Stablecoin Issuers Could Rival Sovereign Nations as Top US Treasury Buyers by 2030—Citigroup

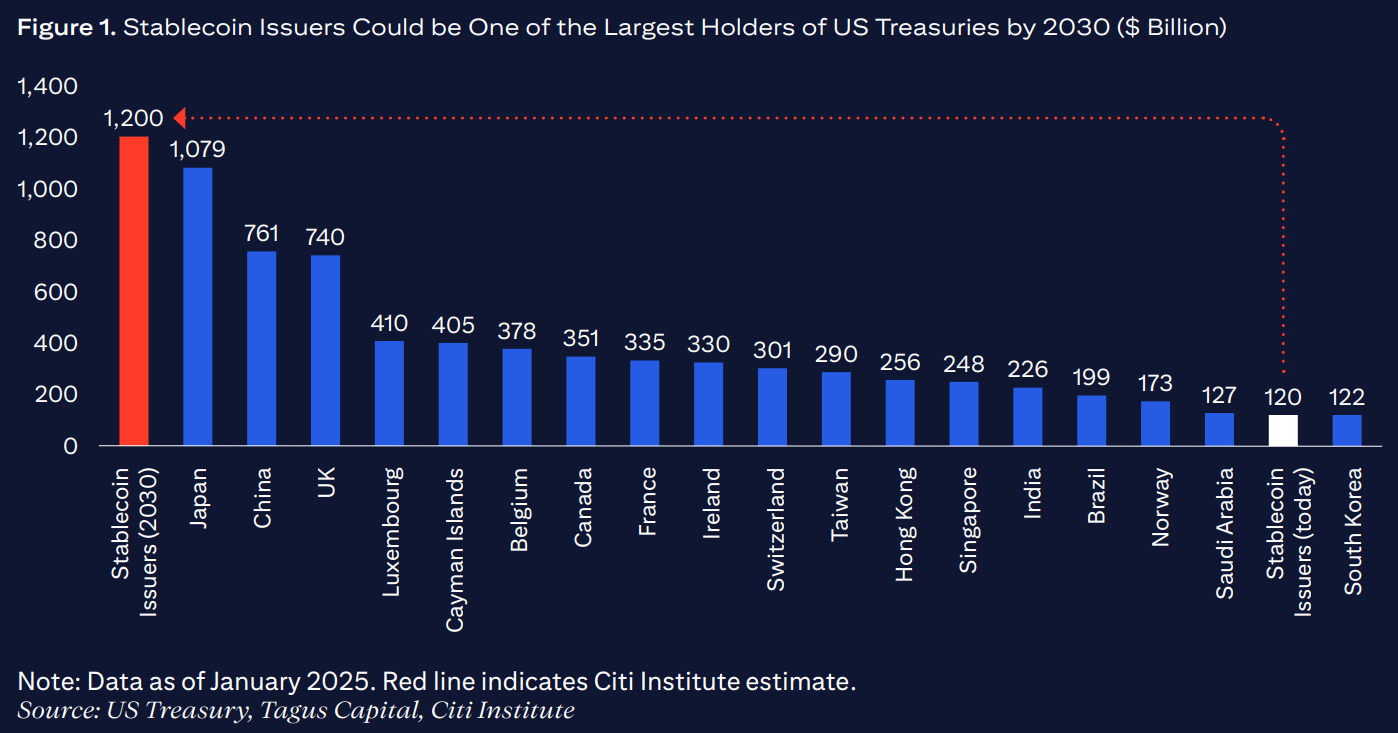

Wall Street’s latest crystal ball gaze? Stablecoin operators—yes, the same folks backing your Tether trades—might soon rank among America’s biggest creditors. Citigroup predicts these crypto players could hold US Treasury reserves on par with nations like Germany or Japan within six years.

The irony isn’t lost: decentralized finance’s most centralized actors becoming key cogs in the old-school debt machine. Just don’t expect the Fed to send them holiday cards.

Citigroup’s projected ranking of U.S. Treasury holders by entity | Source: Citigroup

Citigroup’s projected ranking of U.S. Treasury holders by entity | Source: Citigroup

However, the bank’s analysts also highlighted risks and challenges. Since stablecoins “carry run-risk,” the failure of a major issuer “could cause contagion effect,” the report reads. Citigroup also noted that stablecoins de-pegged “about 1,900 times in 2023, with around 600 of these being large-cap stablecoins.”

Geopolitical risks may also slow global stablecoin adoption as stablecoins “may be viewed by many non-U.S. policy makers as an instrument of dollar hegemony,” Citigroup warned, adding that “policymakers in China and Europe will be keen to promote central bank digital currencies or stablecoins issued in their own currency.”