$3B Crypto Options Expiry Looms—Bitcoin and Ethereum Traders Brace for Impact

Friday’s $3 billion options expiry has crypto markets on edge—BTC and ETH face potential volatility as traders scramble to hedge or cash out.

Why it matters: When this much notional value hits the market at once, even whales sweat. Expect gamma squeezes, last-minute hedging, and the usual Wall Street circus pretending they ’anticipated the move.’

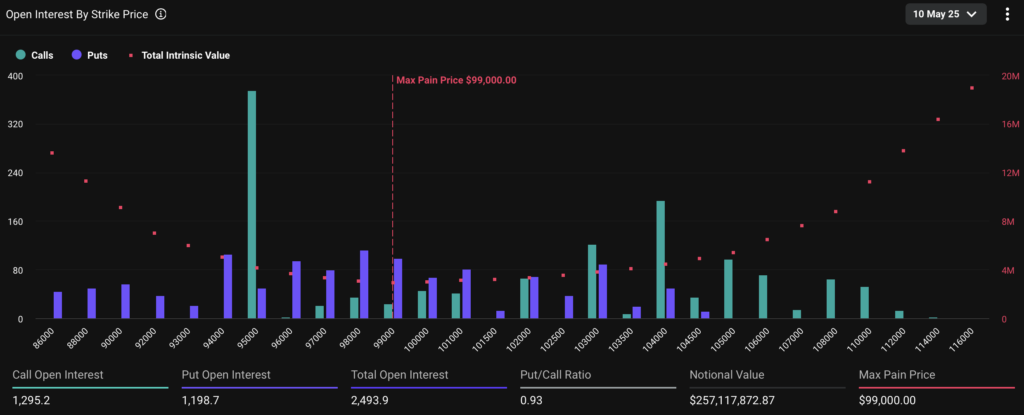

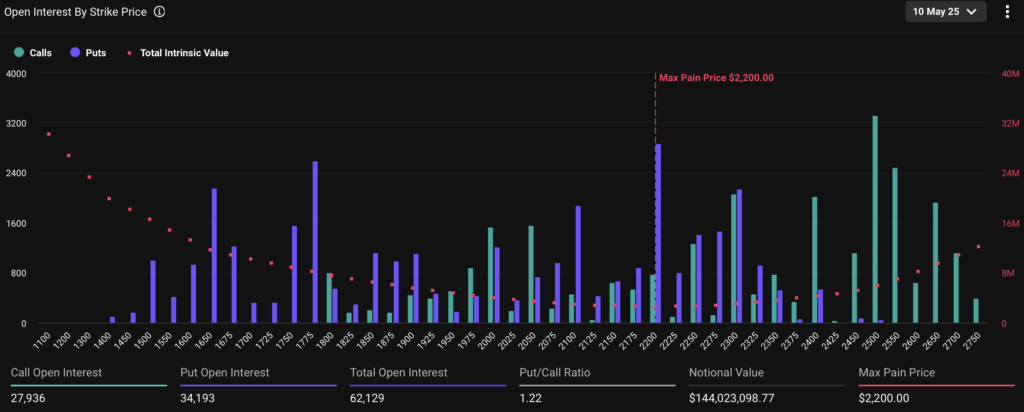

The fine print: 60% of Bitcoin options are calls (bullish bets), while Ethereum’s split is nearly even. Max pain levels suggest some pain for overconfident bulls—because when has crypto ever followed the script?

Bottom line: Grab popcorn. The market’s about to remind everyone why ’derivatives’ and ’danger’ start with the same letter.

Key technical points,

- Options Expiry Volume: Approximately $3 billion in BTC and ETH options are expiring today, potentially leading to increased market volatility.

- Market Sentiment Indicators: The put-to-call ratios for Bitcoin and Ethereum suggest mixed market sentiments, with Ethereum showing a slightly more bullish outlook.

- Potential Price Movements: Traders anticipate possible price swings and increased market activity as a result of the options expiry.

Options contracts allow traders to buy or sell an asset at a predetermined price before a specific date. The expiration of these contracts frequently sparks repositioning, leading to increased activity and short-term volatility. The sheer size of Friday’s expiry could influence near-term price dynamics.

The put-to-call ratio is a common metric used to gauge market sentiment. A ratio above 1 indicates a bearish sentiment, while a ratio below 1 suggests bullishness. Current data shows Bitcoin’s put-to-call ratio at 0.93, indicating a neutral to slightly bullish sentiment, whereas Ethereum’s ratio stands at 1.22, reflecting a more bearish outlook.

Analysts have mixed views on the impact of today’s options expiry. Some believe it could lead to short-term volatility and influence market sentiment, potentially driving prices higher if the prevailing sentiment is bullish. Others view it as a routine event with limited long-term impact, suggesting that while price swings may occur, broader factors such as regulatory developments and macroeconomic conditions will continue to play a significant role in market trends.

What to expect in the market post-expiry

Following the expiration of these options contracts, traders should be prepared for potential short-term volatility as the market adjusts. If bullish sentiment prevails, we could see upward price movements, particularly if key resistance levels are breached.

Conversely, if bearish sentiment dominates, prices may face downward pressure. It’s essential for traders to monitor market indicators and news closely, as external factors like regulatory changes and macroeconomic developments could also influence market direction in the coming days.