XRP ETF Shatters Inflow Records While Price Stumbles—Wall Street’s Latest Contradiction

Another day, another crypto ETF milking hype while the underlying asset flounders. The new XRP exchange-traded fund just posted record-breaking inflows—$250 million in its first week—as XRP’s price wobbles near yearly lows. Traders are piling in, but the token itself can’t catch a break.

Who needs fundamentals when you’ve got financialization?

The ETF’s success highlights Wall Street’s favorite game: packaging volatile assets into neat little products for institutional gamblers. Meanwhile, retail holders watch their actual XRP bags stagnate. Classic.

XRP’s price action remains stuck in neutral despite the ETF frenzy, down 12% this month. But hey—at least the bankers get their cut.

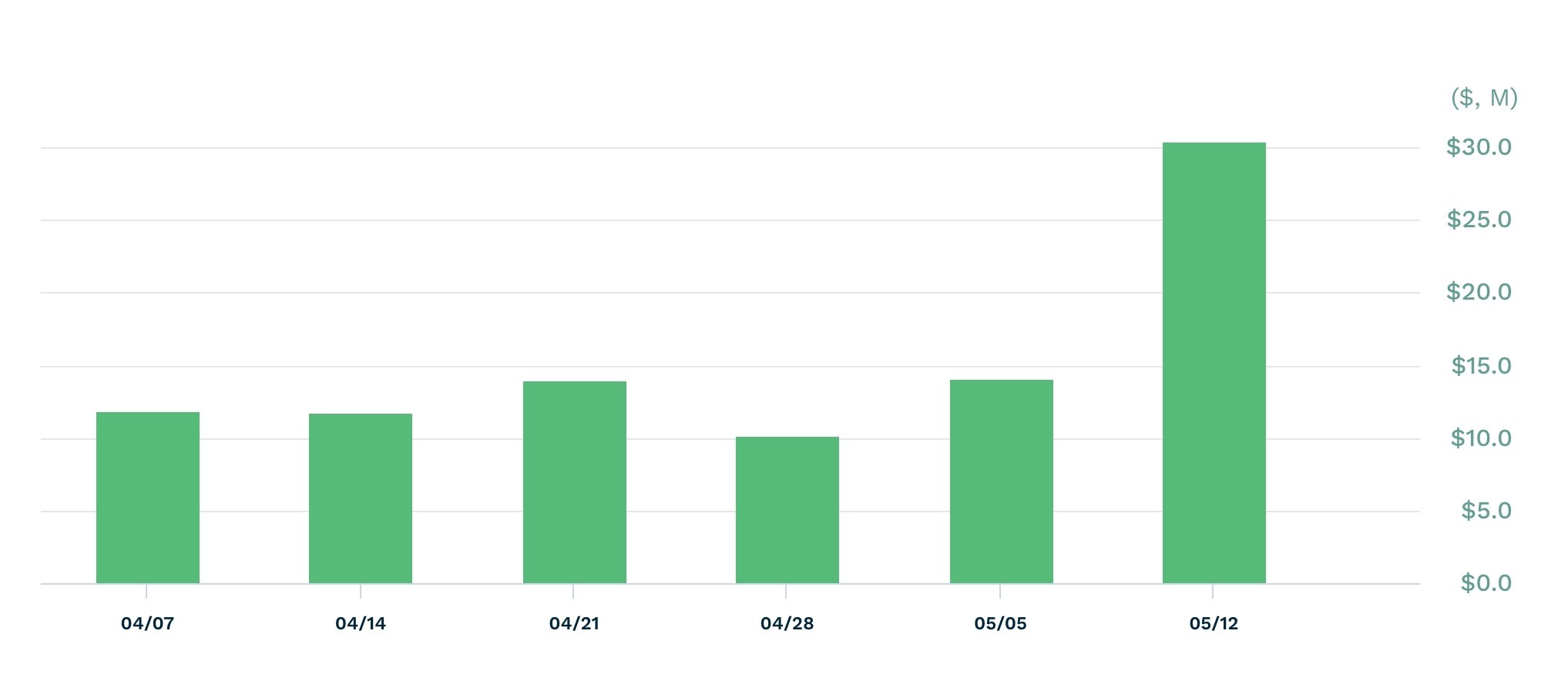

XXRP ETF inflows data | Source: ETF

XXRP ETF inflows data | Source: ETF

The ongoing inflows are a sign that there is demand for XRP ETFs on Wall Street. Spot ethereum ETFs have added just $2.5 billion in assets since September, while the 2X Solana ETF (SOLT) has only $30 million. SOLT was launched two months before the XXRP ETF.

