Gold surges to record high of $3,390, fueling speculation about Bitcoin’s potential rally

As gold achieves a new all-time high at $3,390 per ounce, market analysts are closely watching Bitcoin for signs of a similar breakout. The correlation between gold’s safe-haven rally and Bitcoin’s performance as a digital store of value raises questions about potential capital rotation into cryptocurrencies.

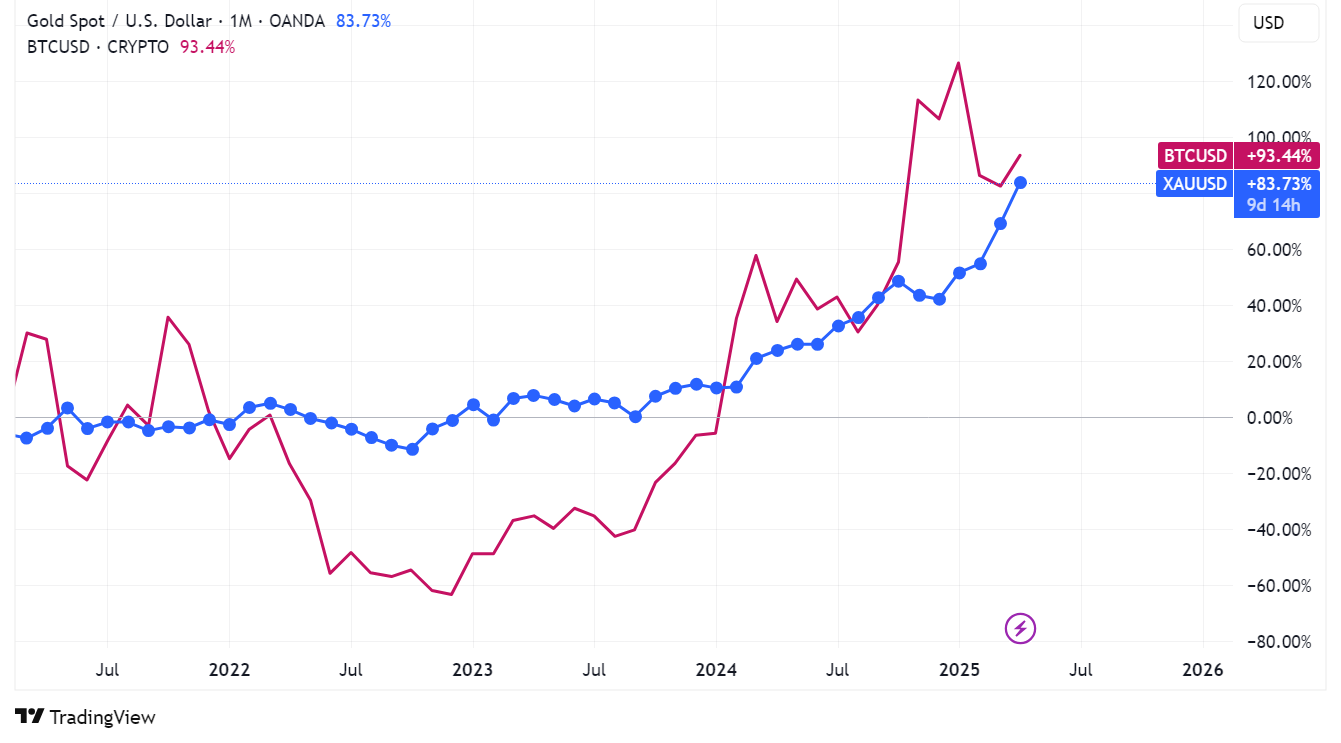

Price chart comparing the movements of Bitcoin and gold on the market, April 21, 2024 | Source: TradingView

Price chart comparing the movements of Bitcoin and gold on the market, April 21, 2024 | Source: TradingView

In fact, on the same day, Bitcoin reached a new monthly-high of $87,570. At press time, BTC has gone up more than 3.2% in the past 24 hours of trading. It is currently trading hands at $87,538. The last time BTC reached above $87,400 was back in March 28, before it experienced a slump in early April.

What is the historical relationship between gold and crypto?

Bitcoin has often been likened to “digital gold” by market traders and investors alike. Federal Reserve Chair Jerome Powell said that Bitcoin was a competitor for gold due to how both assets are used as a store of value rather than as a payment option.

Similarly, founder and CEO of ARK Investment Management, Cathie Wood predicted Bitcoin’s $2 trillion market cap could one day surpass gold’s $15 trillion over time. Despite having been around longer, it evidently took gold a longer time to reach $2 trillion, something that took Bitcoin only 15 years.

“At $2,700, gold is a $15 trillion market, compared to Bitcoin at only $2 trillion. Even after breaking through $100,000, Bitcoin still is in early innings,” said Wood.

Historically, positive market movements in gold are often followed by a boost in Bitcoin prices not long after. Aside from the fact that both assets are seen as “safe havens” that protect investors against the volatility of traditional fiat currencies, both also have finite supplies that need to be mined.

Despite these similarities, a Bloomberg analysis found that gold still has a much lower volatility rate compared to Bitcoin; with gold’s annual volatility rate being around 10% to 20%, while Bitcoin often exceeds 50%. Though this may be the case, analysts have also noted that macro Bitcoin trends have a tendency to follow gold’s within a few months.