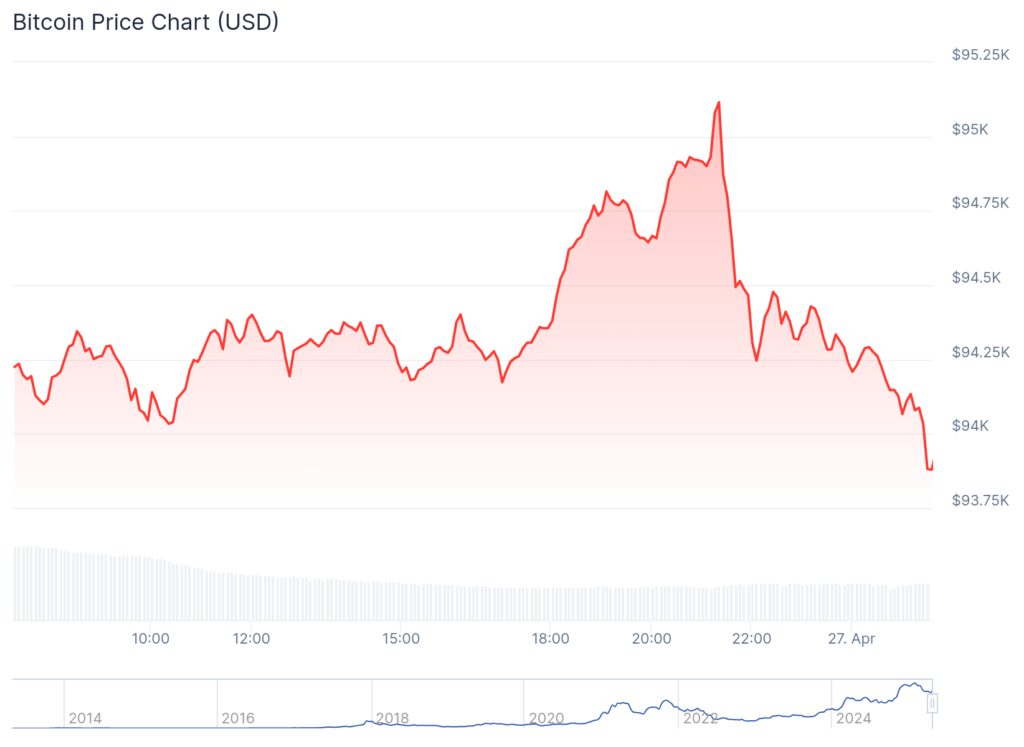

Bitcoin Stumbles Below $94K Despite ETF Firehose—$3B Floods In

BTC takes a 5% haircut as Wall Street’s shiny new ETF toys suck up capital like a Goldman Sachs intern at a free-bar M&A closing. Meanwhile, crypto OGs yawn—they’ve seen this volatility movie before.

Institutional money pours in as ETFs post record $3B weekly inflows. Traders shrug: ’Price discovery still happens on-chain, not in some BlackRock prospectus.’

The dip? A blip. The trend? Your boomer uncle finally admitting you were right about digital gold—between sips of his 401(k)-funded margarita.

Source: CoinGecko

Source: CoinGecko

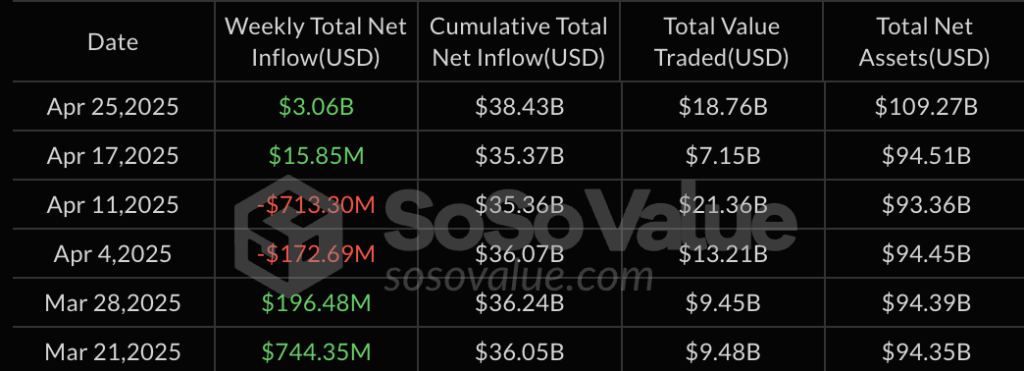

The combined ETF products now hold $109.27 billion in total net assets and account for approximately 5.8% of Bitcoin’s total market capitalization, according to data from SoSoValue.

BlackRock leads Bitcoin ETF inflow

The latest Bitcoin ETF data reveals a strong rebound in investor interest after several weeks of mixed performance. Daily inflows on April 25 reached $379.99 million, contributing to the weekly total of $3.06 billion.

For context, the week ending April 11 recorded $713.30 million in net outflows, followed by a modest $15.85 million inflow the week ending April 17.

BlackRock’s IBIT leads with $240.15 million in daily inflows and maintains its position as the largest Bitcoin ETF with $56.03 billion in assets under management. The fund has accumulated $41.20 billion in cumulative net inflows since its launch.

Fidelity’s FBTC secured the second position with $108.04 million in daily inflows and $19.12 billion in total net assets. Other notable performers include ARKB (ARK 21Shares) with $11.39 million in daily inflows and Grayscale’s BTC with $19.87 million. However, its converted flagship GBTC product continues to experience outflows, with $7.53 million leaving the fund on April 25.

Trading activity has also increased substantially, with $18.76 billion in total value traded for the week, compared to $7.15 billion the previous week. The cumulative total net inflow across all Bitcoin spot ETFs now stands at $38.43 billion since their launch.

Despite Grayscale’s GBTC experiencing cumulative outflows of $22.69 billion since its conversion from a trust structure, the overall ETF ecosystem continues to bring in considerable new capital.