Markets Tread Water as Wall Street Bets Big on June Rate Cuts

Traders hold their breath—and their positions—as the Fed’s rate-cut roulette wheel spins toward June. Tech wobbles, energy dips, but crypto? Naturally, it’s mooning against all logic.

Wall Street’s favorite game: front-running the Fed. This time, they’re all-in on dovish whispers—because what could go wrong with betting on central bank benevolence?

Meanwhile in reality: inflation data gets ’recalculated’, unemployment gets ’seasonally adjusted’, and your portfolio gets rekt. But hey—at least the bankers’ bonus pools are inflation-proof.

Inflation remains stable, but Fed rate cuts are likely

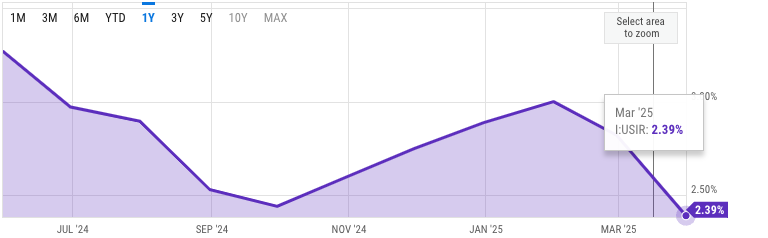

While inflation continues to hold above the Fed’s target of 2%, currently at 2.39%, it has seen two consecutive months of declines. The main reason for inflation cooling is likely the dropping demand due to inflation risks. This is despite the fears that U.S. tariffs, especially on China, would have Ripple effects on consumer prices.

Good news on the inflation front is that OPEC+ announced it would raise its output by 411,000 from June 1. The news contributed to a sharp drop in oil prices, which soon stabilized. Oil prices are a major contributor to inflation, and their declines will have positive effects on consumer prices.

In trade policy, markets were rattled by Donald Trump’s new plans to impose 100% tariffs on foreign-made movies. On Monday, May 5, the President accused foreign countries of offering incentives to drive studios away from the United States, and called this a “National Security threat.”

One of the biggest losers today was a multinational conglomerate, Berkshire Hathaway. Its stock fell 4.33% on news that its founder, Warren Buffett, would retire as CEO, while still remaining the company’s president.