Bitcoin and Gold Defy Markets as Stocks Tumble—Is This the Great Decoupling?

Wall Street’s bad day becomes crypto’s breakout moment. While traditional equities bleed, Bitcoin and gold surge—signaling a potential regime shift in risk assets.

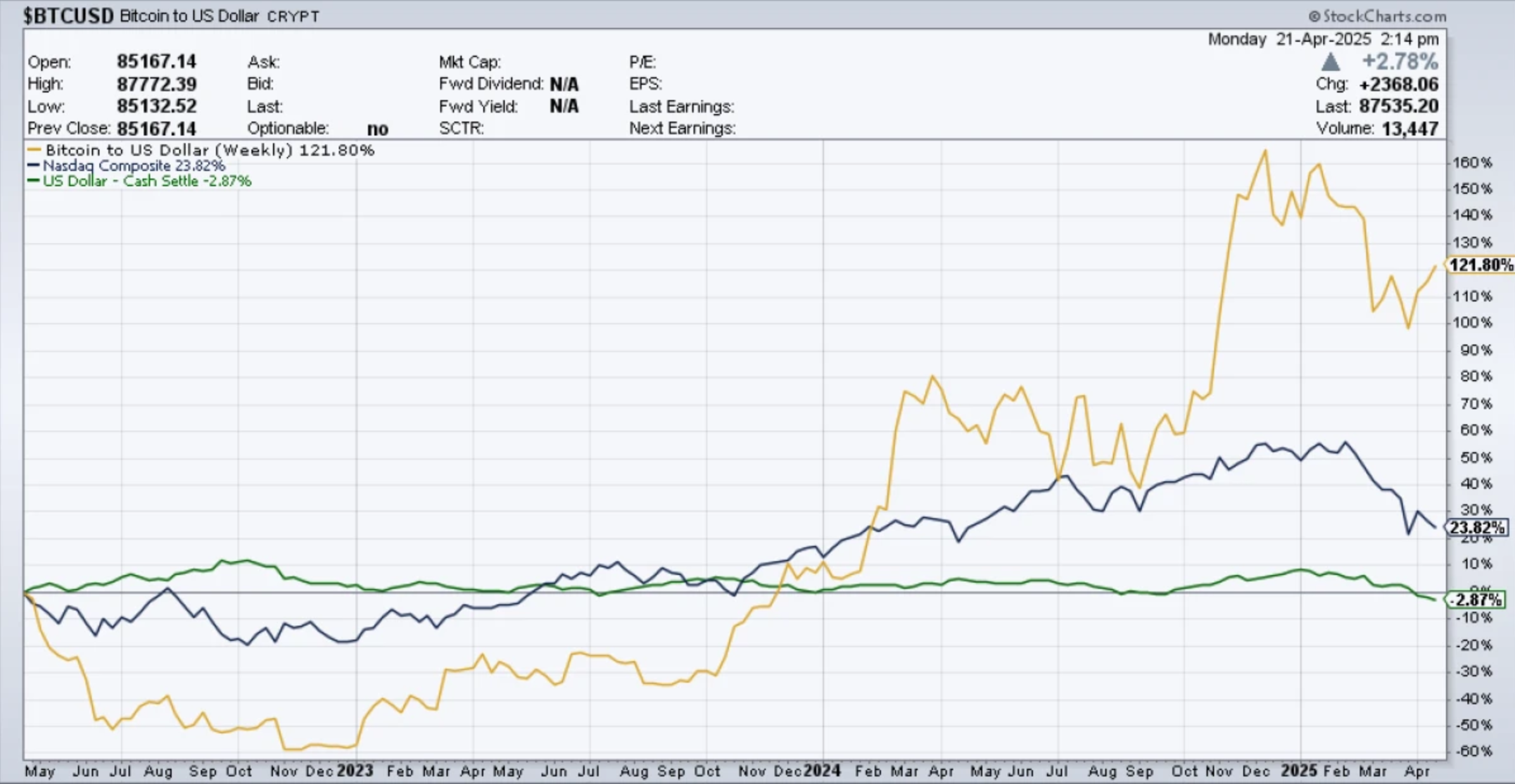

Decoupling or dead cat bounce? The correlation breakdown between crypto and stocks has traders scrambling. Bitcoin’s 12% weekly gain contrasts sharply with the S&P 500’s worst month since September.