This view mirrors the JPMorgan forecast for solana and XRP ETFs. In its reportthe bank predicted that the two funds would attract $15 billion in inflows in the first year, with most of them going to XRP.

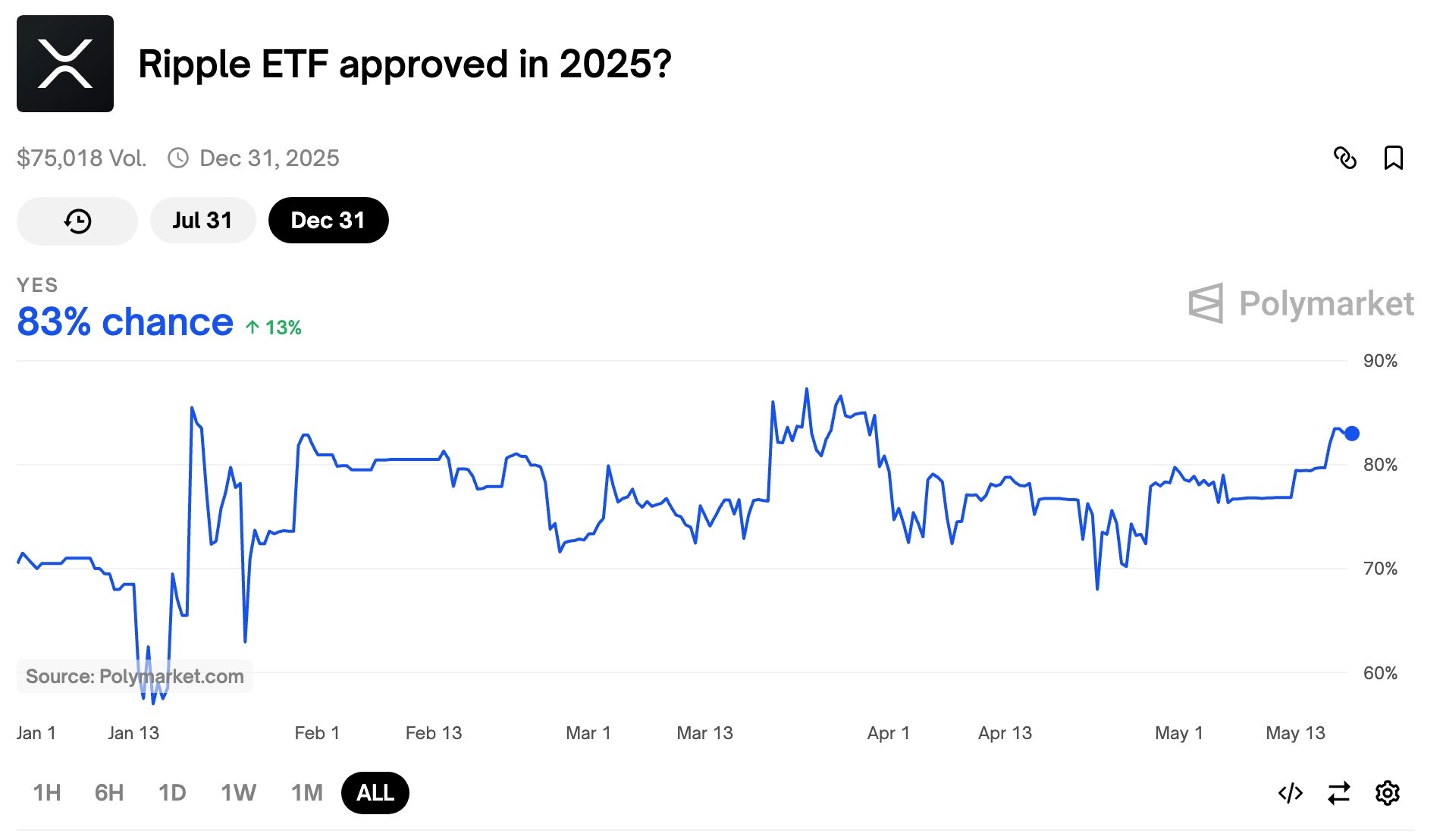

The next important catalyst to watch is in June when the SEC will rule on the Franklin Templeton XRP ETF.

