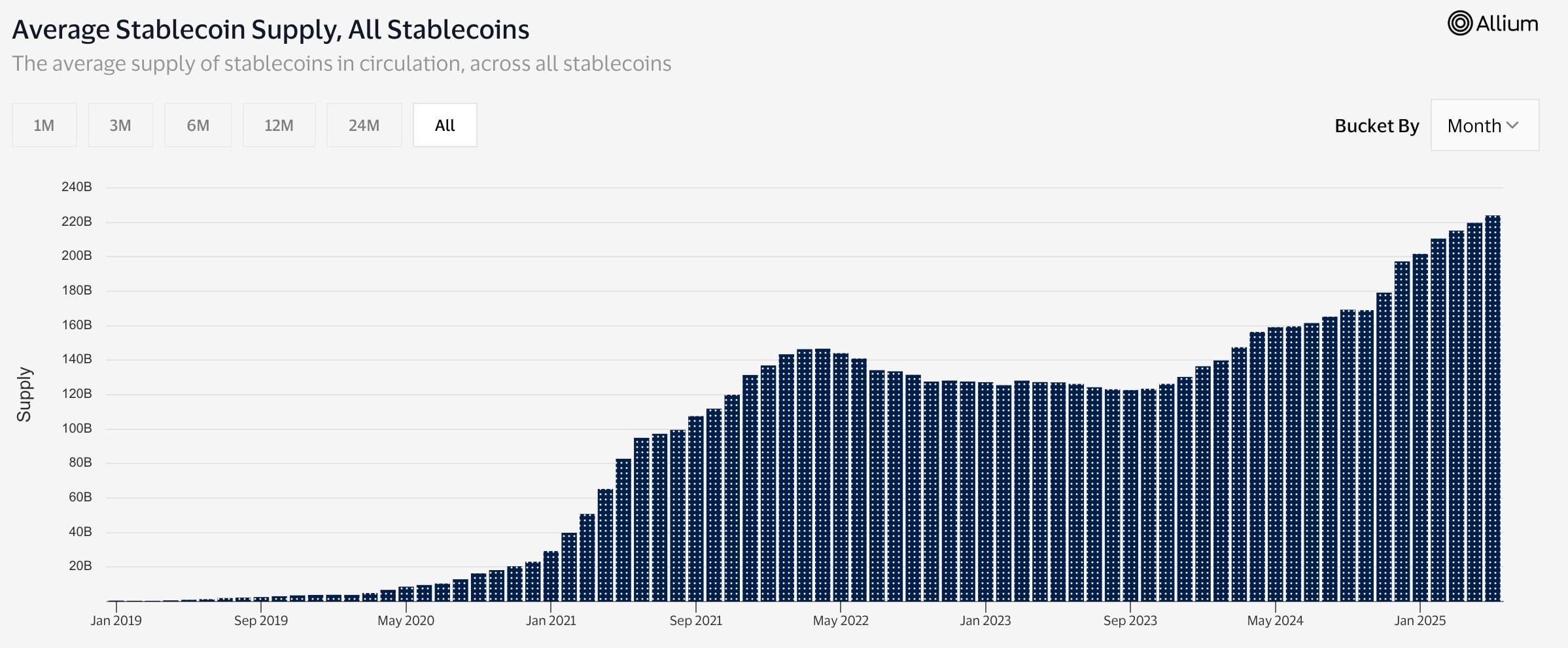

Tether’s Dominance Grows as Stablecoin Market Surges to $243B

Tether tightens its stranglehold on the stablecoin market—now worth a staggering $243 billion—while rivals scramble for scraps. The crypto world’s favorite liquidity lubricant shows no signs of slowing down, even as regulators sharpen their knives.

Behind the numbers: USDT’s market share keeps climbing, proving that when it comes to stablecoins, the market prefers the devil it knows. Meanwhile, decentralized alternatives whisper about ’real audits’ and ’transparency’—how quaint.

Closing thought: In a sector where ’stable’ is often a euphemism for ’tethered to hope,’ Tether’s iron grip might be the closest thing to certainty crypto traders get. Just don’t ask about those reserves—bankers hate that trick.

Stablecoin supply | Source: Visa

Stablecoin supply | Source: Visa

Data compiled by Visa shows that more people are using stablecoins in their daily transactions today. Over 192.2 million unique sending addresses have transacted in the last 12 months, while 242.7 million have received stablecoins. The total active unique addresses jumped to 250 million.

All this has pushed the total transaction count to 5.8 billion and the transaction volume to $33.6 trillion.

Stablecoins have become highly popular because of their lower costs compared to traditional methods. For example, sending $1,000 to a user through PayPal attracts a 2.99% fee plus a variable fee.

Using a stablecoin attracts a significantly smaller fee than that. Also, these transactions are faster than traditional methods like wire transfer.

Citi believes that stablecoins will continue gaining market share in the coming years.

In a recent report, the company estimated that stablecoins will be worth over $1.6 trillion by 2030, while Standard Chartered estimates that they will reach $2 trillion by 2028.