Gold bugs and crypto maximalists unite. Both assets are flashing strength as fiat currencies wobble under inflation pressures—though gold’s institutional approval still gives bankers an excuse to dismiss ’digital gold’.

This isn’t 2021’s ’risk-on’ rally. With bond yields spiking and Fed rhetoric turning hawkish, the simultaneous rise of these alternative assets suggests deeper structural changes. Pension funds allocating to BTC? Central banks buying gold? The playbook’s being rewritten.

Of course, Wall Street will claim they saw it coming—right after they finish downgrading their Q2 forecasts.

Experts remain divided on this. For instance, in March 2025, BlackRock’s Robbie Mitchnick stated that Bitcoin is still yet to consistently move in line with Wall Street, although he anticipates it will happen as more TradFi investors start trading Bitcoin.

Did Bitcoin really decouple from stocks?

The second half of April saw Bitcoin and Gold rise, while major assets including stocks and the USD dropped. On April 22 alone, Bitcoin gained 7%, while risk assets ended the day in negative territory.

Many in the crypto community quickly reacted, declaring that Bitcoin was undergoing a decoupling from stocks. Bitcoin and Gold seemed to confirm their roles as safe havens, while other assets appeared increasingly risky and vulnerable amid political and economic turmoil.

🇺🇸 BLOOMBERG JUST SAID #BITCOIN IS DECOUPLED FROM THE STOCK MARKET

IT’S HAPPENING!!! 🚀

pic.twitter.com/gEbBXxHosq

However, the debate over whether Bitcoin is truly decoupling continues. While there is no doubt that Bitcoin currently stands apart from stocks and the dollar, some market observers warn this could be a short-term phase. They suggest that as headwinds take hold, Bitcoin may eventually follow the broader stock market’s downtrend. In other words, the current divergence could turn out to be just a temporary fluctuation.

"Bitcoin divergence" and "Bitcoin decoupling" will be dominant headlines for 2025. pic.twitter.com/VBXqZNLFul

— Tuur Demeester (@TuurDemeester) April 22, 2025Some commenters attributed the Bitcoin rally to increased liquidity, encouraging investors to “ignore the noise.” They argue that Bitcoin can surge thanks to technical triggers even when news sentiment is mixed. Others pointed to macro headlines as a major driver of the demand for Bitcoin, including comments from U.S. Treasury Secretary Scott Bessent suggesting a possible de-escalation between the U.S. and China. Meanwhile, headlines reported that India was considering sanctions against China, and China itself urged countries to reject collaboration with the U.S.

In this light, it appears that Bitcoin’s rally was at least partly news-driven. Such major economic shake-ups don’t happen often, suggesting that the current decoupling may be more extraordinary than permanent. Bitcoin could realign with the stock market once the trade tensions subside.

Why is decoupling important?

We asked our market analyst and trader, Ekta Mourya, to enlighten our readers on this topic. Here’s what she replied to why decoupling is important and whether she sees the current decoupling as a temporary or a long-term phase:

“Bitcoin’s decoupling comes at a time when the largest cryptocurrency’s correlation with Gold rises. BTC’s outperformance against the Nasdaq during Trump’s tariff crisis marked a pivotal shift in Bitcoin’s price this cycle, bringing back the “digital Gold” narrative.

Bitcoin’s 30-day Pearson correlation coefficient with Gold is up from -0.7 in March 2025 to 0.45 and rising as of April 2025. For traders, this signals an opportunity to enter long positions; it opens doors for Bitcoin’s re-test of the $109K all-time high and likely price discovery.

Bitcoin’s divergence from the stock market feels more like a temporary blip rather than a permanent shift. Market volatility, tariff tensions, and weak earnings are rattling U.S. equities, while Bitcoin is catching a bid as a safe haven for traders’ capital. However, structurally, BTC has always stood apart; it is a high-beta asset with a growing appeal for portfolio diversification. Both retail and institutional traders should watch Bitcoin for its evolving risk/reward profile and gains.”