Metaplanet Stock Surges 12% After Dumping $104M Into Bitcoin—Because Nothing Says ’Financial Strategy’ Like Chasing Crypto Volatility

Tokyo-based investment firm Metaplanet just made its biggest Bitcoin bet yet—and the market’s eating it up. Shares skyrocketed 12% after announcing a $104 million BTC purchase, proving once again that crypto hype still moves traditional markets.

From Skepticism to Bandwagon

Once a cautious player, Metaplanet’s now all-in on Bitcoin as a treasury asset—joining the ranks of MicroStrategy and other corporate crypto converts. Because when in doubt, follow the herd, right?

The Institutional FOMO Is Real

With Bitcoin hovering near all-time highs, the move smells like classic institutional FOMO. Because nothing reassures shareholders like buying at the top—except maybe lighting cash on fire for warmth.

One thing’s clear: In 2025, even conservative firms would rather explain wild crypto swings to investors than admit they missed the boat.

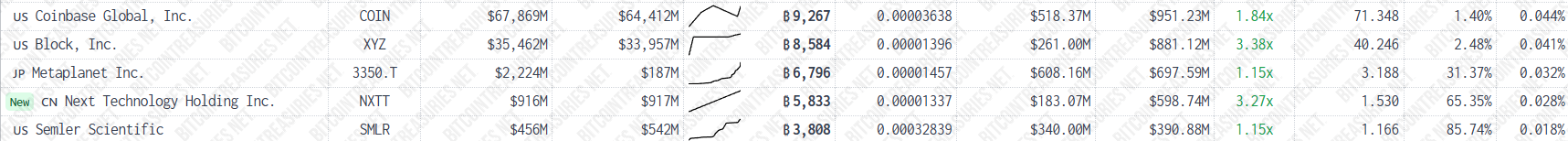

Bitcoin holdings by public companies | Source: Bitcoin Treasuries

Bitcoin holdings by public companies | Source: Bitcoin Treasuries

The latest accumulation puts Metaplanet within range of major corporate Bitcoin holders such as Jack Dorsey’s Block Inc, which holds 8,584 BTC, and U.S.-based cryptocurrency exchange Coinbase, which holds 9,267 BTC, according to tracking website Bitcoin Treasuries.

Metaplanet chief executive Simon Gerovich earlier said the company aims to accumulate 10,000 BTC by the end of 2025. With the latest purchase bringing total holdings to 7,800 BTC, Metaplanet has now reached 78% of that target.