It will likely delay the ETF approval again, and then it will be approved with those of companies like Bitwise and VanEck ahead of their Oct. 15 deadline.

Polymarket traders have placed an 83% chance of XRP ETFs being approved this year.

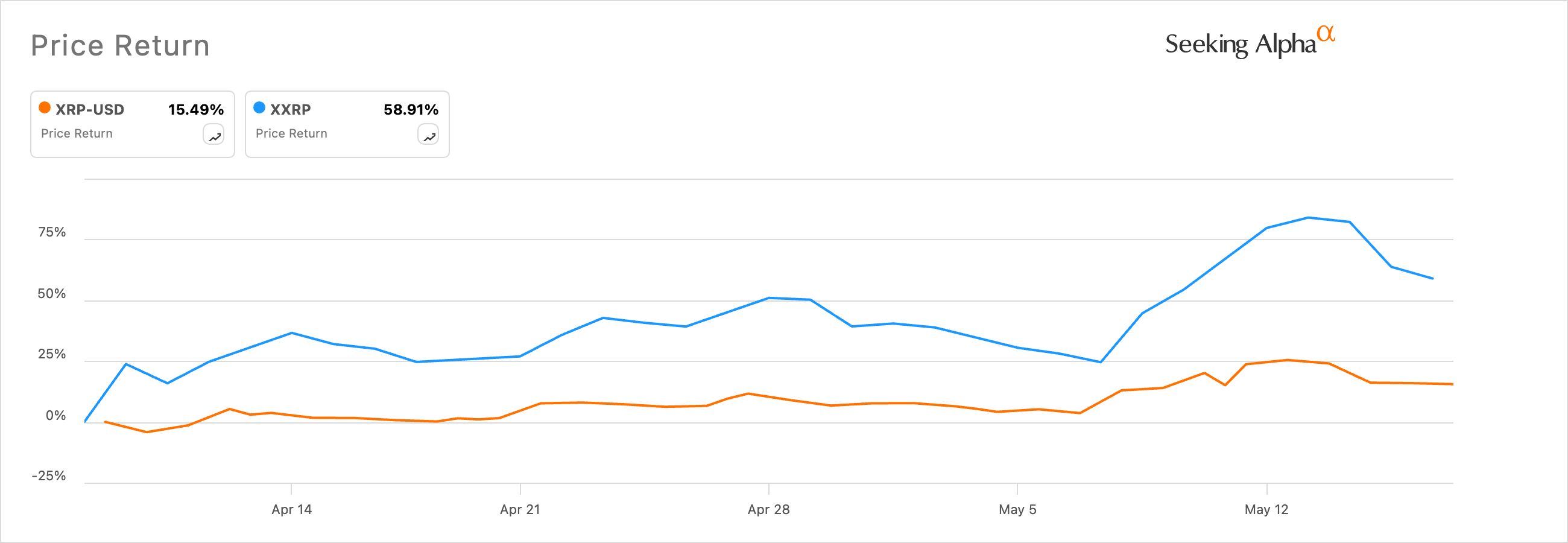

The XXRP ETF is significantly different than the spot XRP ETFs. For one, it is a more expensive fund to own because of its 1.89% expense ratio. Judging by the existing ETH and BTC ETFs, their expense ratios will be less than 0.50%.

The ETF is also leveraged, allowing investors to achieve 2 times the daily returns of XRP. For example, it dropped by almost 3% on Friday as Ripple (XRP) fell by 1.5%.

The long-term performance of a Leveraged ETF can go either way, depending on the underlying asset.

For example, the leveraged ProShares UltraPro QQQ ETF has jumped by 270% in the last five years, while the Nasdaq 100 Index has risen by 130% in the same period.

The XXRP has jumped by 58% since inception, while the XRP has risen by 15%.