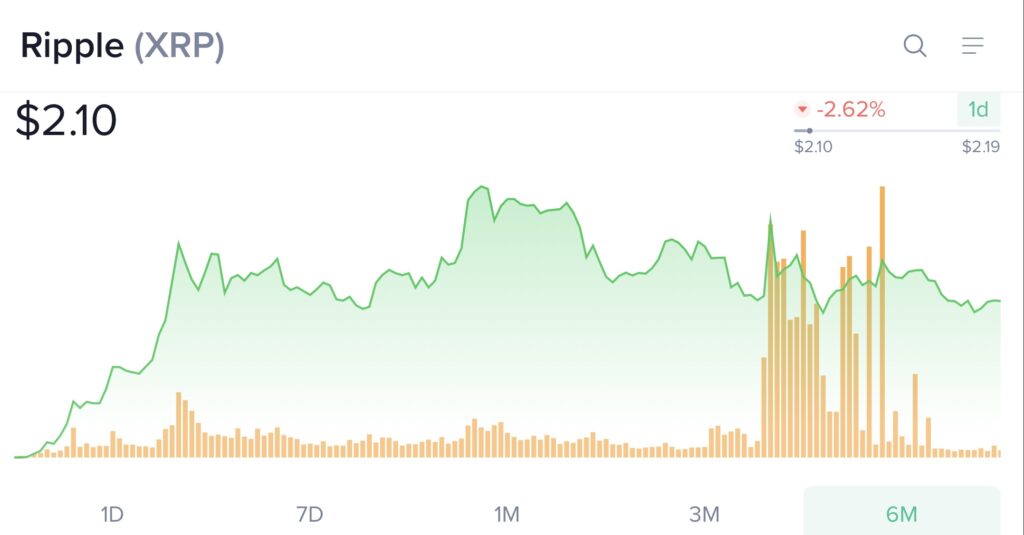

XRP Flatlines as Network Activity Craters—Is This the Calm Before the Storm?

XRP’s price action has gone limp, trapped in a suffocatingly narrow band while on-chain metrics bleed out. Daily transactions just hit their lowest since the SEC lawsuit hangover—not exactly the ’utility coin’ narrative holders were banking on.

Meanwhile, the usual crypto cheerleaders are spinning this as ’accumulation phase’ genius. Because nothing screams bullish like a blockchain turning into a ghost town, right?

Here’s the cold truth: Without fresh money or real-world use cases, even the most ardent XRP maximalists might start questioning their bags. The network’s pulse is fading—and no amount of hopium changes that.

XRP price and daily addresses. Credit: Santiment

XRP price and daily addresses. Credit: Santiment

Additionally, the number of large transactions exceeding $100,000 has dropped, from over 1,500 at the peak in March to roughly 1,000 per day. Despite dwindling usage, development activity appears to be increasing. The last 30 days saw a 196% increase in developer contributions to XRPL, indicating that protocols and updates are on the horizon.

On May 5 alone, two protocols, the tokenized index fund Vaultro Finance and the decentralized lending protocol XpFinance, announced their debut on XRPL. These developments, alongside Ripple’s acquisition of prime broker Hidden Road, could re-ignite interest over the coming months.

On the technical side, XRP remains in a neutral-to-bearish posture. The relative strength index is at 44.7, leaning in the neutral zone while the stochastic RSI suggests that XRP is oversold. The moving average convergence divergence indicator points to a short-term downward trend.

All of the short- to mid-term moving averages are trending lower and are giving off a “sell” signal. Only the 200-day estimated moving average, which is currently trading at $1.99, is providing some support.

A deeper correction toward the 200-day average or even lower may be possible if XRP breaks below $2.03 with significant volume, particularly if on-chain activity stays weak. However, a clean move above $2.30 might lead to a breakout in the direction of the next significant resistance level, which is close to $2.45.

XRP appears to be in a holding pattern at the moment. Low user activity and a decline in transaction volume may hurt sentiment, despite the Securities and Exchange Commission’s legal pressure having eased and new developments growing. The next few weeks may be crucial, especially if the network gains momentum from impending launches.