Bitcoin’s brewing a perfect storm for short sellers. With a surge in bearish bets and liquidity stacking up near the $97K-$100K zone, the stage is set for a violent squeeze. Traders chasing downside might soon learn why Wall Street calls it ’picking up nickels in front of a steamroller.’

The market’s coiled like a spring. Every leveraged short adds fuel to the inevitable rebound—because in crypto, the only thing more predictable than hype is the pain of those fighting it.

Binance Exchange Flows | CryptoQuant

Supporting this,

bitcoin exchange reserves have been declining since April 18. The analysis suggested that this current condition creates a "cleaner" market environment, less vulnerable to large-volume dumps by whales.

Bitcoin Exchange Reserves CryptoQuant

Bitcoin Short Squeeze Looms

Novaque Research confirmed that with Bitcoin’s

market structure appearing to reset after weak-handed longs were flushed between $82,000 and $88,000, remaining shorts above $92,000 are increasingly at risk. Notably, a spike to this level could trigger a short squeeze.

In addition, there is thin liquidity above current levels, and this makes the market highly sensitive to positive catalysts, such as ETF inflows or favorable macroeconomic events, that could rapidly drive Bitcoin past $100,000.

Further, Coinglass data reveals a massive concentration of liquidation leverage at major levels. The most prominent cluster lies around $97,755, with a liquidation leverage amounting to $207.71 million. A second major cluster exists at $99,876, totaling $193.18 million.

Binance BTCUSDT Liquidation Heatmap CoinglassBinance BTCUSDT Liquidation Heatmap | Coinglass

These levels are important because if Bitcoin approaches or surpasses them, massive short liquidations could be triggered, forcing bearish traders to buy back their positions, which would propel the price even higher, confirming a Bitcoin short squeeze.

