided for $11 million worth of SUI tokens. Was it a slick hack or just code gone rogue? The crypto streets are buzzing, but answers are scarce.

DeFi’s ’trustless’ promise meets reality: liquidity pools keep turning into loot boxes for attackers. Meanwhile, the usual suspects—auditors, dev teams, and ’decentralized’ governance—are scrambling for cover. Pro tip: if your yield farm’s APY looks too good to be true, it probably funds someone else’s Lambo.

Stay tuned for the post-mortem. Odds are it’ll feature the classic trio: a vague root cause analysis, a token-recovery ’plan,’ and a fresh round of VC funding to paper over the hole.

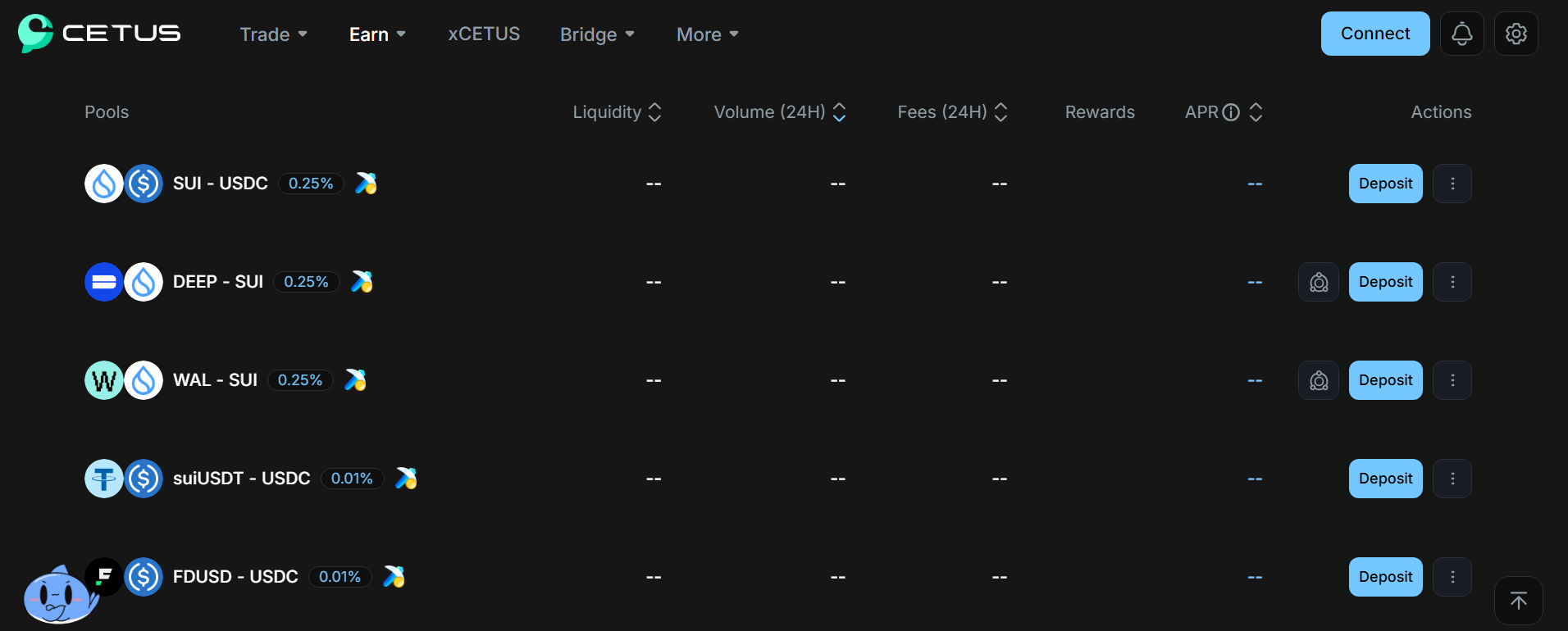

The Cetus team has halted SUI smart contracts temporarily following an incident, May 22, 2025 | Source: app.cetus.zone

The Cetus team has halted SUI smart contracts temporarily following an incident, May 22, 2025 | Source: app.cetus.zone

Despite news of the liquidity drain and the panic related to it circulating online, the SUI (SUI) token still saw modest gains. In the past 24 hours, it has gone up by 3.15%, reaching $4 per token. Its daily trading volume has increased by 112% compared to the previous trading day, reaching nearly $2.5 billion.

In the past month, the token has been on an ongoing rally, going up by nearly 75%.

Some traders who are members of the Discord server for Cetus have shared screenshots of messages from Cetus admins and developers. One of the members, Figure.Cetus, told traders to remain calm and that the team will publish an announcement soon.

Figure.Cetus claimed that the liquidity provider was not hacked, instead the liquidity drain was due to a bug within the liquidity provider’s oracle.

In crypto liquidity pools, oracles serve to connect the pool’s smart contracts to external data sources, such as real-world asset prices or market conditions. This allows the pool to provide accurate pricing, trade execution, and other features based on the external information it receives.

At press time, the Cetus protocol team has yet to publish an official statement regarding its investigations. In addition, smart contracts are still temporarily paused.