Leverage Builds While Short Bias Dominates

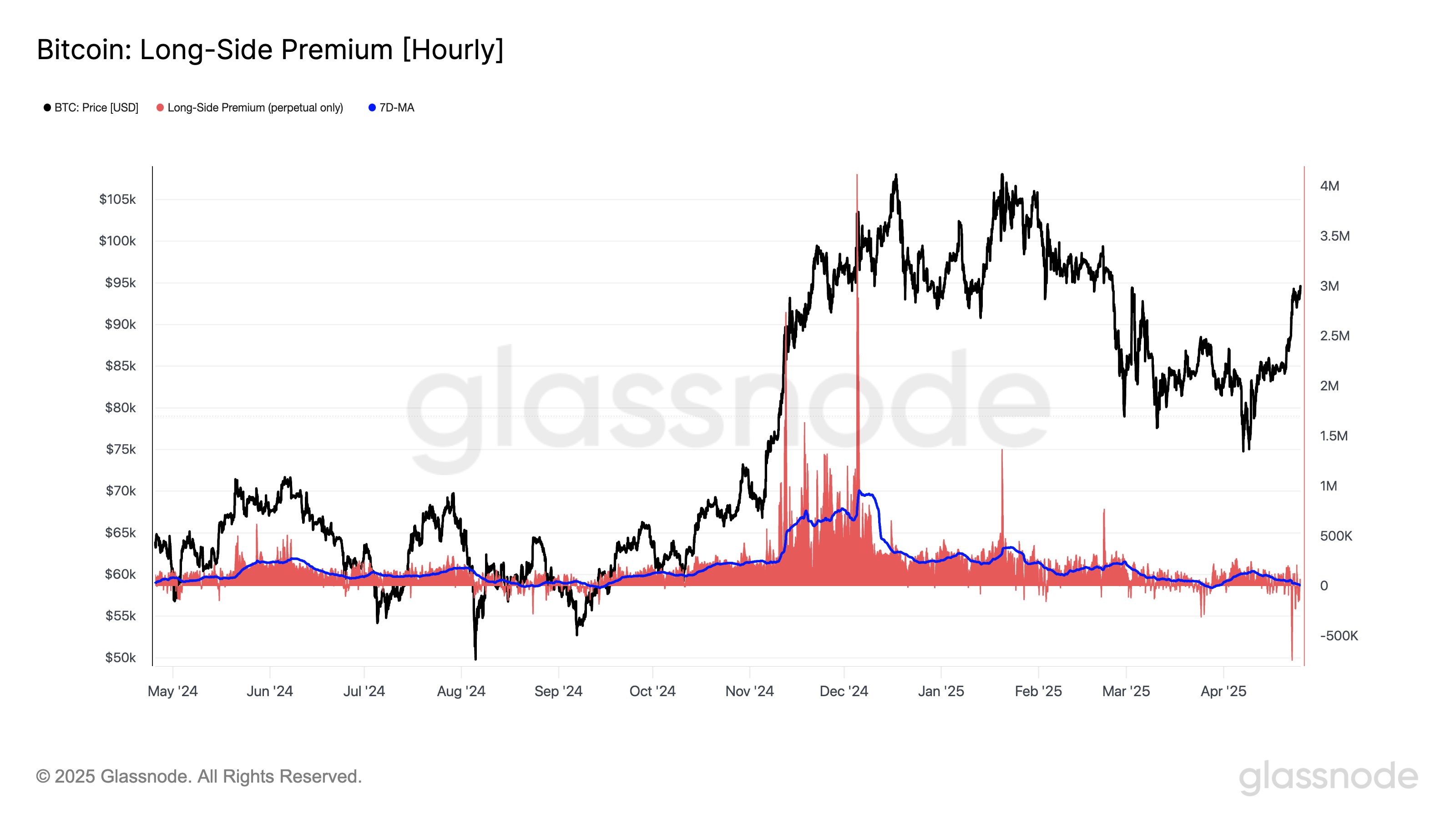

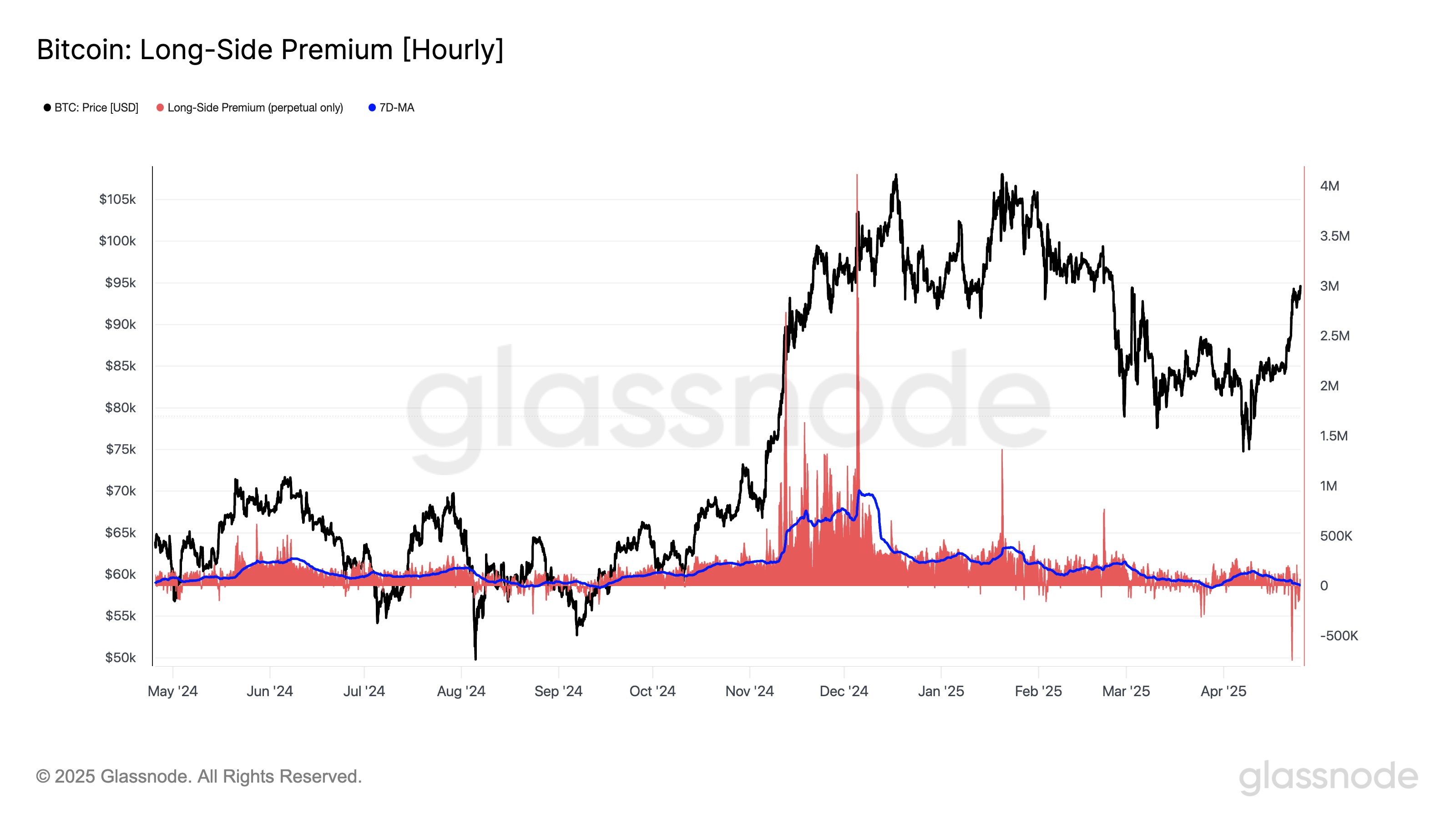

Interestingly, Glassnode also supports the short squeeze narrative. They confirmed that open Interest in perpetual swaps has surged to 281,000 BTC, a 15.6% rise since last month. This spike implies growing leverage in the market, which increases the risk of sharp volatility through liquidations.

https://twitter.com/glassnode/status/1915771198568321329

Also, despite the rise in Open Interest, the average funding rate has turned negative, currently at -0.023%. For context, this trend highlights a growing tilt toward short positioning, increasing the risks of a short squeeze.

Furthermore, the 7-day moving average of long-side funding premiums has fallen to $88,000 per hour and continues to decline, indicating waning interest in long positions and confirming the dominance of a short bias. As a result, a Bitcoin short squeeze could emerge if

BTC spikes further.

Bitcoin Long-Side Premium | Glassnode

Meanwhile, analysts remain bullish on the uptrend. Trader Merlijn recently highlighted a bullish breakout from a flag pattern. He compared the current setup to past events that led Bitcoin into parabolic rallies. In his view, if history repeats, the next stop could be as high as $150,000.

https://twitter.com/MerlijnTrader/status/1915692271099605460

Binance Exchange Flows | CryptoQuant

Supporting this, bitcoin exchange reserves have been declining since April 18. The analysis suggested that this current condition creates a "cleaner" market environment, less vulnerable to large-volume dumps by whales.

Binance Exchange Flows | CryptoQuant

Supporting this, bitcoin exchange reserves have been declining since April 18. The analysis suggested that this current condition creates a "cleaner" market environment, less vulnerable to large-volume dumps by whales.